Personal Finance Management

While customers can easily and securely manage their financial lives, based on the data provided by the Personal Finance Management solution, financial institutions can increase their sales by meeting the actual needs of the customers. Thanks to the data about what customers spend on and save up for, financial services institutions can offer better products to their customers based on their needs.

Personal Finance Management is a great way to offer remarkable customer experiences for your customers, who demand personalized services by,

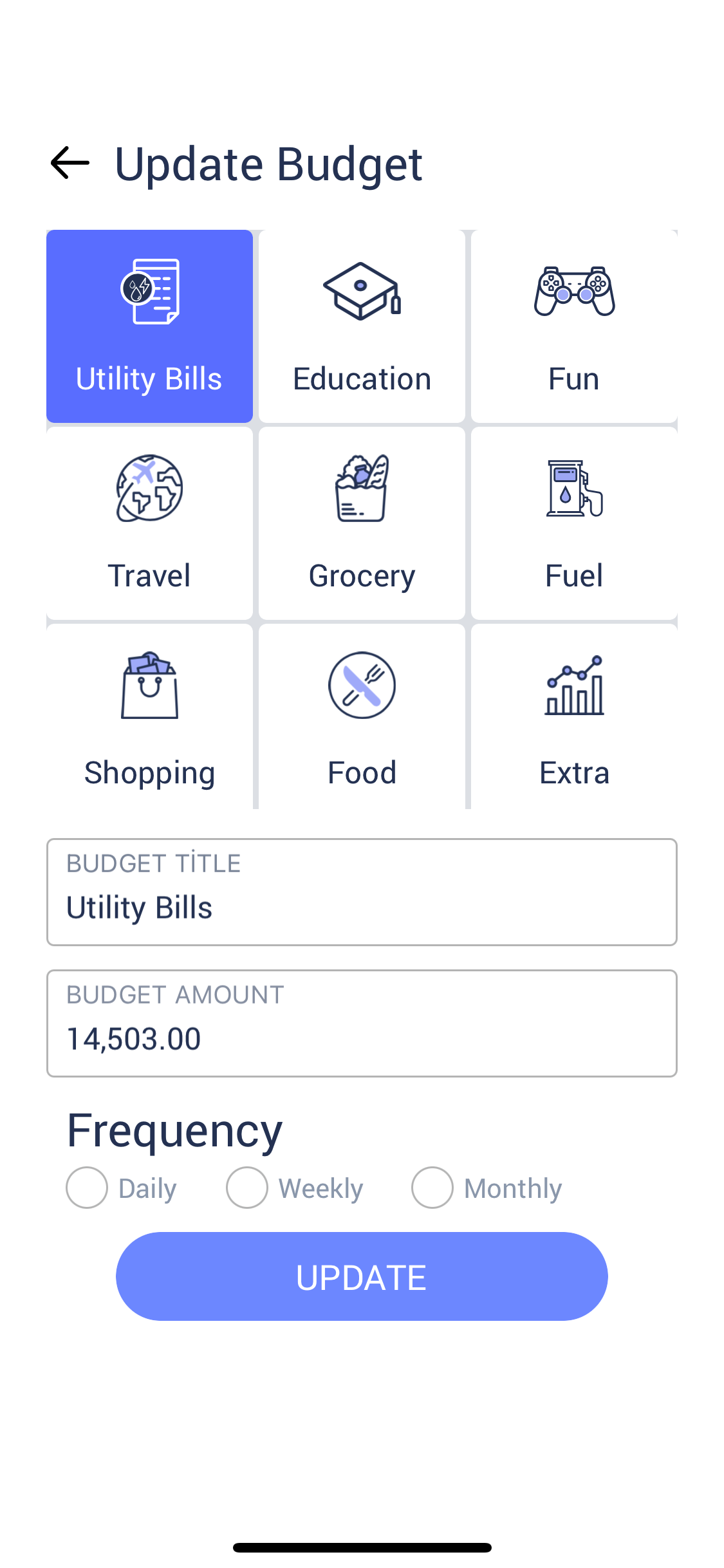

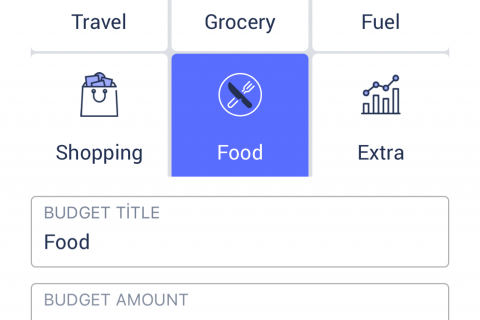

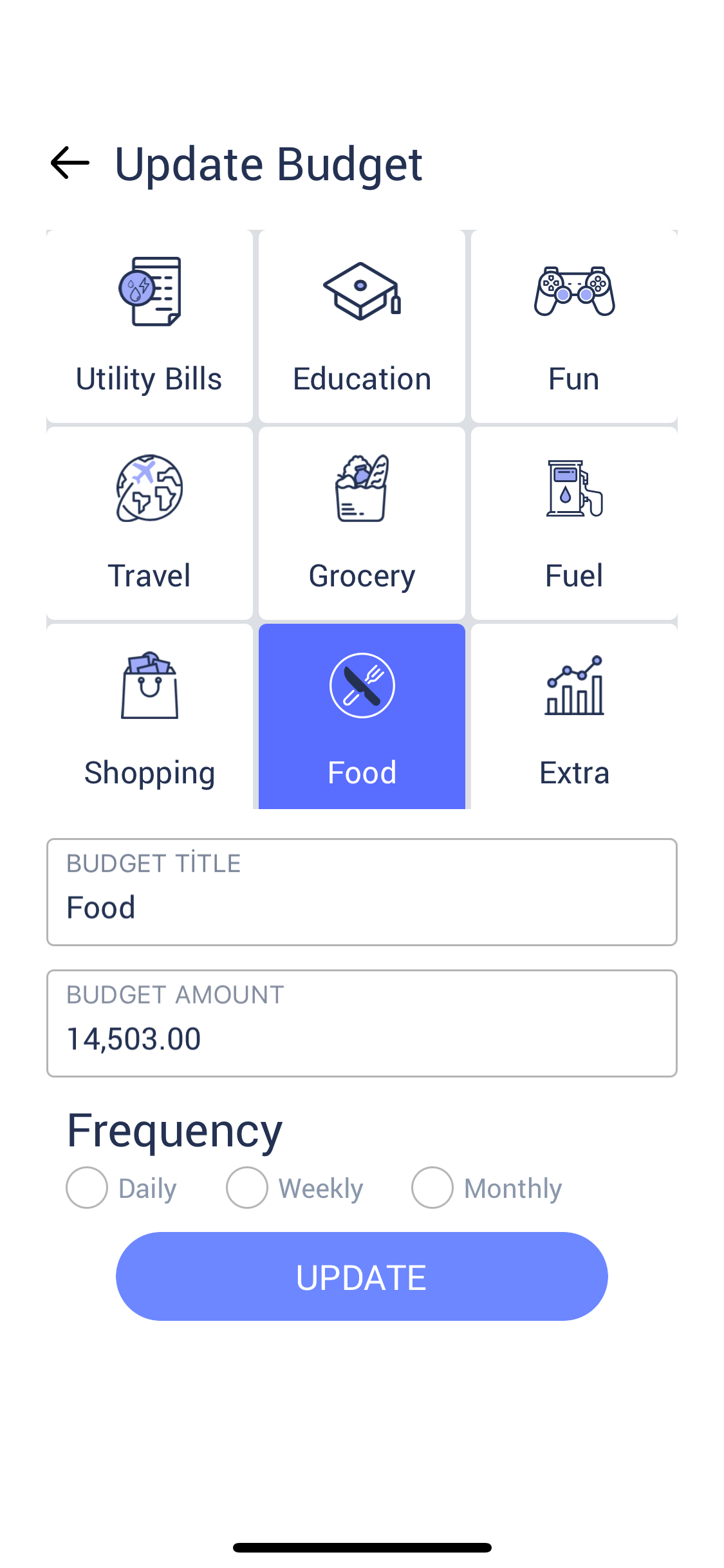

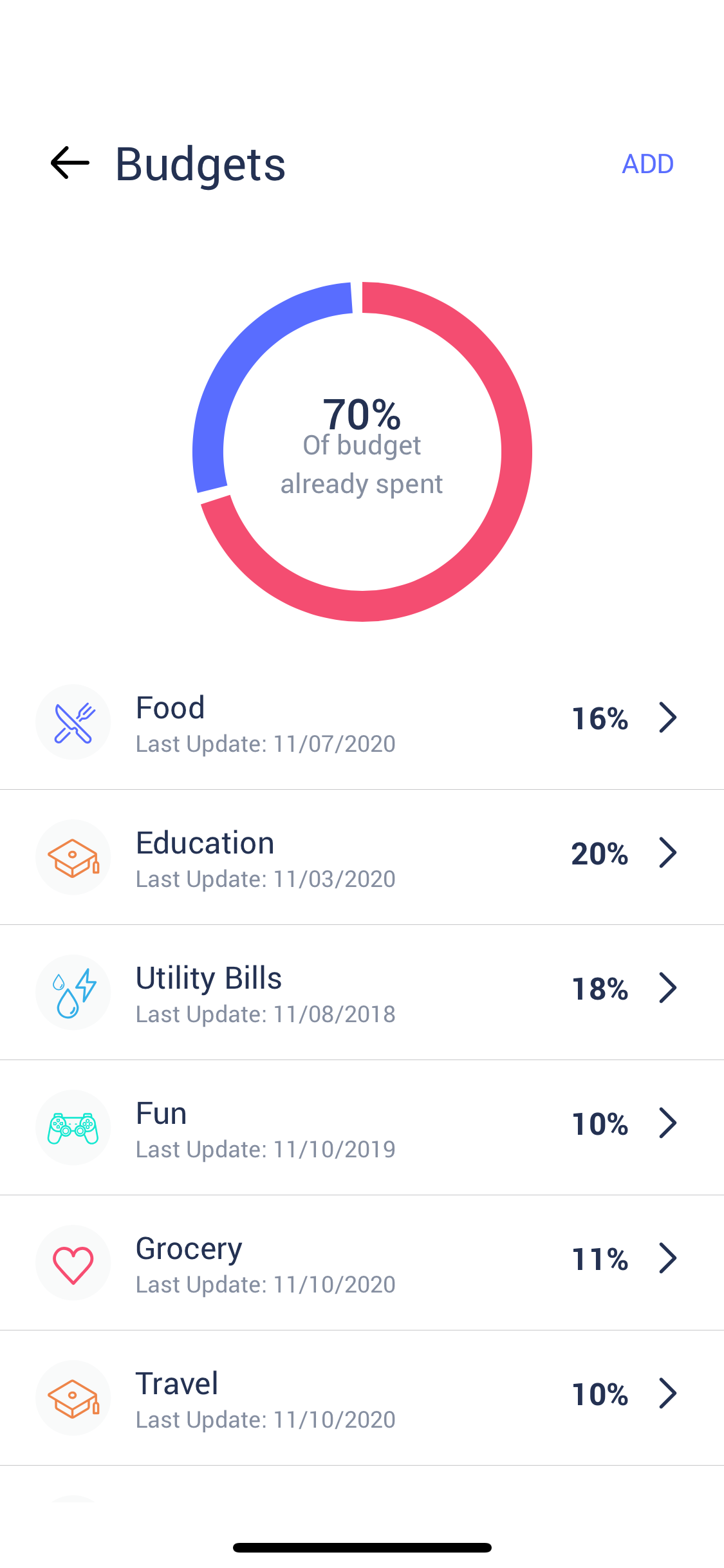

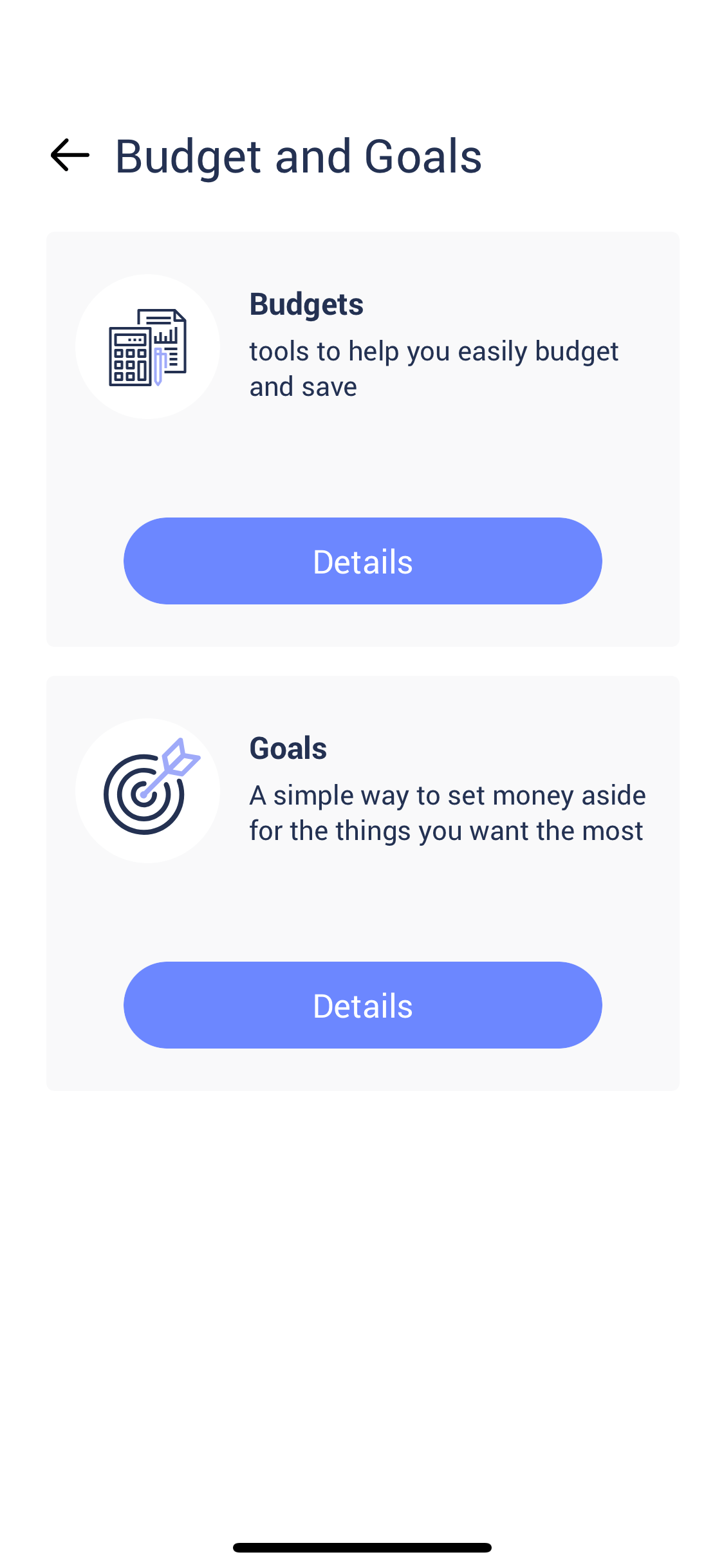

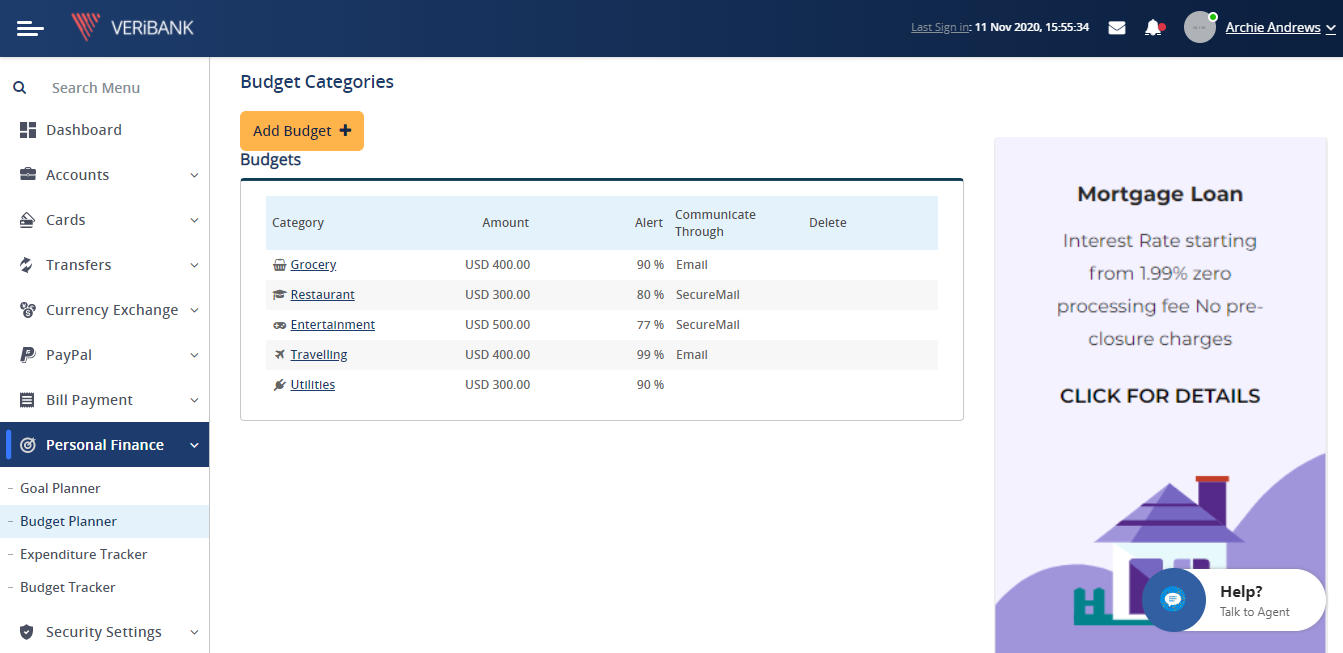

- Defining personal budget areas and specify thresholds,

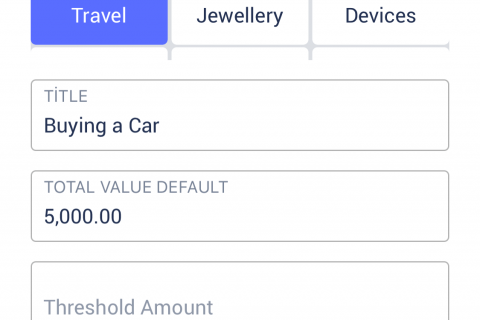

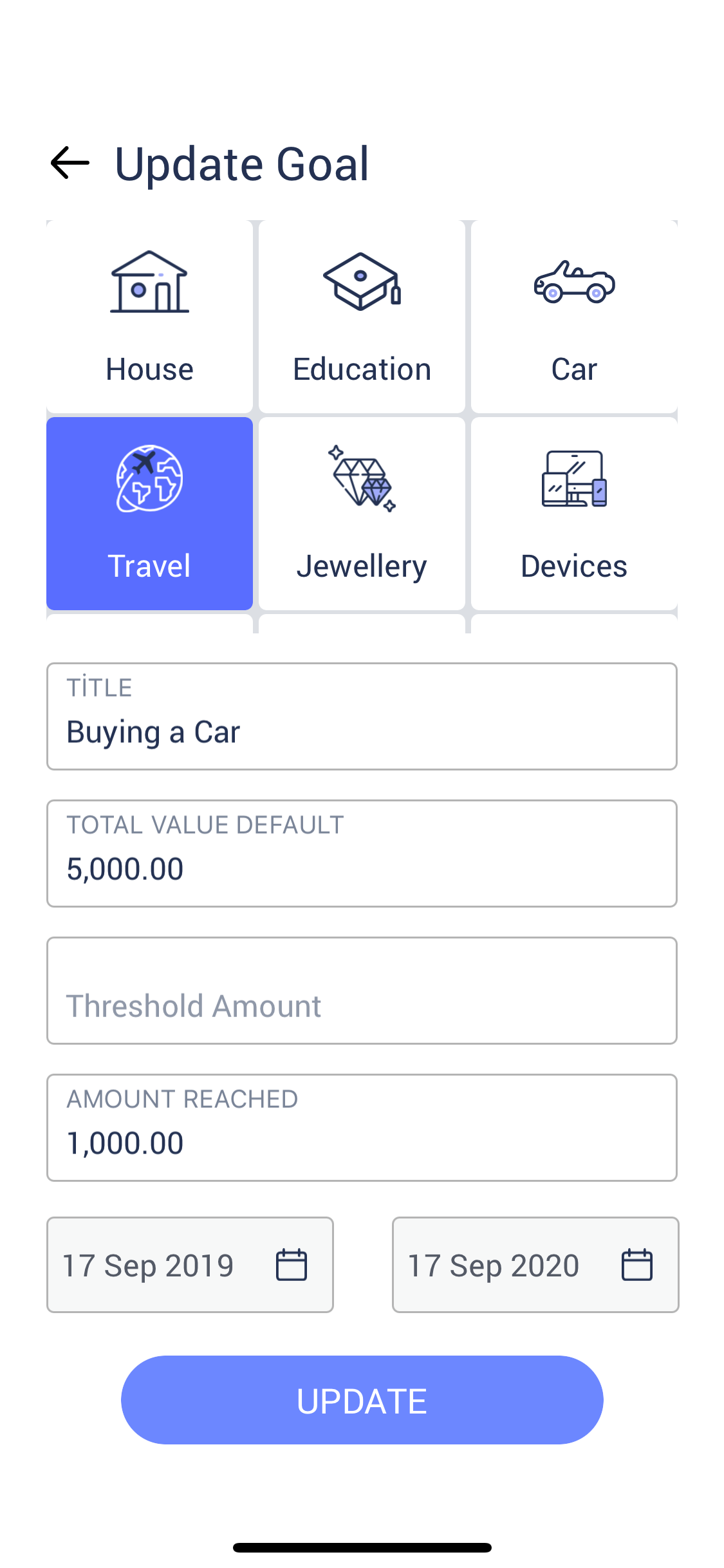

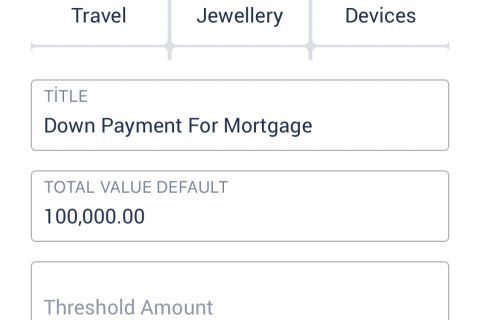

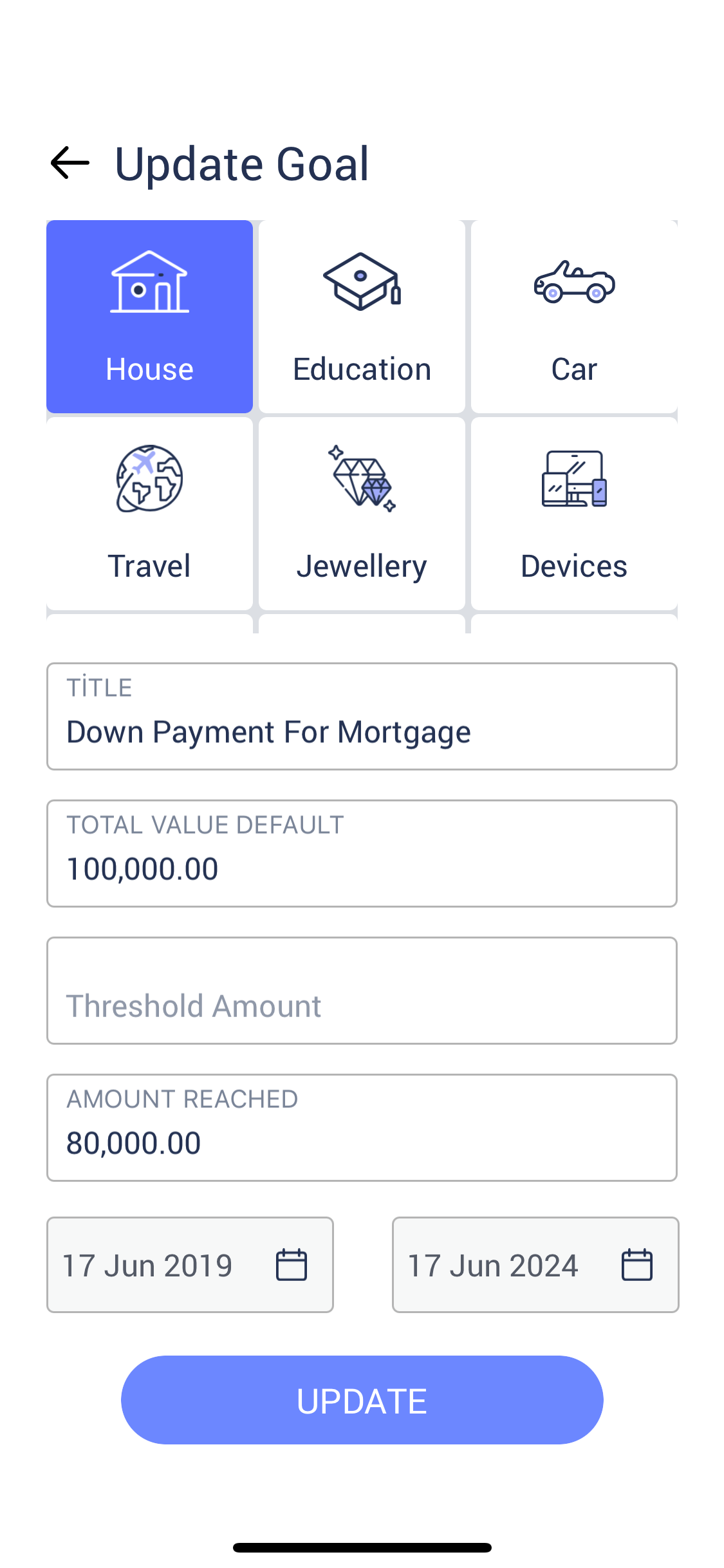

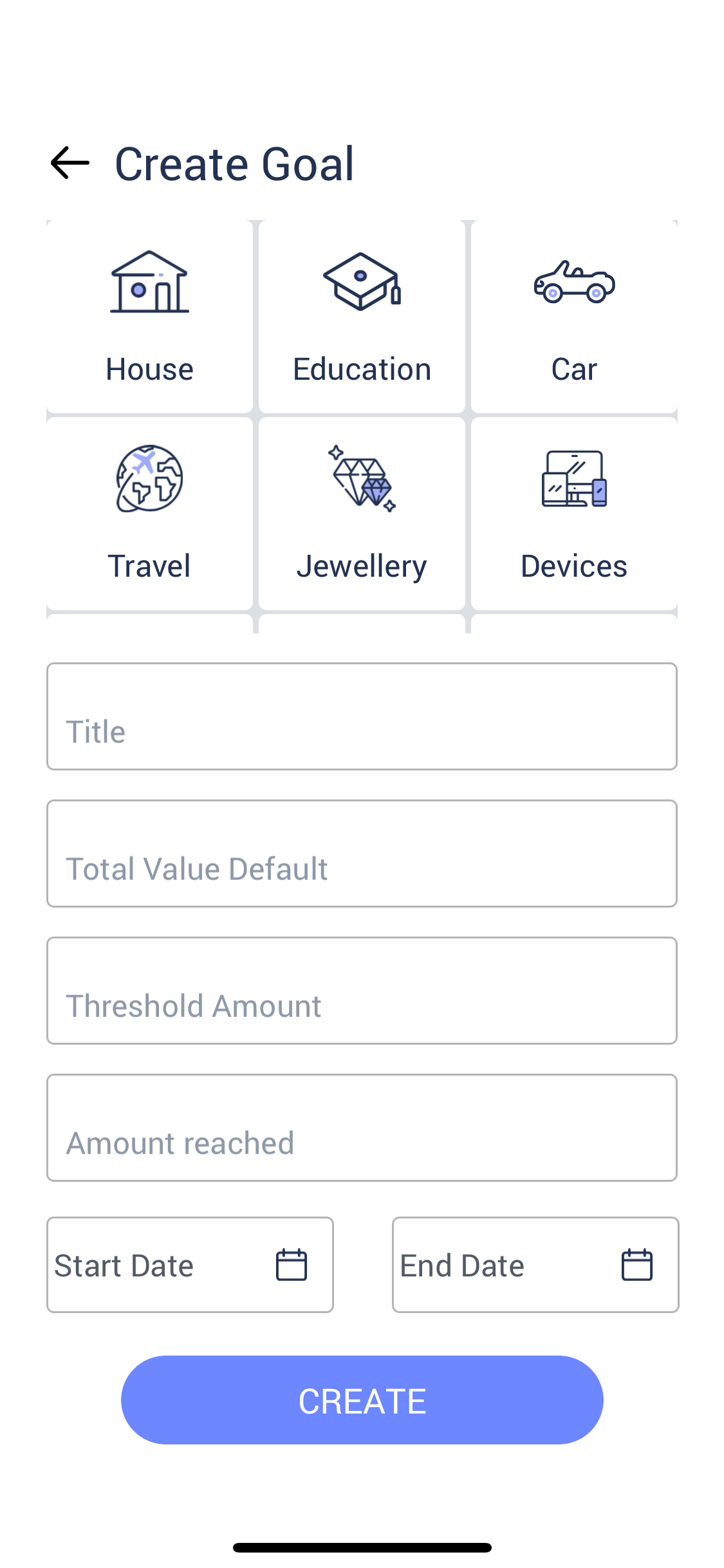

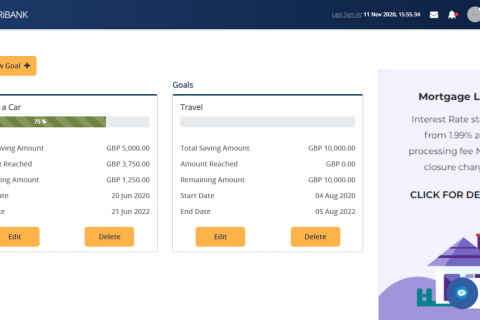

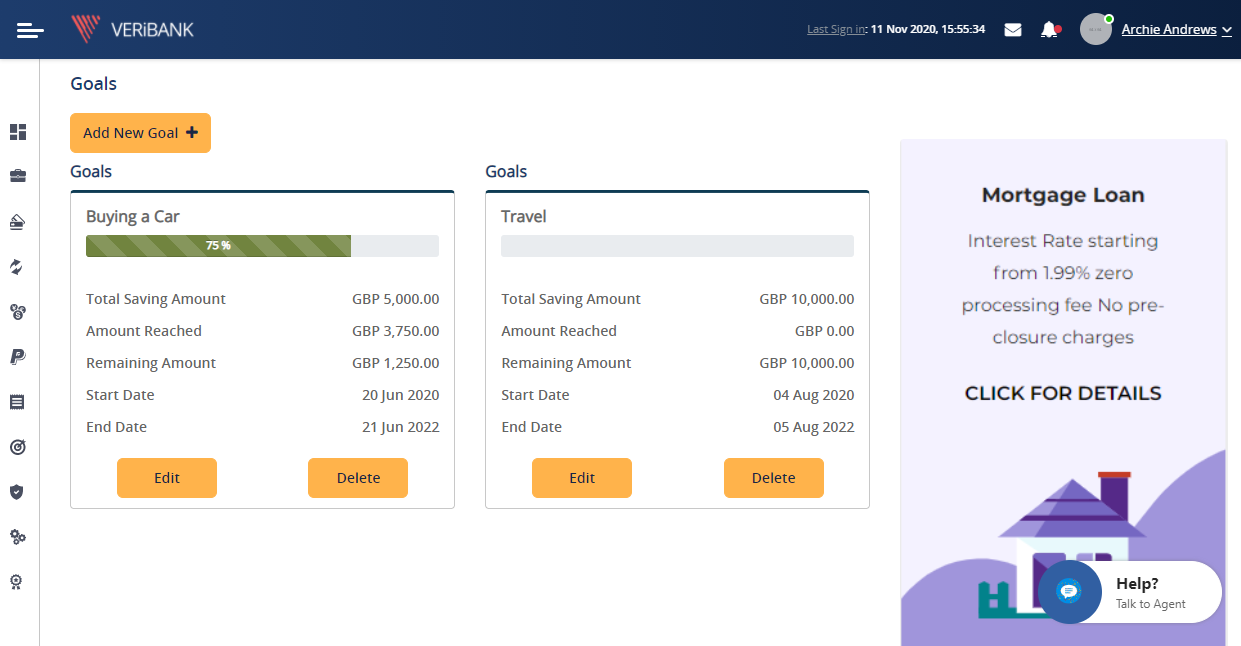

- Setting goals for savings and manage the goals,

- Performing financial health checks,

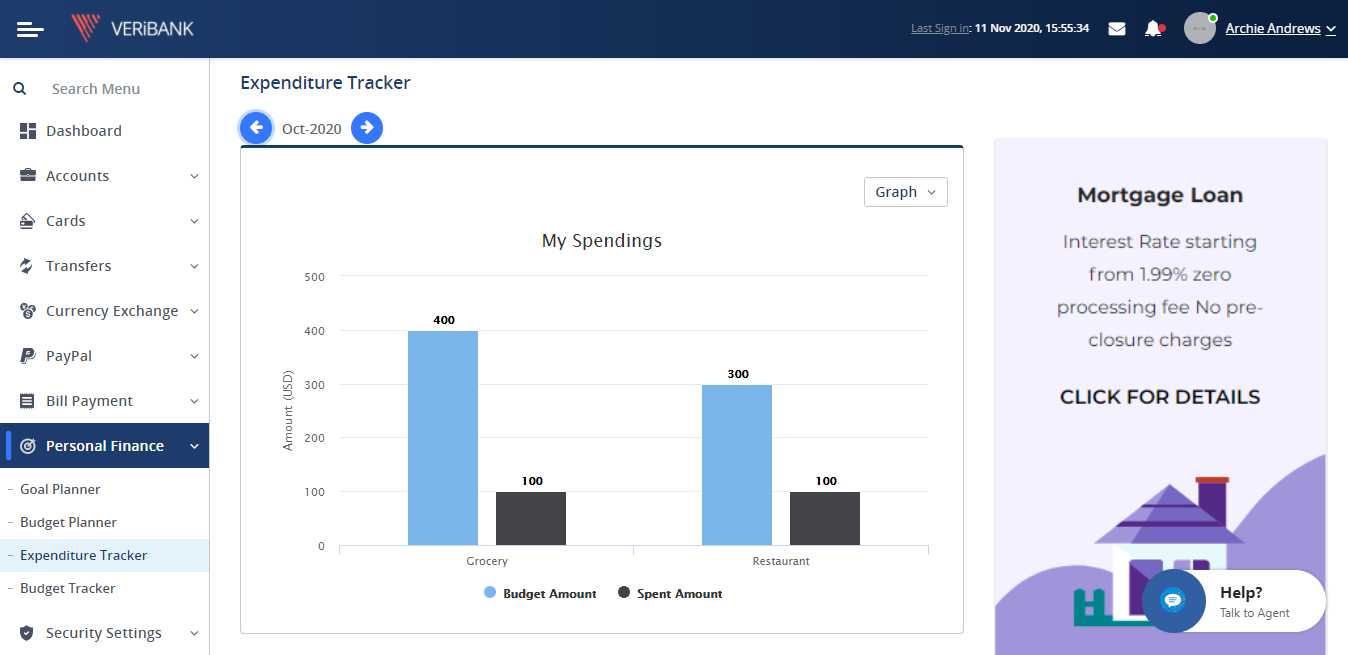

- Categorizing spending based on different filters,

- Categorizing payments and transactions.

VeriPark’s PFM channel makes your customers’ lives simpler, not more complicated. It’s the digital equivalent of the jam-jar approach to money management, where they divide their money into separate pots for different expenses – only with much more flexibility and portability.

For banks, VeriPark’s PFM works as a new distribution channel that drives customer acquisition in a smartphone-dominated world. It also provides deep customer understanding to increase loyalty, cross-sell and up-sell capabilities.

Key Features

-

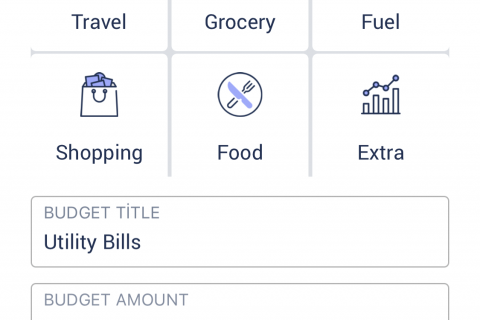

Budget definitions

-

Categorization of expenses

-

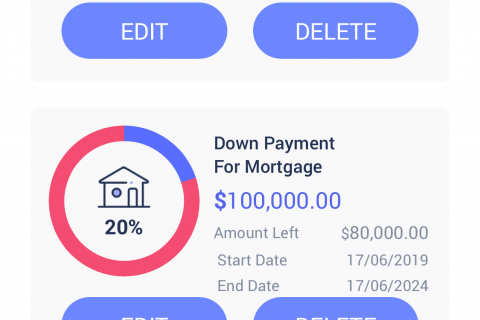

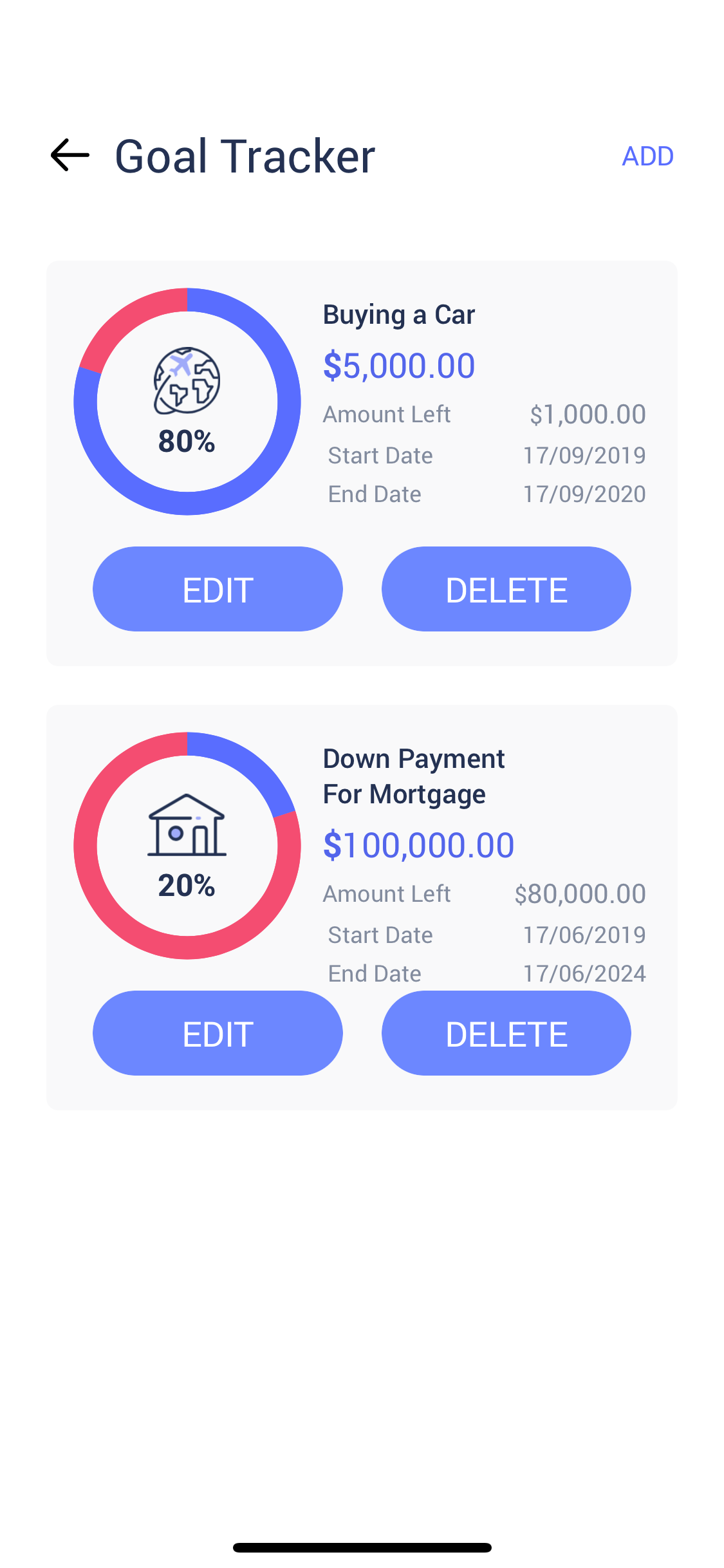

Goal management