Merchant Portal

Merchant Portal

SMEs are vast and potentially profitable segments for banks offering significant business opportunities. However, the lack of relevant offerings and tailored approaches, such as dedicated Relationship Managers to deal with their day-to-day banking activities, hurt both SMEs and banks. In order to win this segment, the banks need to better understand the particular needs and preferences of SMEs and build innovative approaches, products and tools to reach out to them.

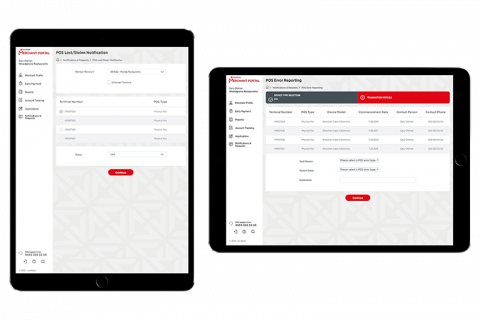

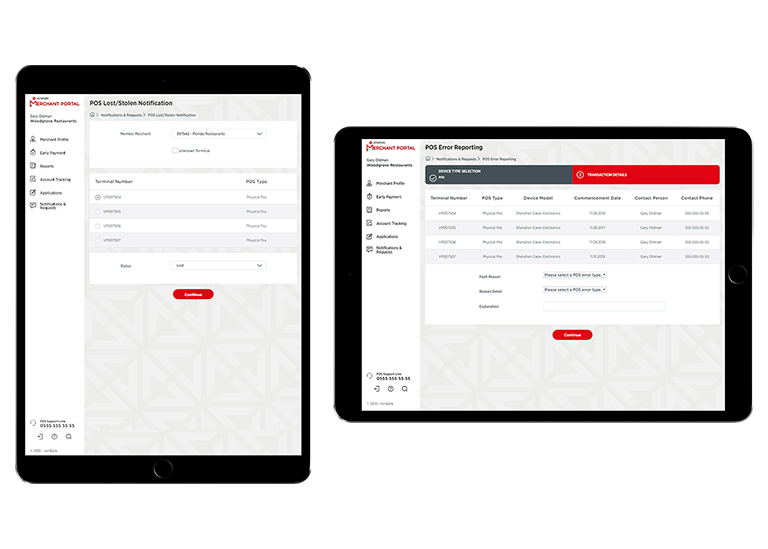

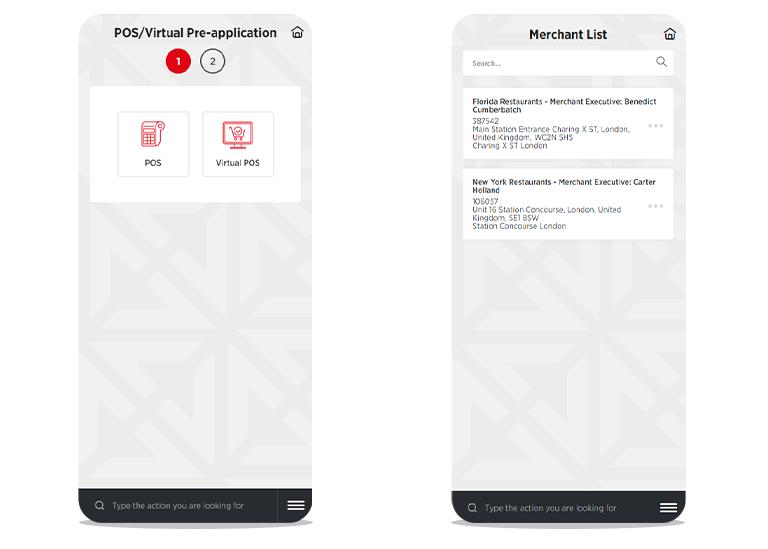

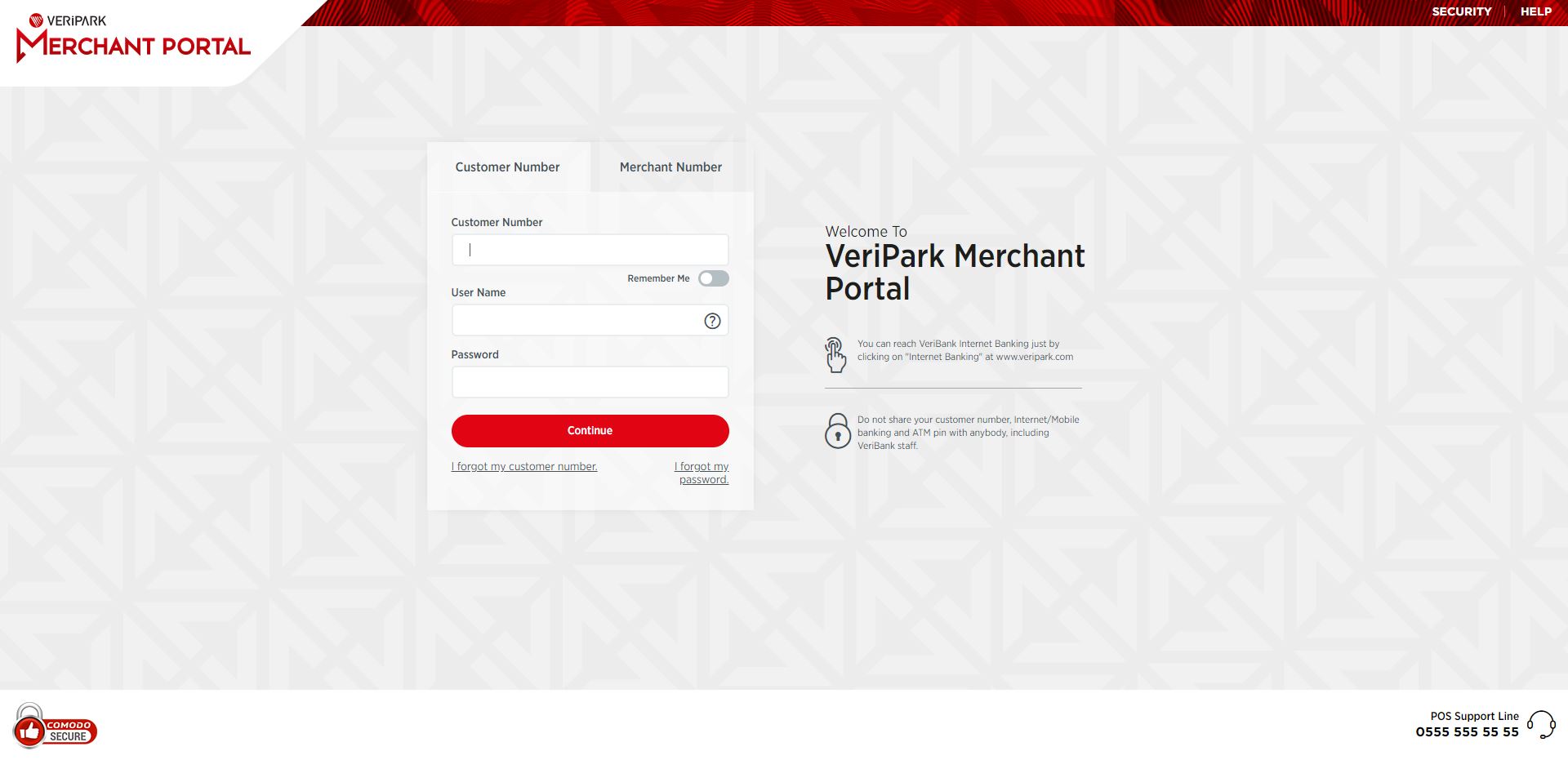

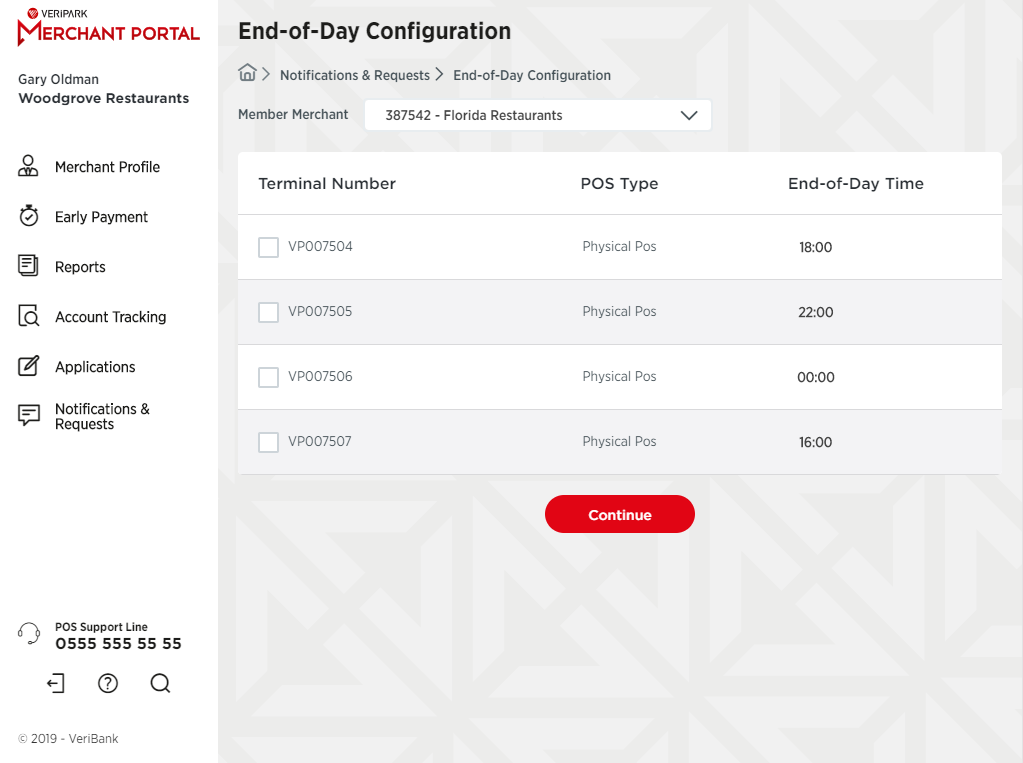

By implementing Merchant Portal, banks can transform their relationship with SMEs and give them exactly what they want. Merchant Portal, built on VeriPark’s Omni-Channel delivery solution VeriChannel, is a platform specifically designed to serve the needs of micro-segments such as grocery stores, restaurants and other merchants. The mobile-first platform provides SMEs insights and tools to manage their day-to-day bank-related business operations. Banks with this in view, execute campaigns and loyalty programs to engage merchants and make timely, relevant offers.

Key Features

-

Single sign-on application to simplify identity management with secure, one-click access for assigned users

-

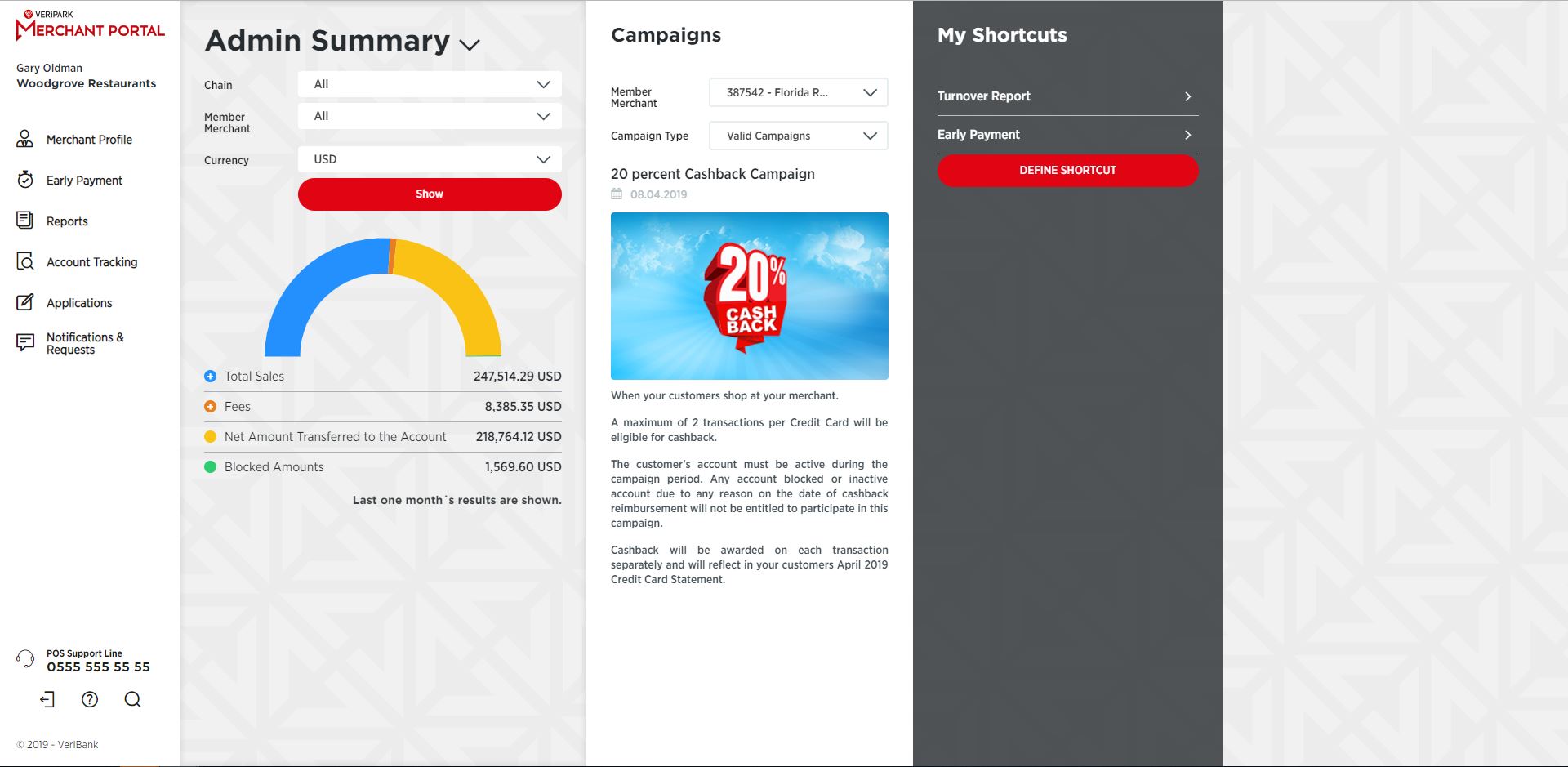

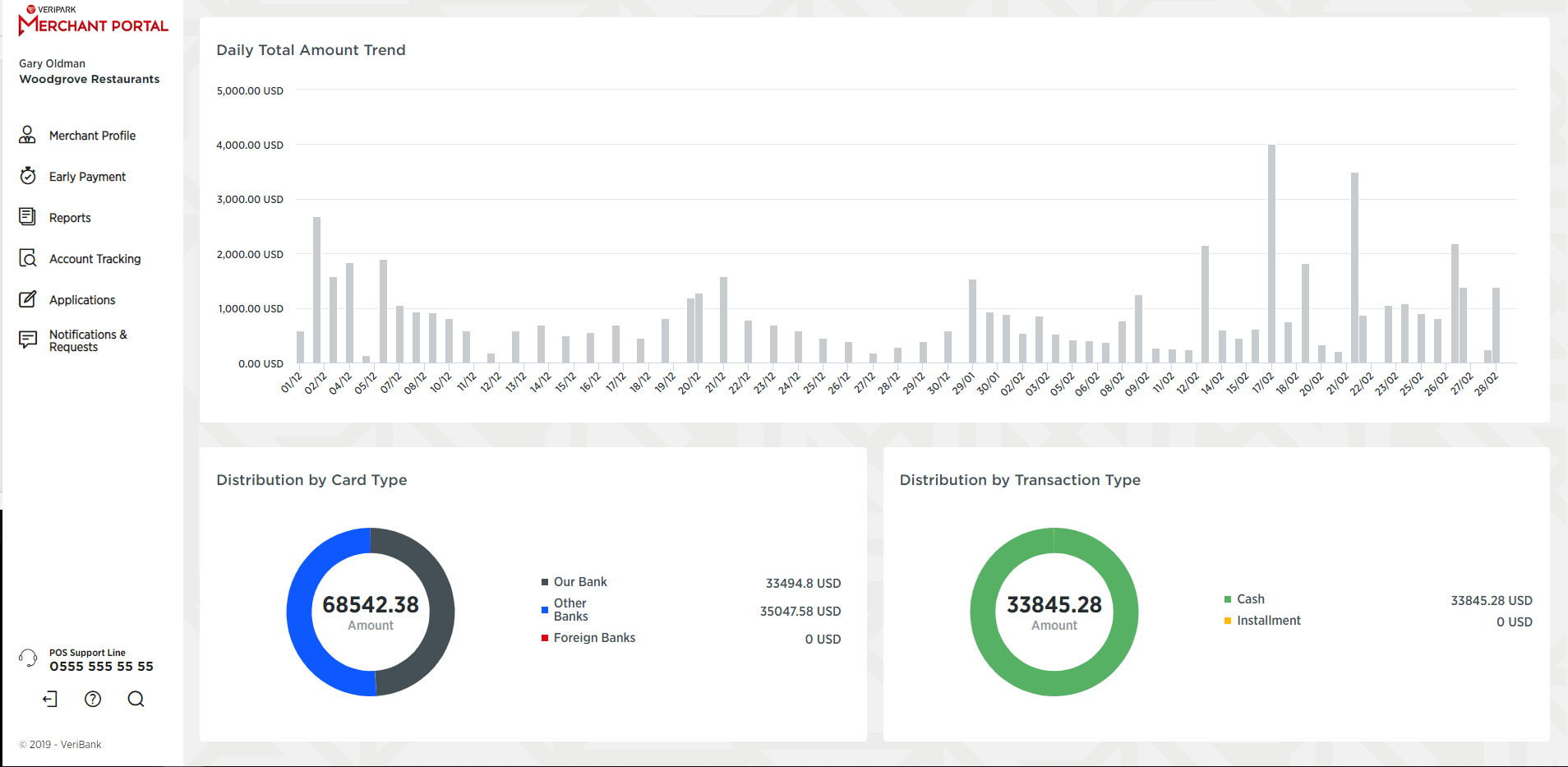

Enriched dashboard to visualize their Point-of-Sale (POS) transactions volume and activities

-

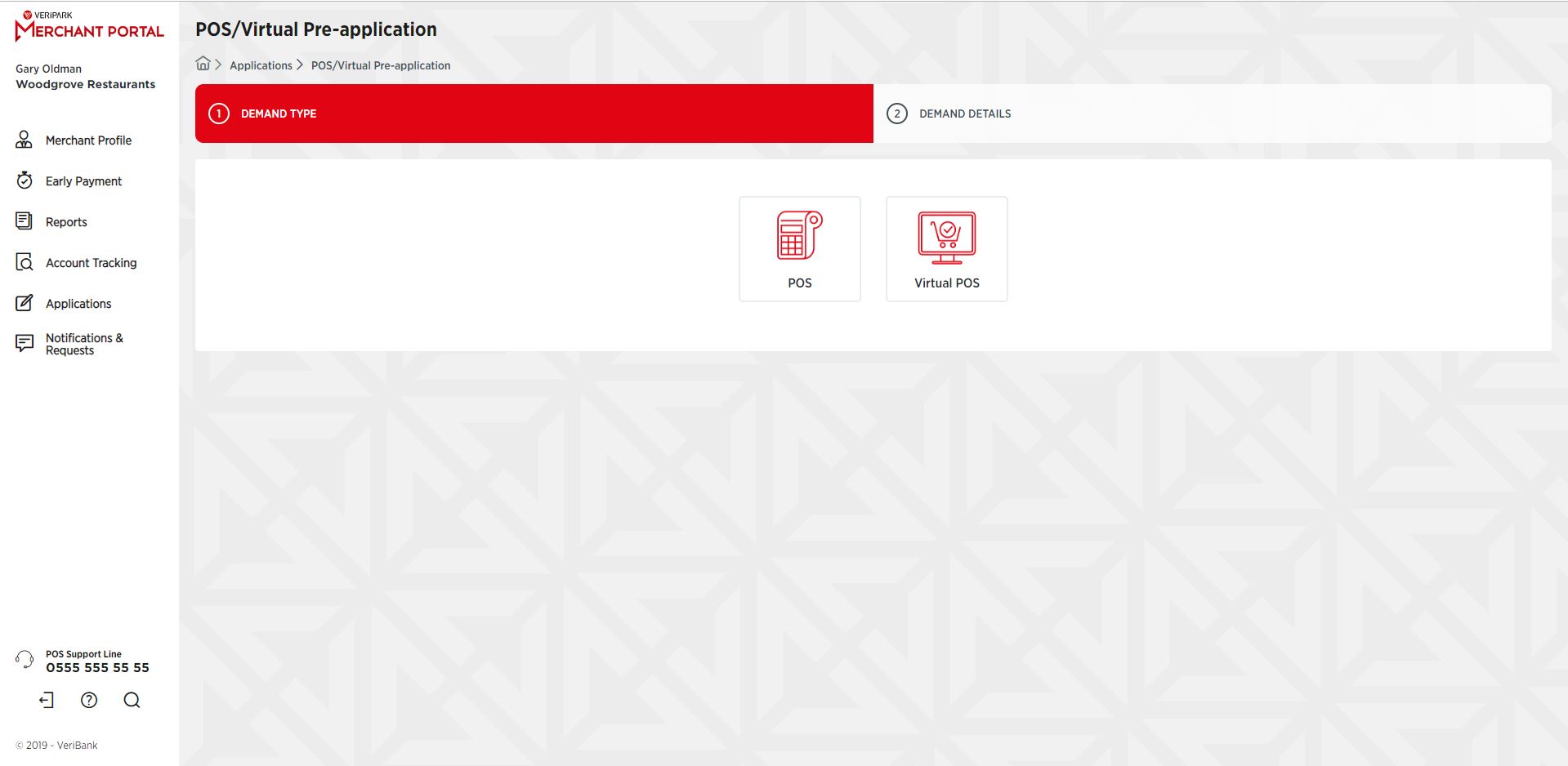

Virtual POS terminals having the capability to validate card payments in real-time and generate reports anytime and anywhere

-

Early payment options for merchants to unblock the pending amount in POS accounts without having to go to the branch

-

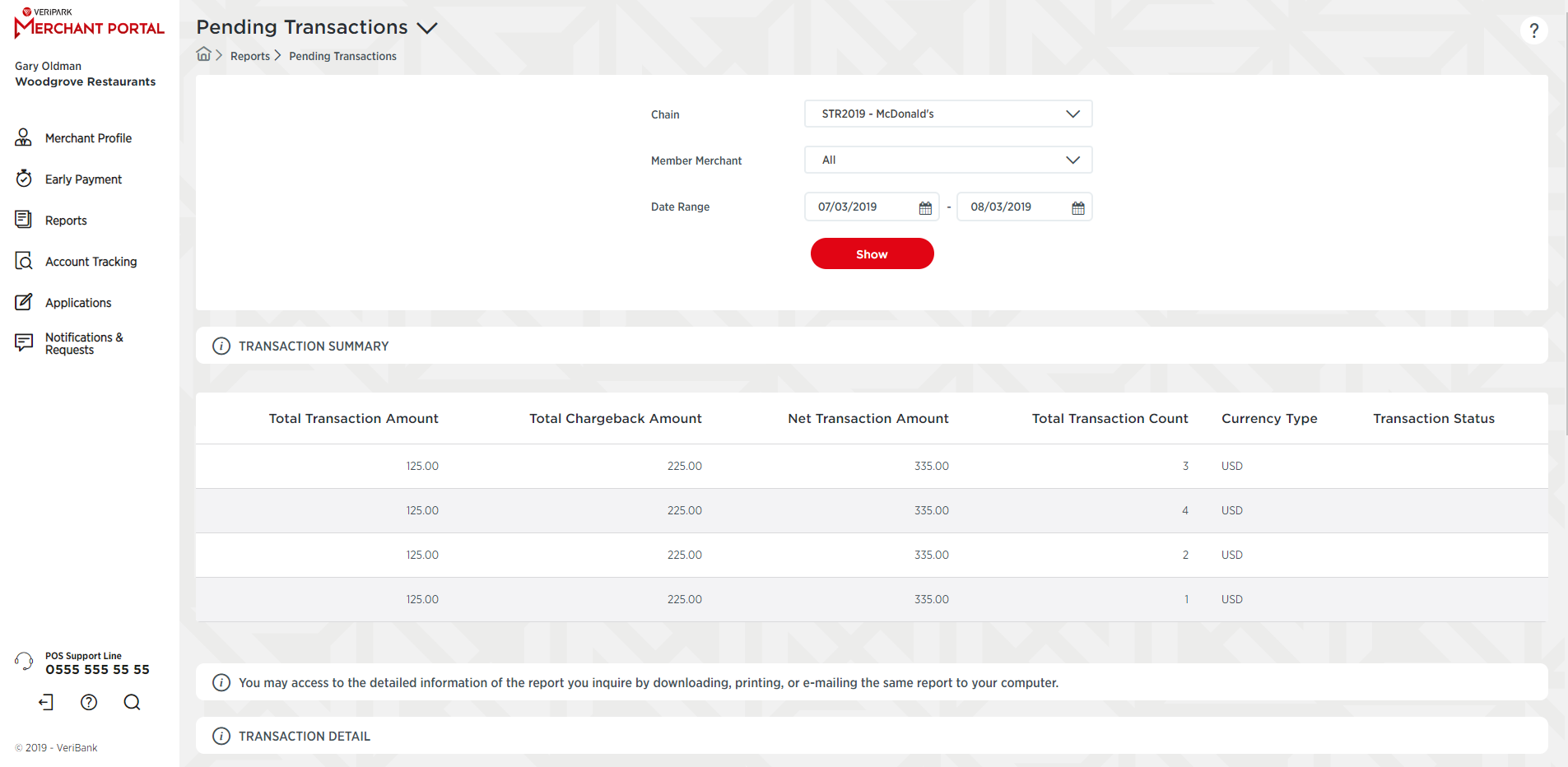

Automated report scheduling capability where merchants’ chosen reports are sent periodically that carry rich and insightful data.

-

Demographic customer reports to highlight demographic trends, segmentation data and consumer expenditure information

-

Location based competitor analysis to provide valuable insight on other merchants’ sales and performance where merchants can make data-driven business decisions to increase their sales

-

Specific campaigns offered by banks for merchants which the merchant can communicate to its customers and drive sales

-

Loyalty programs to boost merchants’ loyalty and retention with gifts and incentives

-

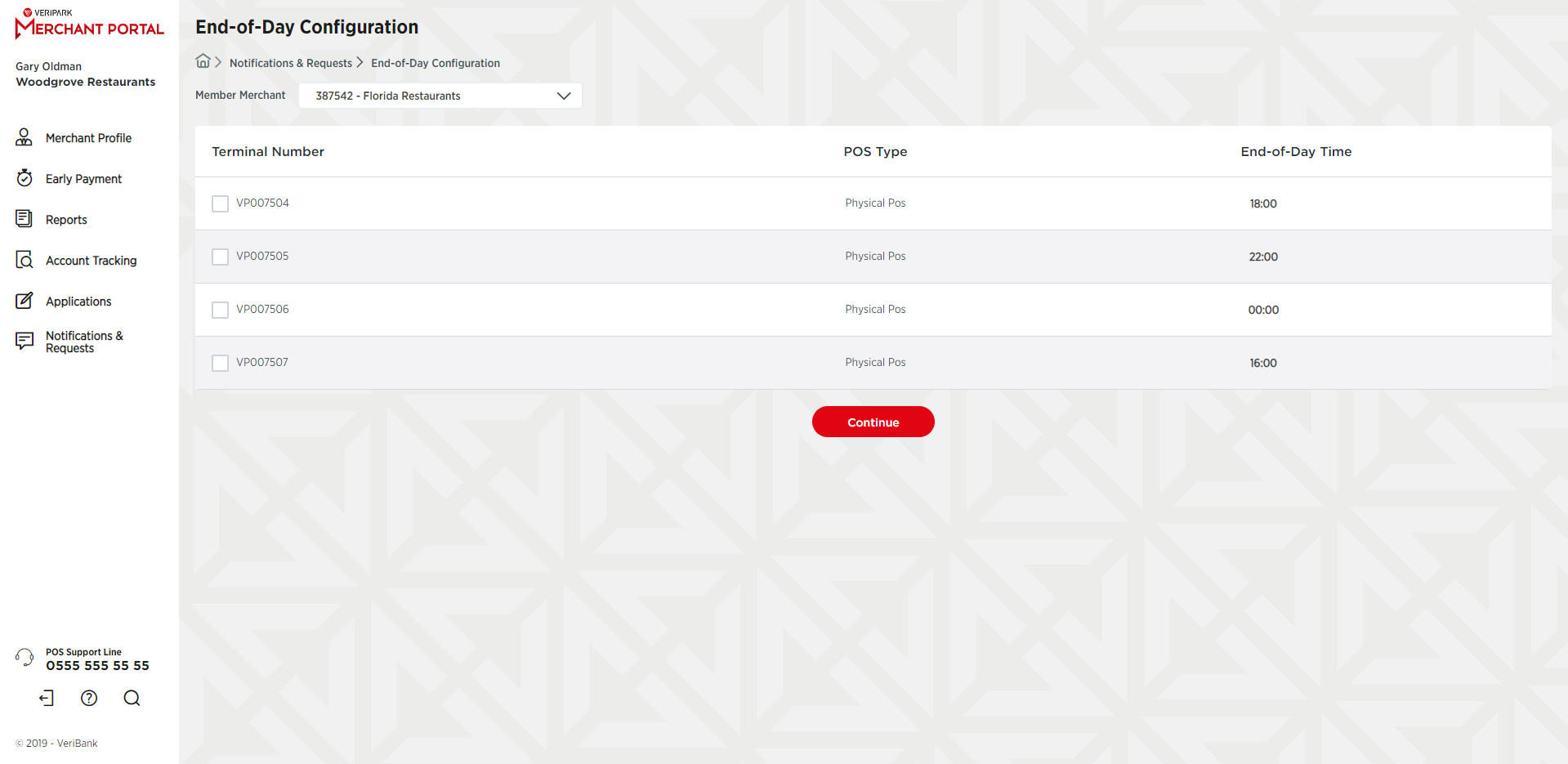

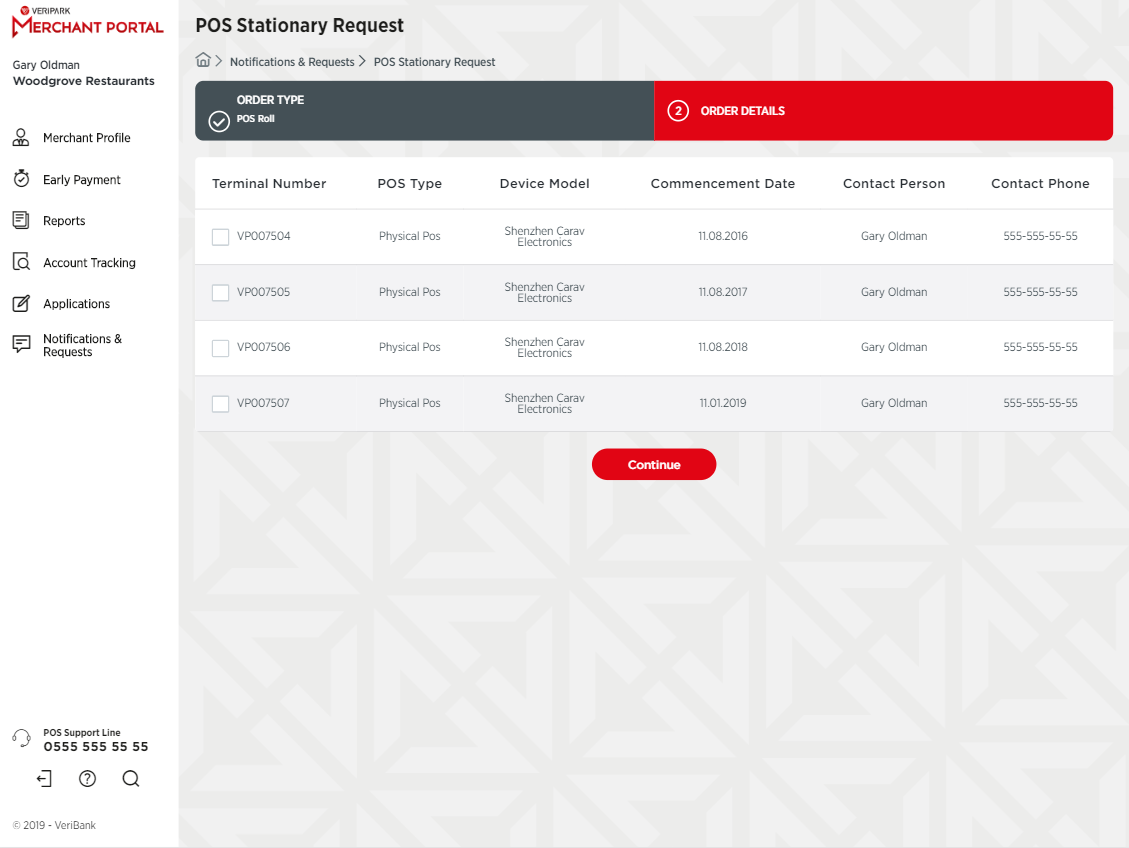

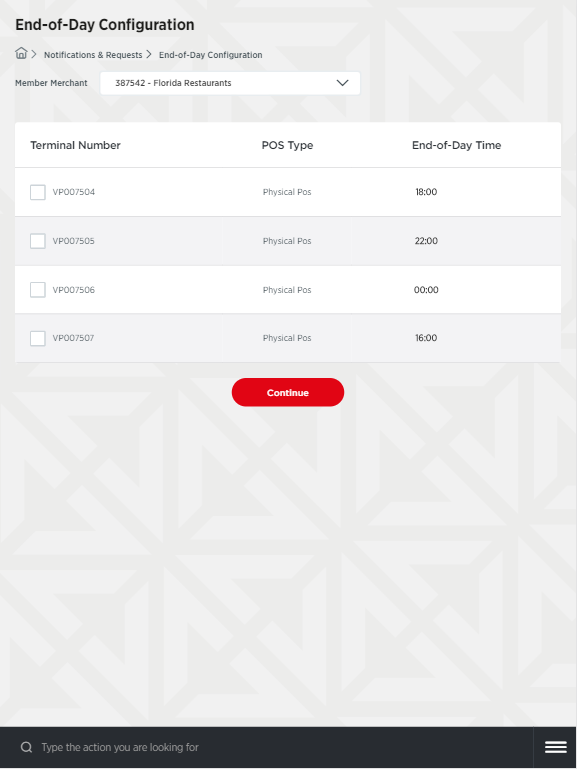

Simple one-button access to key support actions: Requests on POS material purchasing and statements, access permissions, end-of-day configuration, transaction cancellation and refunds

-

User-friendly tools to generate reports on customers, MT940 statements, POS errors and pending and blocked transactions

-

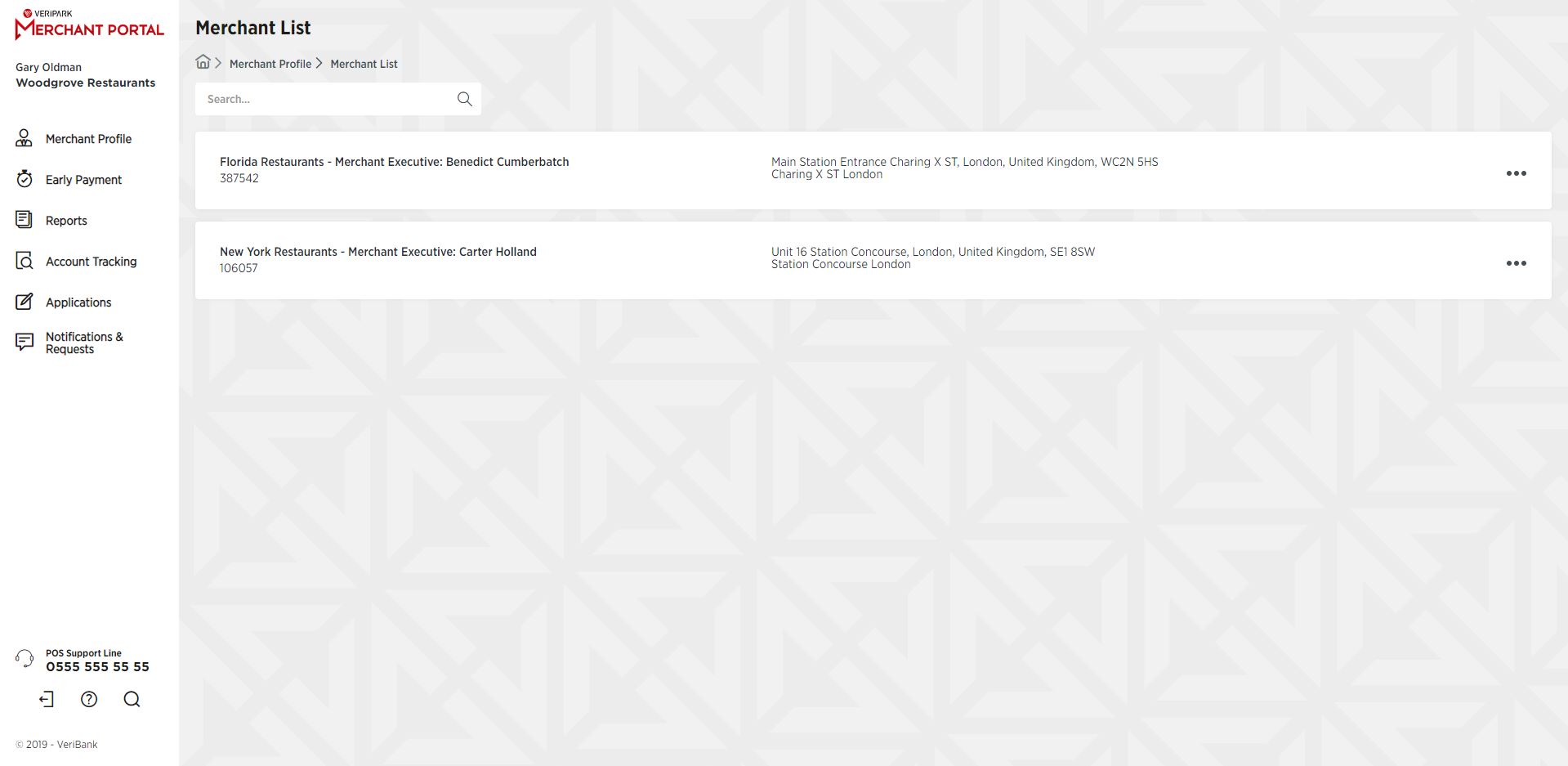

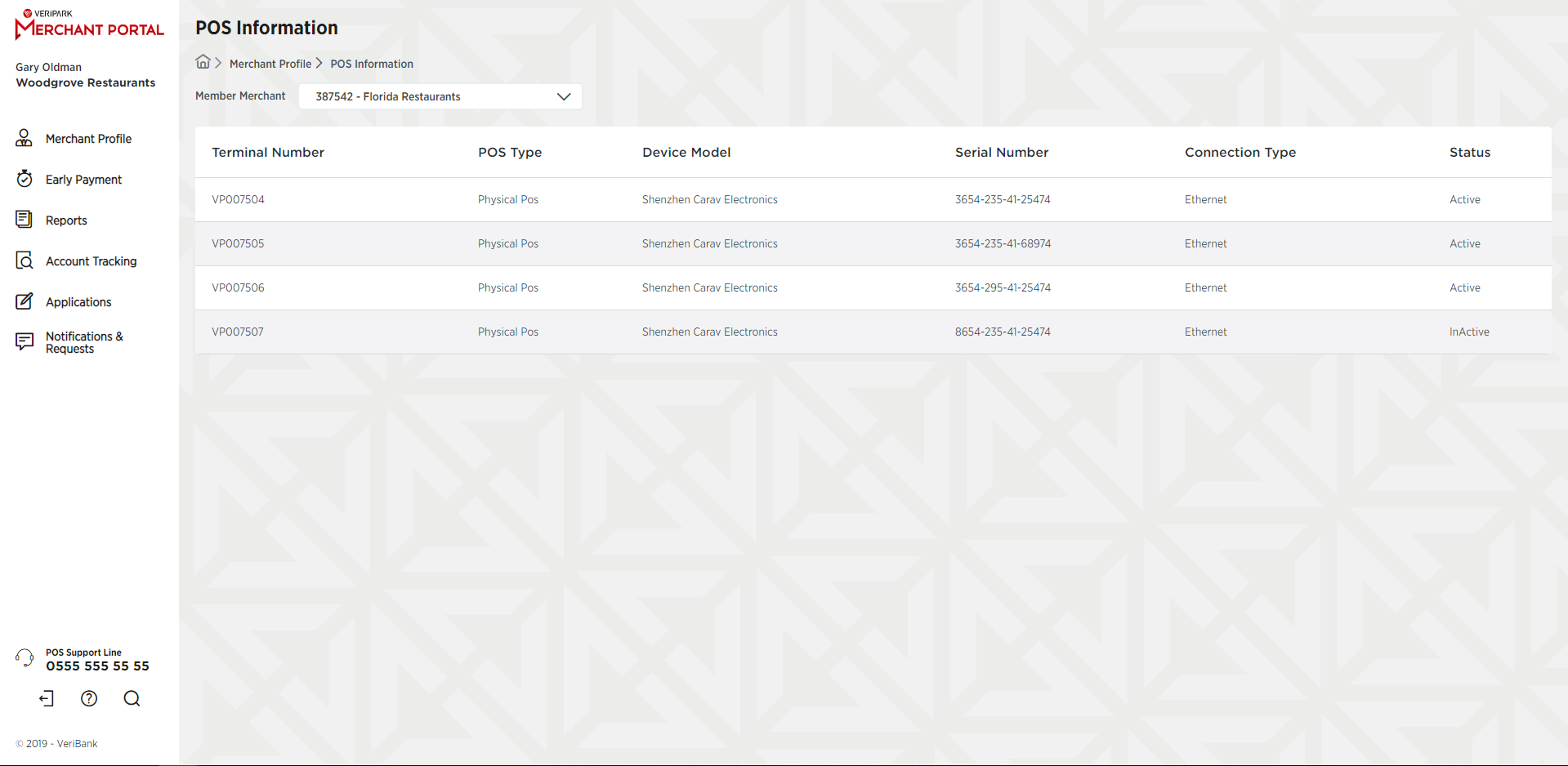

Multi-store, multi-terminal (POS) monitoring capability with drill down functionalities

Key Benefits

-

For Banks

- Empowering merchants with the financial services and digital technology they require to start and grow their businesses

- Digitalizing and streamlining transactions performed by merchants, speeding up daily processes of merchants, increasing productivity

- Reducing the contact center overhead cost with the increase of self-serving merchant customers

- Reducing the cost-to-serve for POS owner merchants

- Increasing cross-sell to micro segments through campaigns and loyalty programs

- Increasing the loyalty level of existing clients and onboarding new merchants by offering a range of useful services for managing POS systems

- Generating interest and commission income through merchants using early payment options

-

For Merchants

- Having one self-service platform that supports merchant chains where merchants can manage existing POS systems, integrate customer data from different sources to have more detailed insights

- Early payment option to manage cash flows more efficiently and quickly where the merchants can either ask for the total pending amount to be paid early or can ask for a partial amount as early payment

- Overview of the campaigns offered by the bank for merchants’ businesses where they can provide offers to their customers and increase the volume of sales

- Ability to create customized report formats and to access detailed turnover reports, demographic reports and competition analysis

- Ability to define terms and conditions for each bank card, to display card information and its associated rates & charges along with the blocking time

Request a live demo

Success Story of Ziraat Bank Digital Merchant Platform

Ziraat Bank wanted to build a platform to digitalize transactions performed by its 20,000 merchant customers and decided to implement VeriPark’s Merchant Portal. Following the implementation, the cost of servicing for POS owner merchants reduced significantly. The merchants of Ziraat Bank now can easily manage their existing POS systems, place purchasing orders and create failure records in the event of a failure by using this platform. Thanks to the Early Payment options, the merchants can unblock the pending amount in POS accounts and manage their cash flows efficiently.