From touchpoints to journeys: single customer view for insurers

However, insurers face barriers to achieving this ideal. Typically, they sell policies on a case-by-case basis through multiple touchpoints. Customers supply lots of personal information, but it's in individual product lines held in separate databases.

Customers over products

It's essential to bring this data together to achieve a true single customer view. If your customers are receiving different messages from each business line, product type or channel, that's going to leave them feeling confused and inconvenienced. It's also going to limit your business performance; you won't spot the gaps in your customer data or be able to use that data to understand and model the best action for each individual customer.

Relationships = Revenue

Insurers can feel at a disadvantage when it comes to forging long-term relationships with customers. Unlike banks or retailers, interactions tend to be limited to renewal notices and claims procedures. Until we have to pay for it or need to make a claim, most of us don't give our insurance that much thought.

But, with Single Customer View data as the foundation, insurers can create individual, relevant customer communications and build positive engagement.

Single Customer View: Serve, Solve and Sell in one place

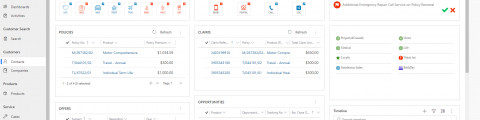

Unified, accessible and reliable customer data opens up many opportunities for insurers. For example, when Carl calls to renew his home insurance, the contact center agent, Jennifer, can immediately see all his policies and interactions on one screen with VeriPark's VeriTouch CRM system. That makes the renewal process fast and efficient and leaves Carl feeling satisfied; he's got a good deal and it hasn't been a hassle.

Jennifer takes this opportunity to have a more meaningful interaction. From the interaction timeline, she can see that Carl had a query about his car insurance three months ago. It was resolved quickly and Carl had sent a text to confirm he was happy, but Jennifer decides to check that's still the case. After positive feedback from Carl, Jennifer notices he has travel insurance as a 'Next Best Action Offer' so, with his permission, she emails him the details. Finally, she notices from his pet insurance that tomorrow is his dog's birthday, so she wishes Oscar many happy returns!

This type of fast, effective service and problem solving really comes into its own during the claims process. Typically, this is a difficult time for customers. For example, their house has flooded or their dog is poorly. The last thing they want is to have delays, inaccuracies or be forced to repeat the details again and again at different touchpoints in the process.

Single Customer View offers major opportunities

Single View of the Customer – part of VeriPark's VeriTouch CRM solution - plugs into all an insurers' legacy systems and surfaces the data into a single front-end screen or customer card. This is how Jennifer is able to provide Carl with an exceptional customer experience. She has a full interaction history, so can take the time to ensure the interaction is meaningful and engaging. She even has the opportunity to cross-sell a relevant, personalized travel insurance offer.

Customers now expect this level of fast, convenient, personalized experience – across all channels. VeriTouch can give all front line teams, such as sales, marketing, call centers or brokers and intermediaries, an understanding of the full context of the customer relationship. When your teams know more about your customers, their needs and preferred channel of contact, they can communicate more effectively, boost loyalty and nurture longer, more valuable customer relationships.

VeriTouch is already boosting customer engagement and reducing costs for leading retail and corporate insurance providers. It offers a ready-to-use data model encompassing many insurance related fields, such as policies, claims and payments, that can quickly and efficiently be built onto the Microsoft Dynamics 365 CRM system. The results can be transformational – insurance companies can serve their customers, solve their problems and sell them targeted, personalized products and services all in one place.