Banks must integrate digital technologies with CRM: The new core of banking - PART 2

How a CRM core enables the Universal Banker: one role, multiple solutions

Forward-thinking banks understand that branch networks are extremely relevant in this digital world. Their branch of the future no longer has separate tellers, advisors, and sellers. Instead, they have Universal Bankers – able to manage all customer transactions, seamlessly.

This unified approach eliminates the need for customers to queue for different services. It ensures they receive consistent, personalized support, no matter how they choose to engage with the bank. However, such an integrated approach requires a new strategic banking architecture, with CRM at the core.

If a universal banker has to touch several systems to conduct their business servicing the customers, then this is not the bank of the future.”

– Zubair Ahmed, Chief Industry Officer, Financial services, VeriPark

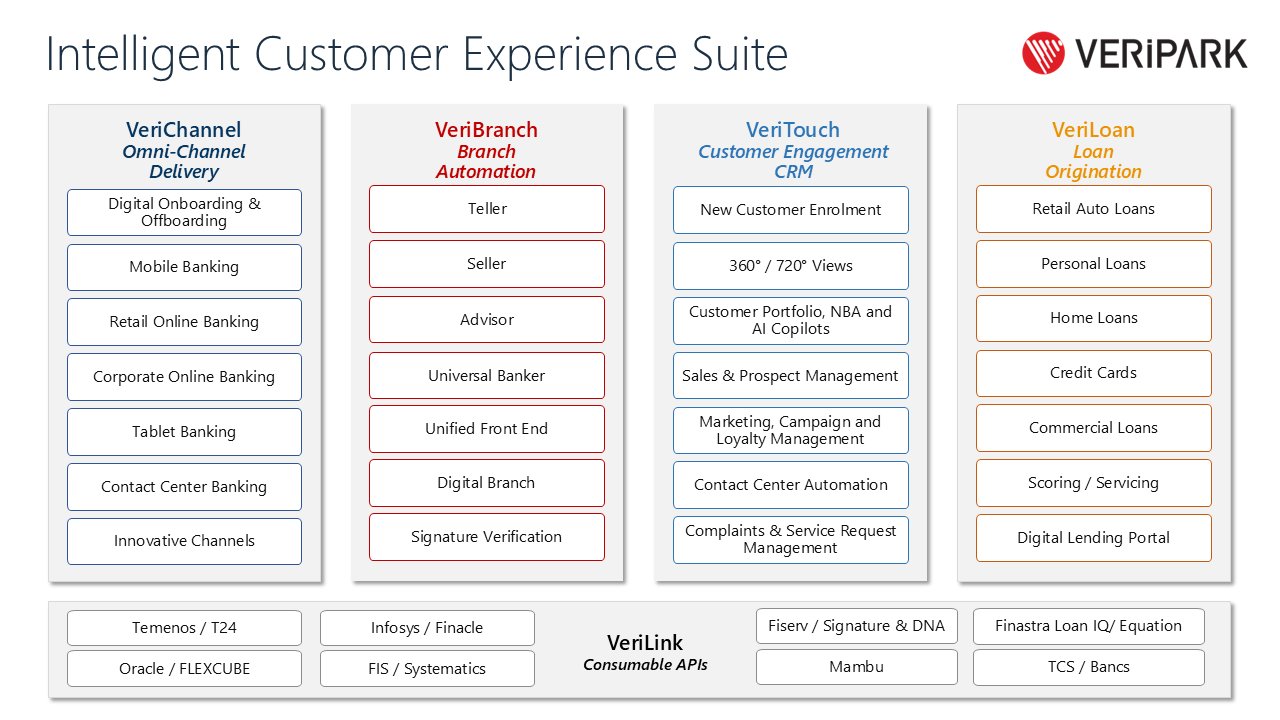

VeriPark solved this problem by creating VeriBranch branch automation system which integrates seamlessly with the enterprise CRM.

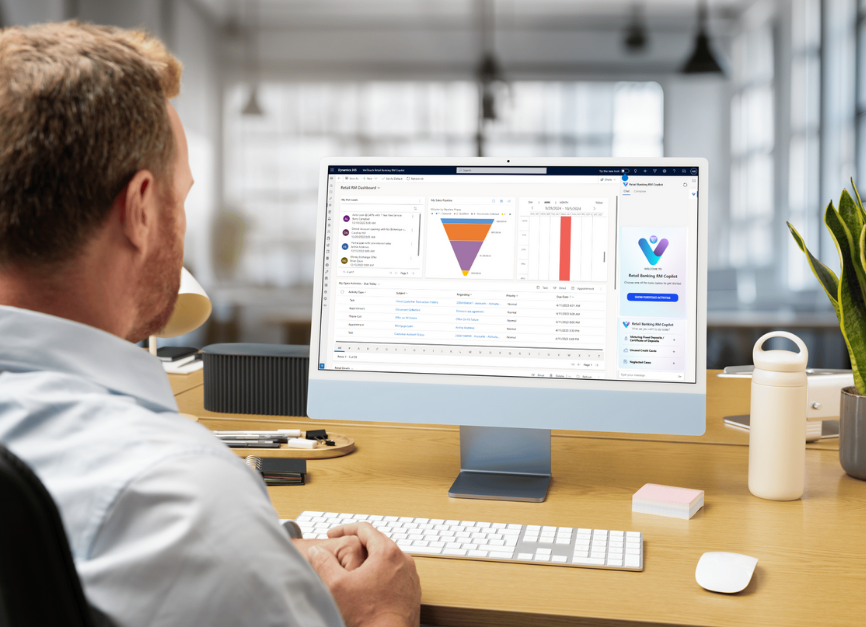

This system enables branch teams to access customer details such as applications and transaction histories. Using VeriChannel, VeriPark’s omnichannel banking platform, employees can seamlessly interact with customers on their tablets to provide personalized services. At the same time, VeriTouch CRM provides them with AI-enabled next best action (NBA) guidance on how, what and when to sell first, and for each successive product. All of this happens within a single, unified interface, eliminating the need to switch between multiple applications.

Customer scenario 2: The happy customer

Now, meet Olivia. She has already opened an account with you – because she knows that your bank has embraced the idea of creating seamless customer journeys.

She is now planning a holiday and orders some foreign currency through your Internet banking platform just before leaving for work. She receives a notification on her mobile app during her commute confirming the currency is ready for collection from her local branch. She books a convenient time slot for her visit.

When she arrives, her Universal Banker is expecting her and greets her in full knowledge of her journey so far. They hand over the currency and Olivia ‘signs’ for it on their tablet using the biometric security stored on her account. They also use a next best action prompt from the VeriTouch CRM to offer Olivia travel insurance because a 360-degree scan of her relationship with your bank indicates she has none.

The Universal Banker calls up the insurance terms on their tablet and takes time to explain them to Olivia. She accepts the offer and completes the application process on the Universal Banker’s tablet.

On her way home by bus, Olivia remembers she wanted to pay for holiday car hire and calls your contact center. The system recognizes her number instantly and the call handler has all her real-time data in front of them. After going through security checks, they make the payment for her – and email her confirmation.

This is the sort of bank that people like Olivia now prefer to use. Customers like her will even become advocates – happy to promote your bank to their friends and colleagues, like John. This is the branch of the future – but you need fully integrated systems behind it, with CRM at the core.

VeriPark’s vision for creating the future of banking, today!

The bank of the future is about more than technology – and VeriPark is more than just a technology provider: both are focused on delivering customer value. Banks that embrace a customer-centric, omnichannel, natively-integrated-with-CRM approach will stand out in a competitive landscape. With the right tools and strategies, they can transform their operations, enhance customer experiences, and unlock growth opportunities.

Branch automation empowers banks to implement this vision now, by integrating multiple systems into a unified platform with CRM at the core. Access to real-time customer data, whether in a call center or on a Universal Banker’s tablet enables bank employees to make customers feel welcome and valued. It provides them with the means to serve well and sell better.

We are always keen to partner with banks to shape their vision of the future – one where every customer journey is seamless, every interaction is meaningful, and every transaction is an opportunity. We work closely with banks to design a phased digital transformation. This ensures the evolving solutions always align with business objectives, create a clear development path and start delivering immediate value.

Find out how to put CRM at the core of your banking services

Talk to us about how to create connected journeys across your channels, branches and CRM to create a customer-focused bank of the future.

This is part two of a two-part article on why banks must integrate digital technologies with CRM: The new core of banking. Read the first part of the article here.

VeriPark's Banking CRM VeriTouch is built on top of