Banks must integrate digital technologies with CRM: The new core of banking - PART 1

Reimagine banking to achieve seamless customer journeys

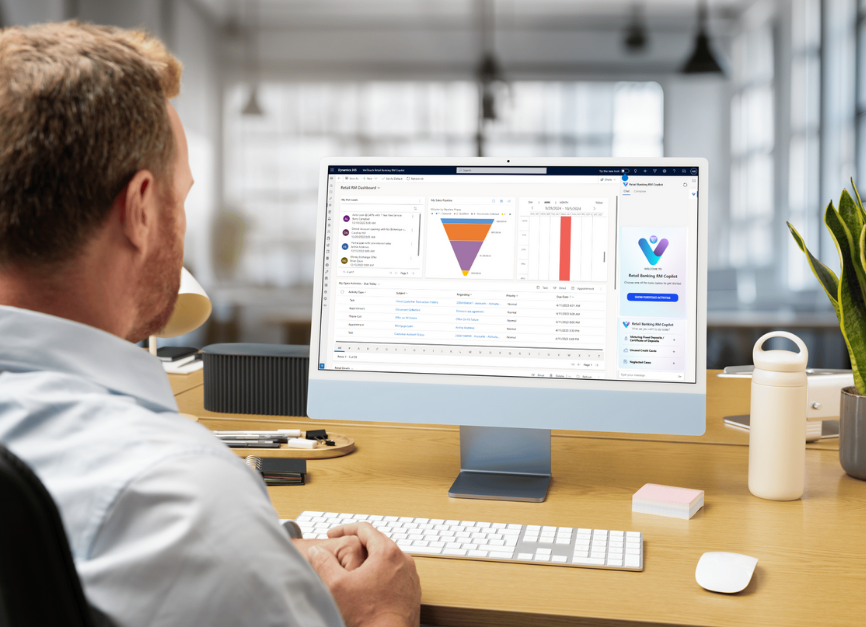

Many traditional banks are struggling to compete with new fintech entrants to the financial services industry. Too often, their transactional mindset and siloed thinking fails to engage with the way younger generations of tech-savvy customers experience their interconnected lives. To remain relevant, VeriPark believes banks must integrate digital technologies with the new core of banking which is the CRM, to provide customers with seamless connected journeys that meet their demanding financial needs in real time.

Key points

-

Low value transactions are inevitable, but high value transactions offer the real opportunity

-

Real-time data requires a single platform, fully integrating all channels, from front to back

-

Moving from low value to high value transactions requires meaningful customer engagement

-

Integrating all channels enables employees to anticipate customer needs and serve them well

-

Engagement requires all contact points to share the same 360-degree customer view

-

Serving them well enhances customer experience and enables employees to sell better

-

360-degree customer view empowers the Next Best Action which uses predictive insights on real-time data

-

Selling better helps drive business growth.

VeriPark makes a unified customer experience possible

As VeriPark’s Chief Industry Officer, Zubair Ahmed, explains, “Many banks, and branches in particular, tend to operate routinely in transaction mode, focused on handling low value transactions, like check clearing or cash withdrawals, as quickly and efficiently as possible.” However, by treating such transactions as separate, unconnected events, they fail to engage meaningfully with customers’ broader needs. As such, they miss opportunities for cross-selling or up-selling higher value products and services over the customer’s lifetime.

That failure to understand their customers arises because many banks are burdened with disconnected legacy systems, which require multiple, repetitive, manual processes to share data. As such, they lack a single coherent view of the customer, which leaves customers – and bank employees – feeling frustrated and undervalued. VeriPark contends that this presents banks with a great opportunity to transform their business by shifting to a “serve well to sell better” approach based on a new core of banking which is a CRM platform.

Disconnected journeys drive customers to competitors

Customers, especially the younger generations, increasingly expect smooth, omnichannel experiences when they engage with any modern brand. They want effortless switching between mobile, desktop, phone and in-person interactions. They assume their favorite brands will know them well enough to serve them well, no matter what channels they choose to use.

When it comes to banking, they are not apprehensive about things like the color of your application forms, or whether your systems are on-premise or hosted in the cloud somewhere. They don’t care how your back-office works or which middleware you use. All they really care about is the user experience which you deliver with quality and consistency – specifically the last experience that they had with their bank.

If your customers feel that your UX is unsatisfactory – impersonal, cumbersome, tediously repetitive – then whatever you’re spending on branding or technology is not paying off. If your siloed systems force customers to restart processes or retell their story each time they switch channels, they’ll go elsewhere. Your customers now expect to be able to start application processes, enquiries and transactions in one channel and complete them in another, seamlessly, without once being asked to re-enter personal data.

Customer scenario – 1: The frustrated customer

Meet John.

John wants to bank with you. He starts the onboarding process on his laptop at home over breakfast. But he breaks off to leave for work and decides to use mobile later to provide KYC biometrics, like face recognition. That seems OK – he finds it easier to take a selfie on his phone.

However, he then discovers there is no seamless transition between your internet and mobile platforms. If that’s not bad enough, he gets a message saying he either needs to start over again on his mobile or visit a branch during his lunch break. Understandably, he is annoyed – he has no time for this sort of hassle.

He opts instead for a bank that offers a better UX – even though its product range is not as good as yours!

The New Core of Banking: Why should CRM be at the heart of digital transformation?

As we have seen, disconnected journeys leave customers frustrated and drive them towards new competitors. Ideally, banks would offer their customers seamless, unified service journeys, where every touchpoint is integrated and intuitive to use. This would not only enhance customer experience but also build trust, loyalty and even advocacy in your brand.

However, creating such a unified operation requires banks to adopt a completely new way of thinking about their functional systems architecture. It requires their business decision makers and information technology decision makers to no longer treat CRM as an auxiliary system to bolt onto existing structures. Instead, they need to agree to make CRM the heart of their complete digital transformation strategy.

VeriPark believes that the new core of banking is a modern AI-led enterprise CRM.

"Many banks focus on acquiring specialized systems for individual channels—such as contact centers, internet banking, and corporate banking. While these systems excel within their domains, the challenge lies in ensuring seamless integration across channels. Without a unified platform, banks risk creating disjointed experiences for customers and inefficiencies for employees."

The way some banks think they can solve this is by throwing more resources (time, money, people, and now AI-bots) into their infrastructure systems. The result is costly and ongoing integration, maintenance and interoperability problems. Yet they still don’t have a single, 360-degree view of their customers.

The true solution lies in shifting from a focus on standalone, specialized applications to a mindset centered on seamless integration. The aim should be to streamline all processes, so bank customers and employees only need a single, secure point of entry to get the products and services they need. This will help create consistent customer experiences across all channels, from initial touch points to delivery of products or services.

Banks that adopt a ‘New core of banking is CRM’ mindset will be better equipped to respond to evolving customer expectations and emerging market demands. It must be central to your strategic thinking, if you want to serve your customers well and help your teams sell better. It will enable you to know everything about your customer, from the day they join to the day they leave – and everything they need in between.

Building your new CRM core on Microsoft products.

VeriPark’s solutions are built on Microsoft technology, offering seamless integration across its product range, from Microsoft Azure to Dynamics 365. From our perspective, its greatest strength is this ease of integration. Such integration is crucial for enabling straight-through processing, ensuring all your systems operate using the same real-time data.

As one of our clients explains it: “We said to Microsoft ‘if you had a digital bank we would buy it’. Microsoft responded by introducing us to VeriPark. VeriPark offered precisely the integrated platform approach we wanted across all our channels, including online and mobile banking, and CRM.”

That level of integration gives each customer a single view of your bank, regardless of which channel they use because they are all interconnected. Your own bank staff also get a single view of each customer, regardless of the customer segment. For example, a 360-degree view of your SME customers allows your call center to see that the CEO of GreenTech Solutions, Sarah Morgan, also has retail accounts with you in her own name and is a director of another company that’s also a customer.

This is part two of a two-part article on why banks must integrate digital technologies with CRM: The new core of banking. Read the second part of the article here.

VeriPark's Banking CRM VeriTouch is built on top of