Chatbot

Chatbot

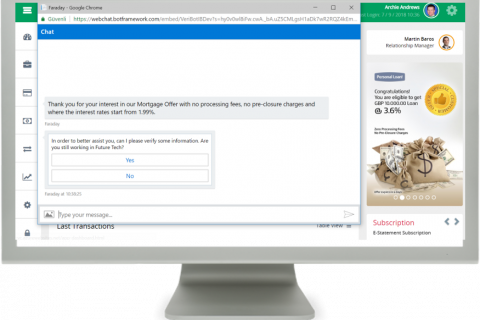

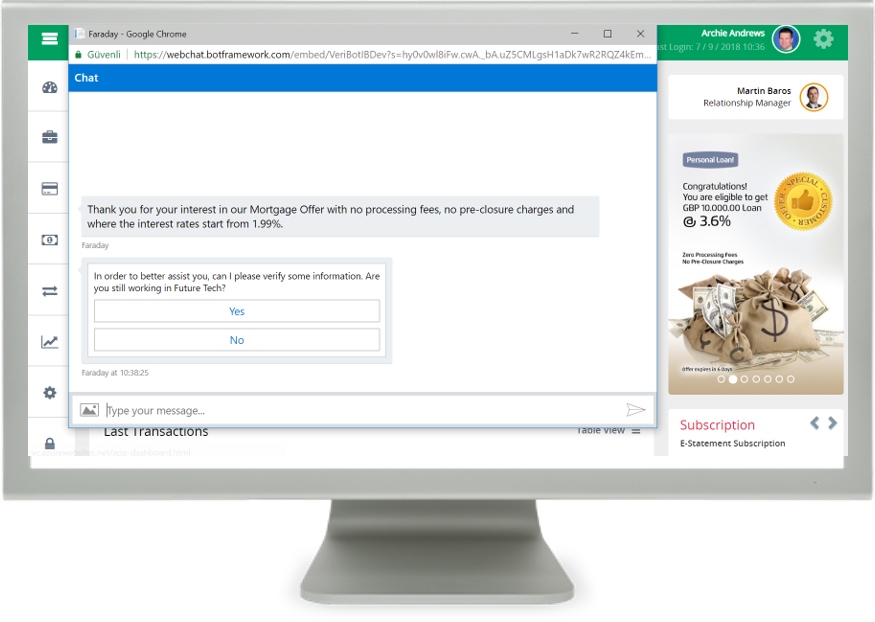

At a time when personalized, omni-channel customer experiences are becoming the new norm, we recognize the importance of engaging customers in new ways.

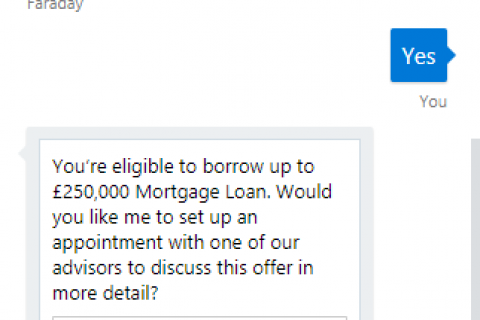

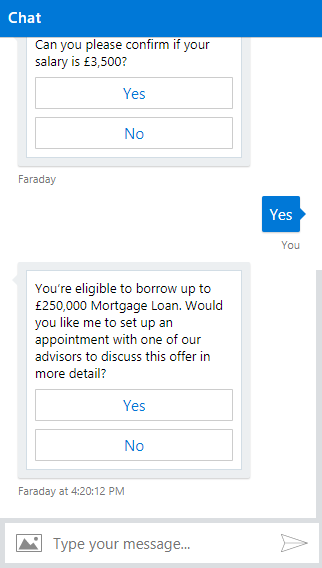

VeriPark designed a chatbot module for customer-centric banks & insurers looking to unite all platforms around their customers and shift their communications. With the chatbot, banks & insurers can offer services that go beyond normal business hours, boost sales and increase loyalty.

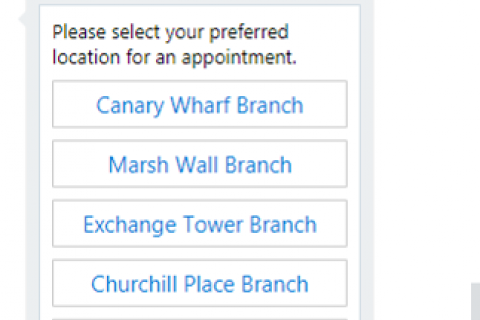

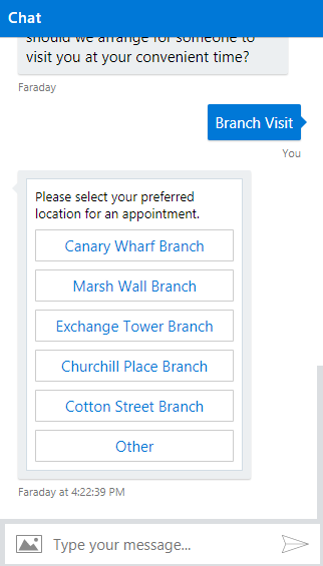

The chatbot module runs across all digital channels from web to mobile and delivers a holistic communication. In other words, customers can choose the channel that suits them and get the same omni-channel experience everywhere. With the instant chat feature, they can access quick services and get transactional support 24/7. The conversational functionalities of the chatbot enable customers to resolve an issue or get an answer to a question faster than a live person. What is more, the transactional capabilities allow them to perform transactions such as payments, transfers and loan applications instantly.

Key Features

-

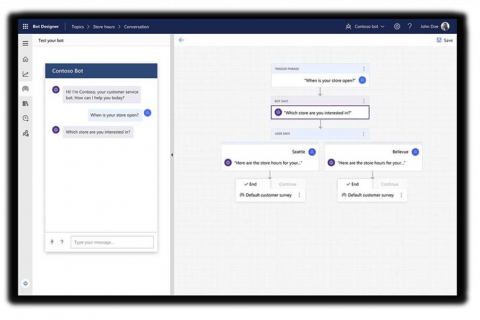

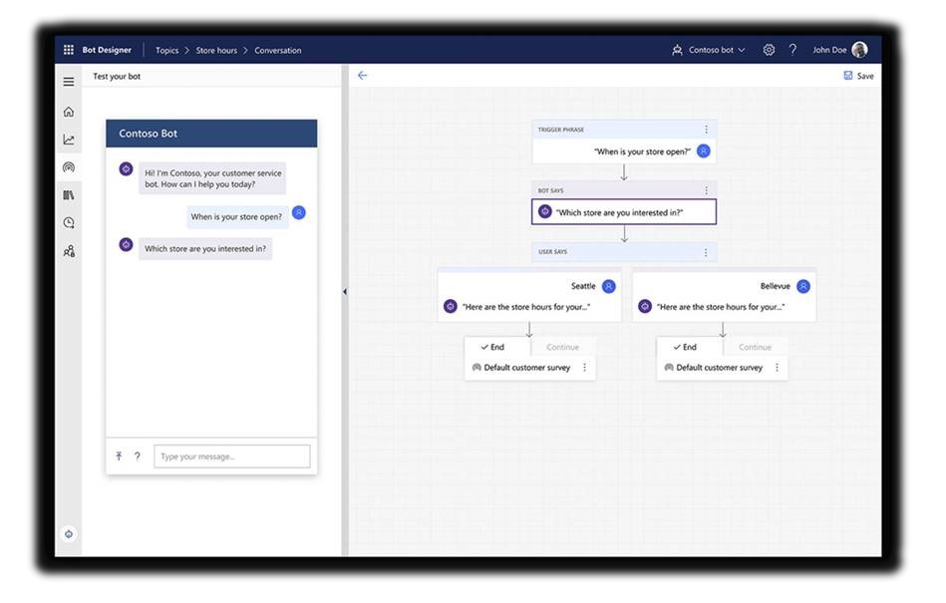

Using Natural Language Processing (NLP) for intent and entity recognition to provide a way for systems to understand customers in their own language from any device

-

Interacting with customers to make sure that they get answers to their questions or find what they’re looking for in real-time

-

Using Machine Learning (ML) to better understand customer requests and provide a natural, near-human communication by streamlining and optimizing customer service operations

-

Integration capability with Microsoft Bot Framework and LUIS

-

Integration capability with social channels such as Facebook and LinkedIn

-

Connecting channels to any back end system to carry out the tasks

-

Straight-through processing (STP) capability for routine activities

-

Offering a mix of both live conversation and speed

-

Multi-device and multi-platform compatibility: IOS, Android, Windows

Key Benefits

-

For Financial Institutions

- Facilitating two-way, human-like communications and directing customers to perform many banking transactions using chatbot

- Offering 24/7 customer support, giving guidance and advice on financial decisions

- Driving dramatic cost savings by automating transactional enquiries

- Redirecting workforce to focus on more complex customer issues that require deeper human insight

- Becoming more interactive with the customers, re-establishing relationship banking, enhancing customer engagement

- Getting a deeper understanding of customers' behavior and transactions and using this data to deliver highly-targeted personalized offers

- Making omnichannel banking cost-effective and consistent

- Gaining actionable insights and using them for cross-sale and up-sale opportunities.

-

For Customers

- Reaching instant and personalized services that are available 24/7 via their preferred digital channel

- Easy and intuitive banking anytime, virtually anywhere

- Managing accounts, ordering and cancelling services, making transactions, within seconds

- Having smooth interactions

- Getting extensive customer support and guidance on financial matters