Retail Banking

Transform the way your bank engages with customers to unlock more meaningful customer relationships and create new business growth opportunities

Retail banking is changing at unprecedented speed. Banks are juggling multiple priorities, including managing revenue and low interest rates alongside increasing demands from customers who are changing their behaviors as they deal with their own financial pressures. How you deal with these challenges will not only define the future of your bank's brand; it will significantly affect your customers and employees.

VeriPark’s Retail Banking Solutions are designed to help Retail Banks to satisfy both the demands of the consumers and the needs of employees while complying with changing regulations. They help banks to unlock more meaningful customer relationships and create new business growth opportunities. And, with improved data insight, they are better placed to anticipate what customers want and transform the way they interact and engage with them.

Omni-Channel Banking Experience with VeriChannel

VeriChannel offers a secure, unified platform that empowers organizations to manage seamless, consistent and engaging customer journeys across multiple customer touch points. With an extended channel coverage ranging from assisted to digital channels, including contact center, web, mobile, kiosk and ATMs, customers and employees can access the system from devices of varying sizes and resolutions.

To give customers a seamless, integrated experience across all channels, these channels cannot operate separately. They are connected in order to provide a streamlined, consistent and personalized customer experience at every touch-point, even if customers decide to switch between channels at various points in the customer journey.

VeriChannel modules for retail banking

Branch Automation with VeriBranch

With its unified frontend, VeriBranch gives banks all the tools to transform their branches into high-value sales centers. It leverages technology to empower branch staff and deliver unparalleled customer satisfaction.

VeriBranch directly connects to back-office customer systems enabling banks to streamline business processes. With this solution, banks can provide their branch staff with the necessary infrastructure and tools to make sure they are equipped with everything they need, even in a remote work environment. Bank tellers can execute efficient transactions, such as loan origination, account origination and transfers from a single user interface. Relationship Managers and advisors can engage customers and provide personalized financial planning services whether they work at the branch or at their remote work stations.

VeriBranch modules - supporting conventional & digital branches

VeriTouch Retail Banking CRM solution

As a vertical solution built on top of Dynamics 365, VeriTouch leverages the core capabilities of CRM and tailors it to meet the unique and specific needs of Retail Banking, enabling banks to place customer relationship management at the core of their digital transformation journey. The solution provides acquisition, development, retention and loyalty capabilities in an omni-channel architecture.

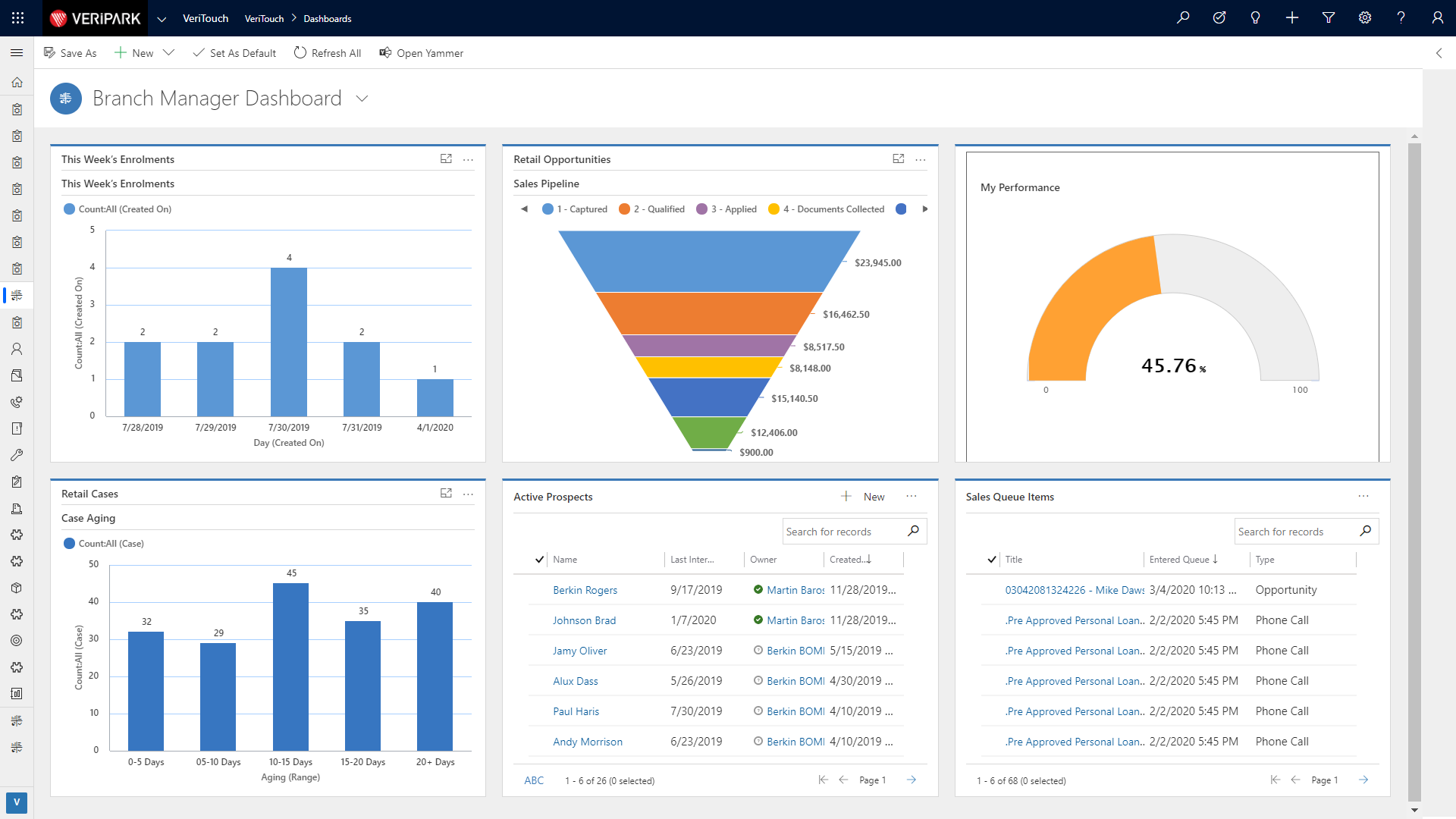

VeriTouch offers many role-based dashboards such as Relationship Manager Dashboards, Branch Manager Dashboards and Contact Center Agent Dashboards to provide valuable insights to the various departments of the banks. It strongly influences executive decision making and enables banks to monitor operations effectively.

VeriTouch modules

Loan Origination & Servicing with VeriLoan

VeriLoan is a powerful end-to-end digital loan origination, servicing and collection solution built on top of Dynamics 365. The customer-centric solution allows managing the entire customer lifecycle in one, unified platform. Covering everything from pre-screening, onboarding, underwriting, disbursement to collection, VeriLoan automates the entire retail loan process from start to finish.

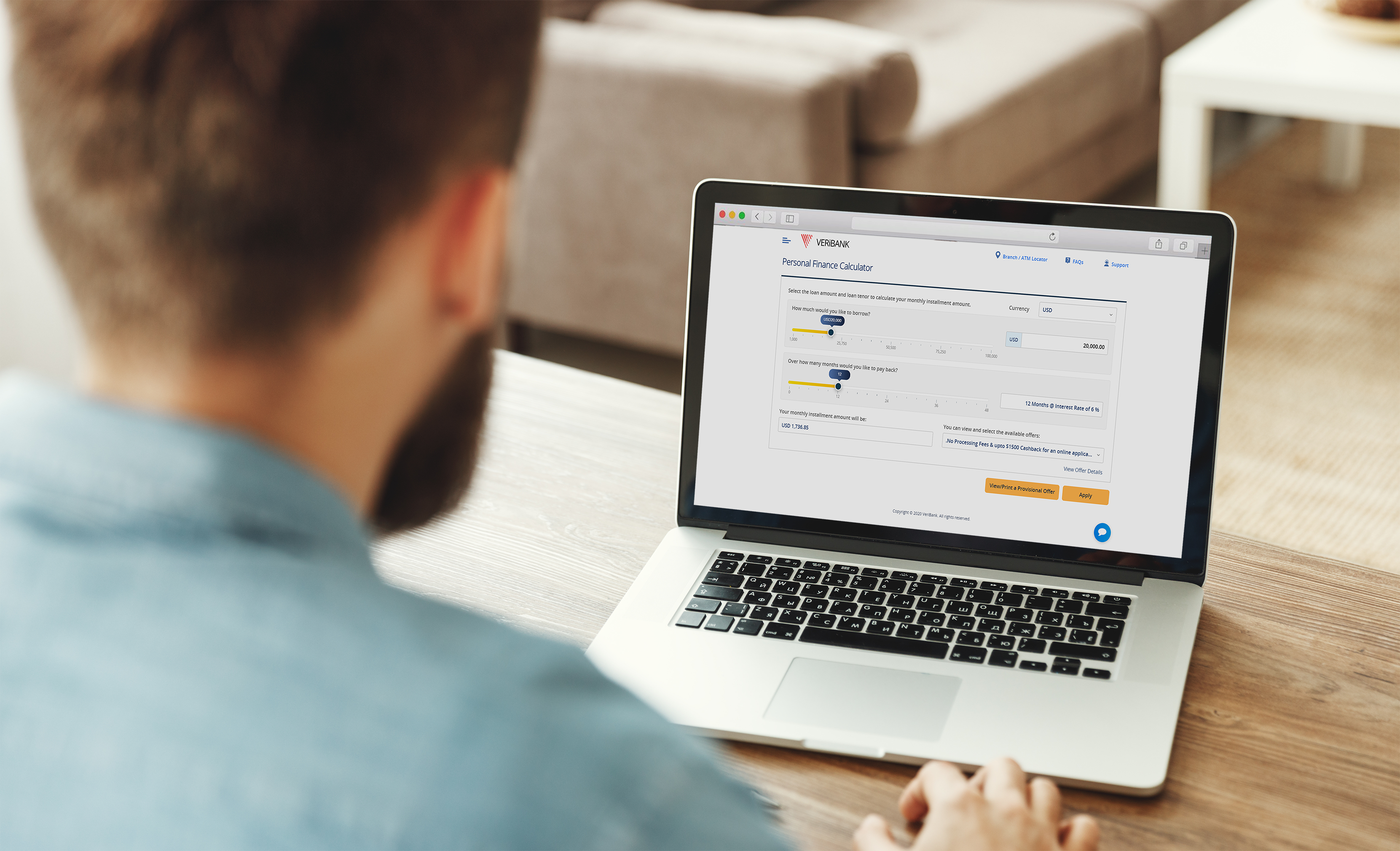

The solution empowers retail banks to make fast, consistent and cost effective loan decisions within predefined risk margins. It provides straight-through processing (STP), sophisticated rule engine, simplified KYC and AML check processes and advanced eligibility calculator. Using VeriLoan, banks can deliver paperless, future-ready loan journeys for their retail banking customers anytime, anywhere and on any device.