VeriChannel as a Service

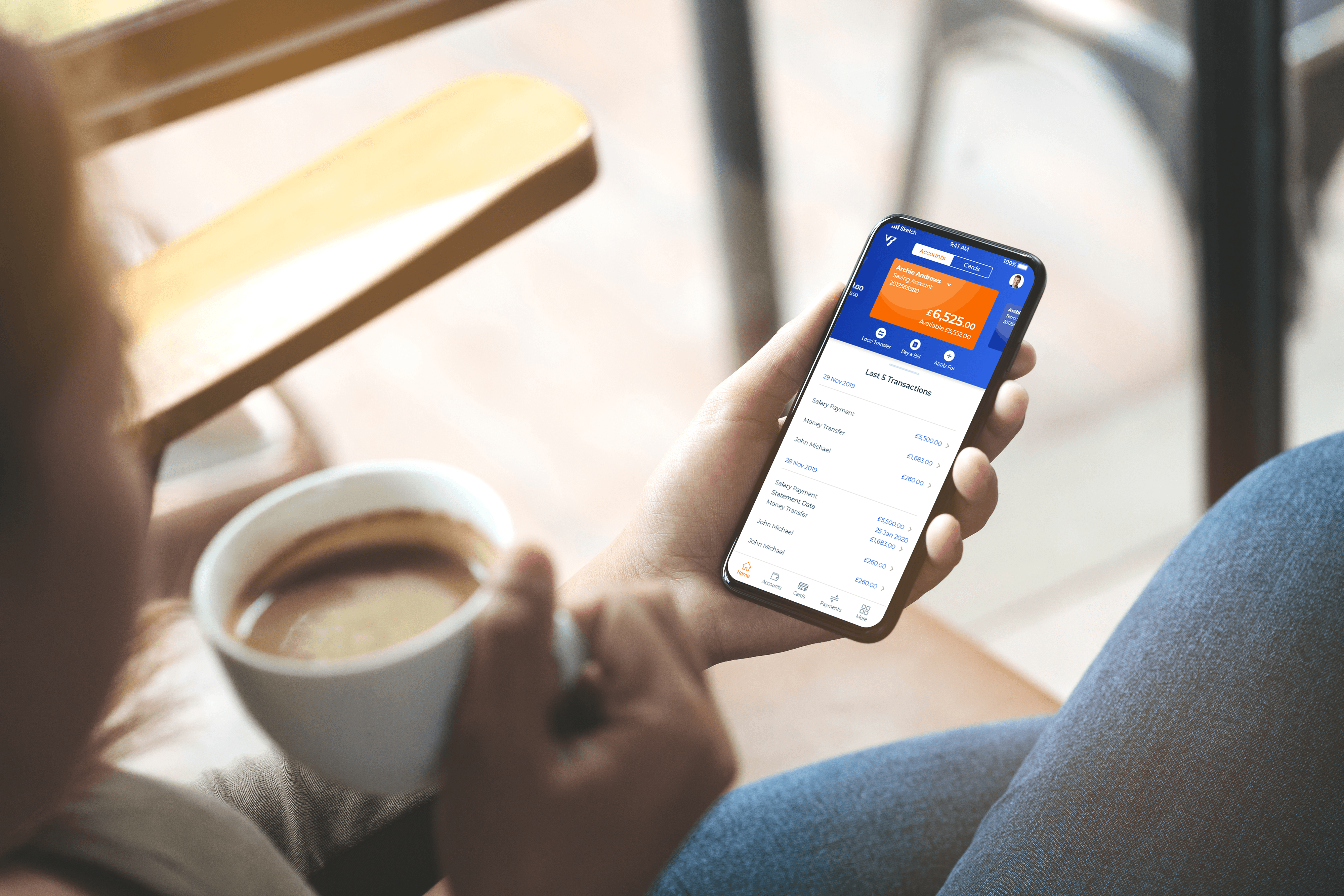

Launch your Digital Bank on Mobile in less than 90 Days !

For most banks, traditional operating models and legacy systems are the biggest challenges and greatest obstacles to remain competitive. In order to move at speed and pace in their digital transformation journeys, banks need to:

- Catch up with the next wave in digital banking: speed, personalization and enhanced customer experience,

- Create a unique alternative to a traditional banking experience,

- Provide best-in-class transactional capabilities & functionalities.

To help you to wow your customers, offer them new value-added services that are available 24/7 and put financial power at their fingertips: VeriChannel as a Service is the future.

Hosted on Microsoft Azure Cloud and integrated with Dynamics 365, the solution enables banks to spend less time working on development and integration, and more time enhancing the customer experience.

Why VeriChannel as a Service?

VeriChannel as a Service is a game changer agile cloud solution coupled with pre-packaged, out-of-the-box business processes, making it possible to launch your digital bank on mobile in less than 90 days! We have simplified processes so that you can save time on development of new products and speed up your time to market.

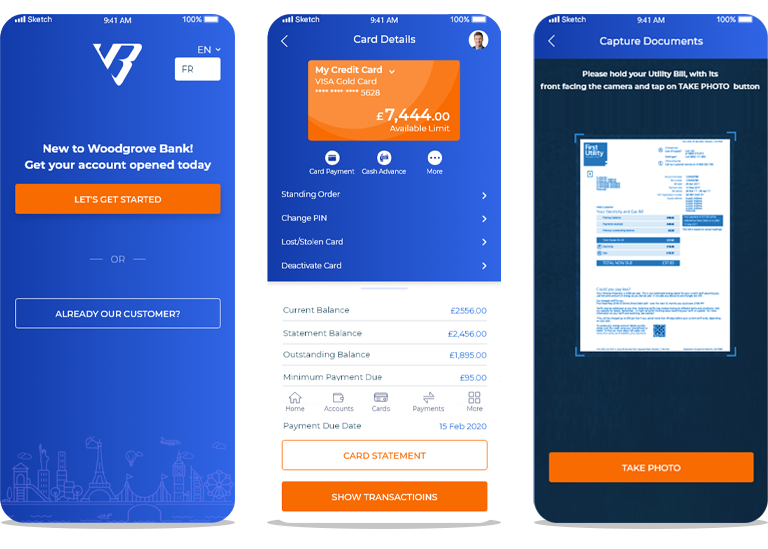

If you want to offer meaningful and delightful banking experiences that will create customers for life, VeriChannel as a Service is your solution. It provides a set of ready-to-deploy banking services including current accounts, cards management and payments.

Key Features

-

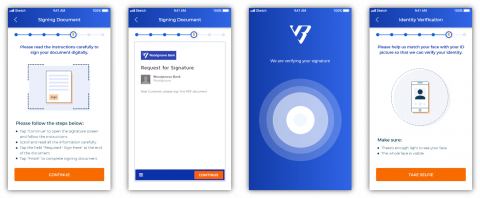

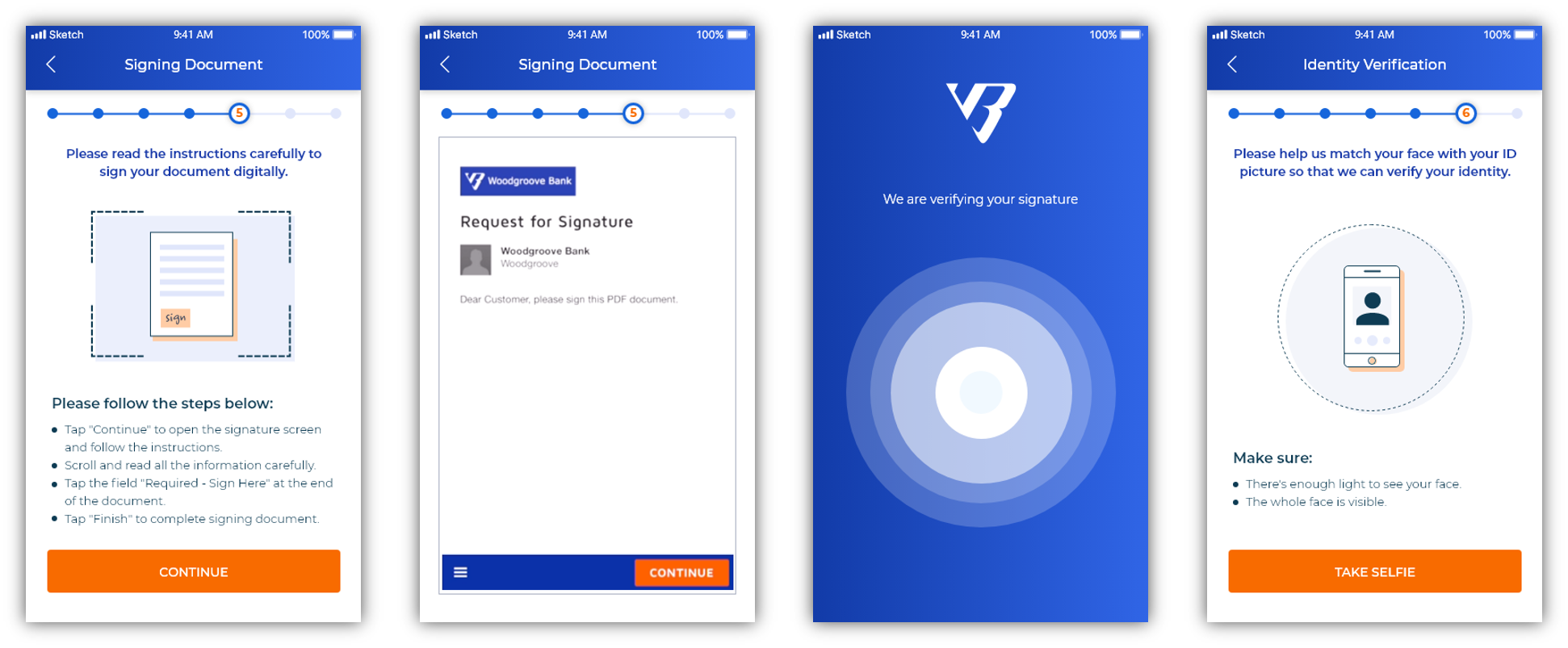

Digital Onboarding

-

Account Management

-

Card Management

-

Payments

-

Foreign Exchange

-

Marketing

-

Fund Transfers

-

Financial Calculators

-

Personalization & Security

Key Benefits

-

For Financial Institutions

- Easy and fast launch of a digital bank on mobile in less than 90 days,

- Transforming the digital bank to a profit center by generating new revenue channels,

- Reducing IT capital costs,

- Set of ready-to-deploy banking services including current accounts and cards management, payments and personal finance management,

- Increasing agility with pre-configured services provided on Azure

- Improving scalability and flexibility,

- Expanding the scope of value-added services to customers,

- Creating rich and meaningful mobile banking experiences,

- Anytime, anywhere bank interactions with customers

-

For Customers

- Faster and personalized customer experience

- Banking and managing entire financial life 24/7 without the need of visiting a branch

- Seamless digital onboarding experience that's over in less than 4 minutes