Digital Lending

VeriPark's digital lending solution enables financial institutions to streamline lending and offer their customers the convenience of self-service digital loan experiences. Aimed at making loan origination simple, the solution turns lending into a quick, painless process and helps to sustain customer-centric digital experiences at scale. It replaces traditional loan processes with dynamic loan application flows and increases customer conversion rates.

With a unified, flexible and efficient approach, the solution makes it possible to manage retail, commercial and corporate lending journeys across various internal and external stakeholders. The future-ready lending platform built on Dynamics 365 empowers financial institutions to offer various loan products in retail, SME and corporate segments across digital channels. Covering everything from pre-screening, onboarding, underwriting to disbursement, the solution automates the entire digital lending flow from start to finish.

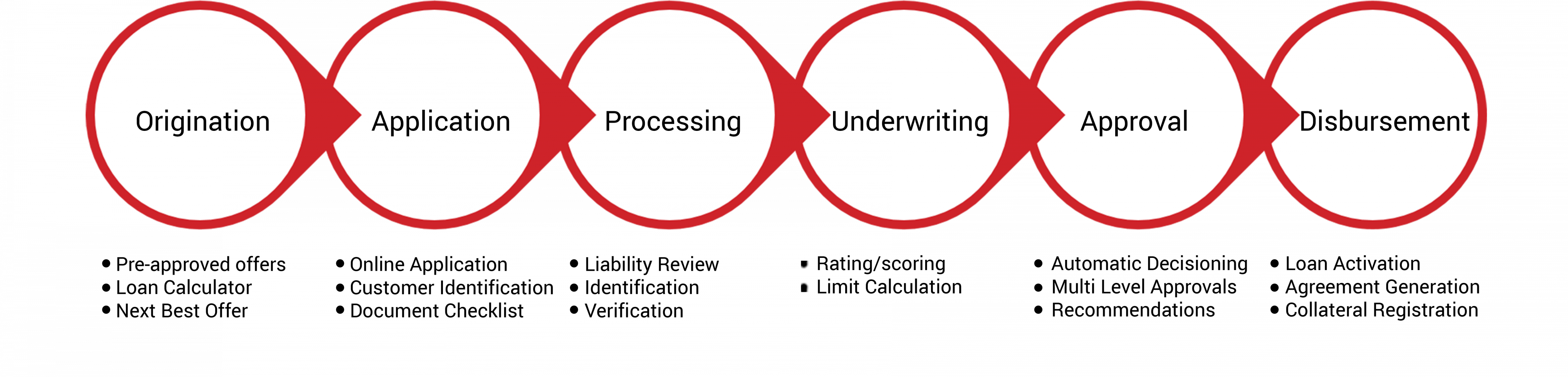

6 Steps to a Seamless Digital Lending Process

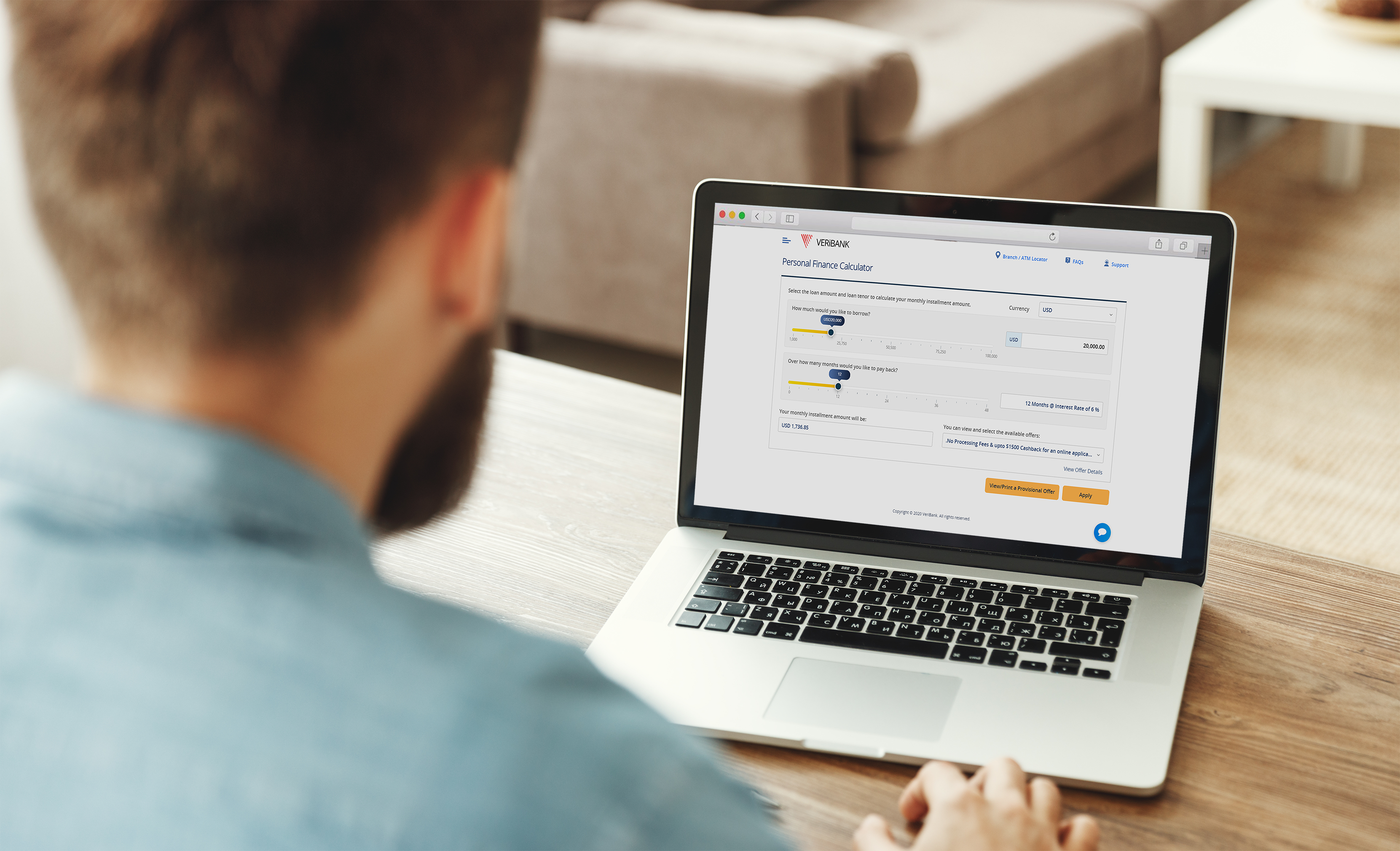

Step 1: Loan Origination

- Using Loan Calculator to select the amount and duration of the loan to instantly find out the monthly installment amount

- Pre-approved offers for simple, hassle-free and fast loan applications

- Ensuring a personalized customer journey with Next Best Offer

Step 2: Application and Data Capturing

- Online application: offering a fully-digital, customer-driven lending experience

- Customer identification: complying with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations

- Document checklist: handling large volumes of loan documents swiftly and accurately with Optical Character Recognition (OCR) technology

- Digital verification for proof of customer (income and repayment capability

Step 3: Loan Processing

- Using Microsoft 365 capabilities to define a list of pre-approved automated loan checks

- Swift decision-making processes to facilitate pre-approved offers and instant loan approvals

- Connecting to multiple credit checking organizations

Step 4: Underwriting

- Integrating eligibility calculator to reduce acquisition costs

- Approval in principle for customers with limited data

Step 5: Loan Approval

- Digitizing confirmation process to onboard the new customer

- Robust decisioning engine for fast decisions and instant disbursement

Step 6: Disbursement

- Simplifying loan applications with digital signature workflow

- Handling documents digitally from template automation to printing, document scanning to archiving

- Cross collateralization where borrowers use one asset to back up multiple loans*

- Connecting contracts post signature to API's and existing systems through clause templates*

*Applicable for commercial and corporate loans, ranging from construction loans to asset finance, real estate loans to term and operating loans

Key Features

-

Straight-through loan processing and automated workflows

-

Feeding customer data into the bank's CRM system

-

Document capturing

-

Performing OCR to parse document content such as ID or Passport

-

E-signature integration with DocuSign

-

Easy document generation

-

Rule-engine based product policy

-

Channel migration capability between in-branch and mobile

Key Benefits

-

For Financial Institutions

- Reduced errors, shorter time scales, greater decision-making consistency

- Reduced cost of customer acquisition and cost of servicing

- Less churn, increased satisfaction, higher retention

- Mitigated risk & enhanced decisioning

- Providing simplified lending and improving the retail, commercial and corporate loan experience

- Offering the convenience of applying for a loan with minimal manual inputs

- Reassigning employees to higher-value work

- Accelerated speed to market

-

For Retail, SME and Corporate Customers

- A smoother, less stressful digital loan origination journey

- The convenience of being able to apply with minimal manual inputs

- Ability to provide and sign documents digitally at any time, from any device

- Faster loan decisioning

- Simplified borrowing experience

- Improved satisfaction