Mobile Banking

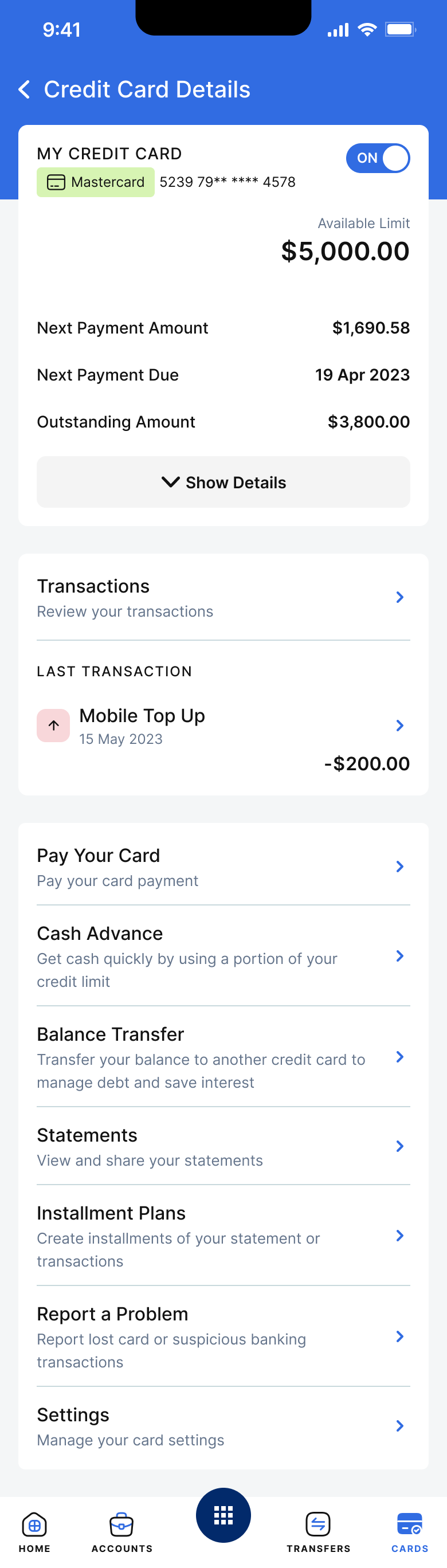

We see mobile as the future of finance. VeriPark’s Mobile Banking Solution provides AI-powered, secure and intuitive mobile banking apps to offer banking customers a unified and personalized cross-platform experience across devices for both the retail, SME and corporate sectors.

Because we understand that every business works differently, our mobile solutions have been developed to offer financial institutions such as banks and credit unions maximum flexibility. We believe mobile banking should be easy for customers and even easier for banks and businesses to integrate:

- Build options include responsive web apps, platform-specific (native), hybrid (Angular) and Fluter apps wrapped in native containers

- Multi-platform compatibility – iOS & Android & Windows

- Seamless integration into your existing banking architecture (core banking, CRM, loan origination, credit card systems, investment systems, etc.)

- Extended channel reach: mobile, tablet, speech banking, and wearable devices (e.g. smartwatch banking)

- Ready-to-use solutions that can be configured to fit your business needs

Key Features

-

Digital Onboarding & Offboarding

-

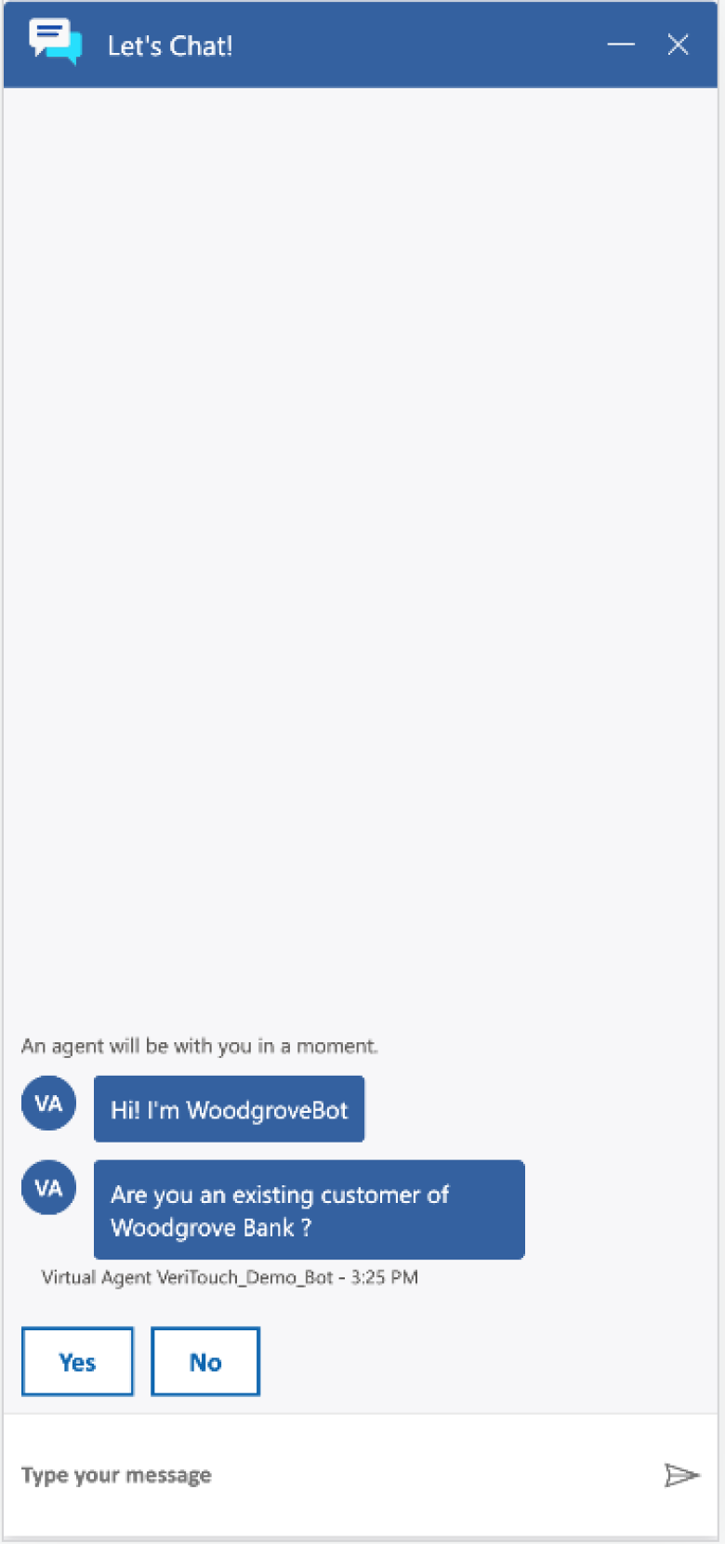

Transactional Chatbots

-

Omni-channel Servicing

-

Open Banking & Embedded Finance

-

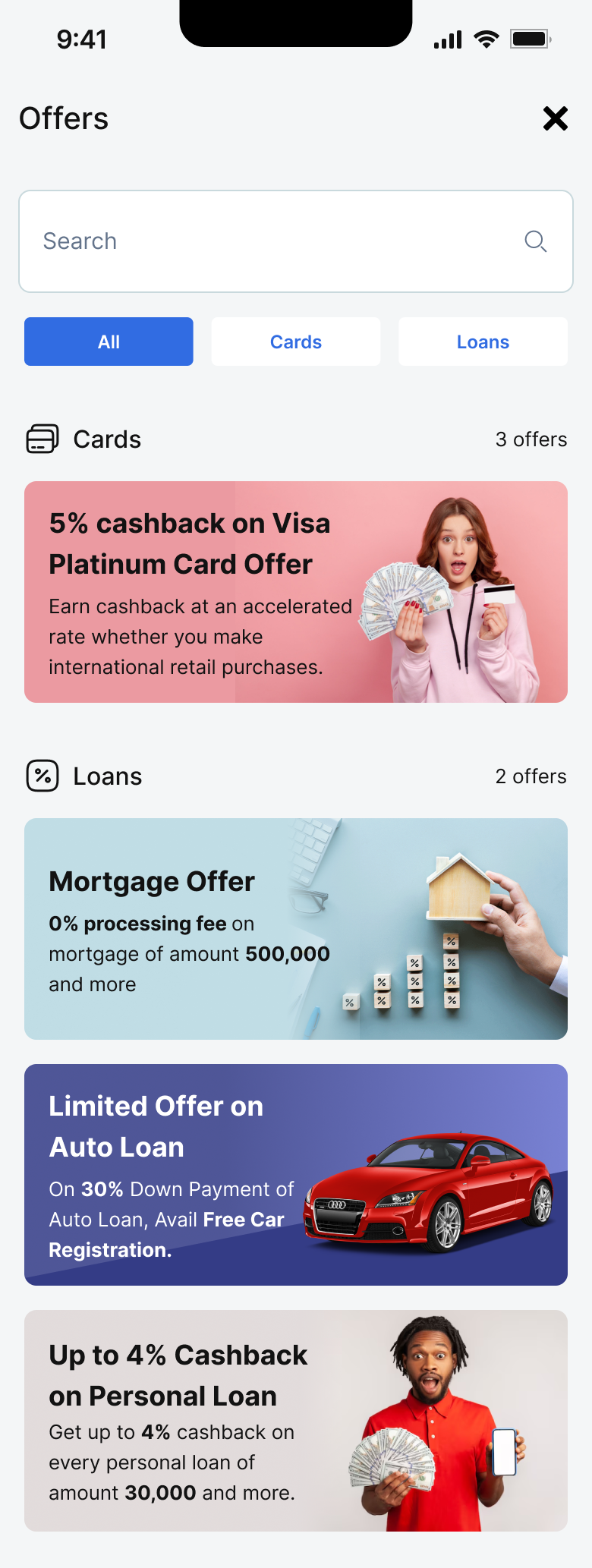

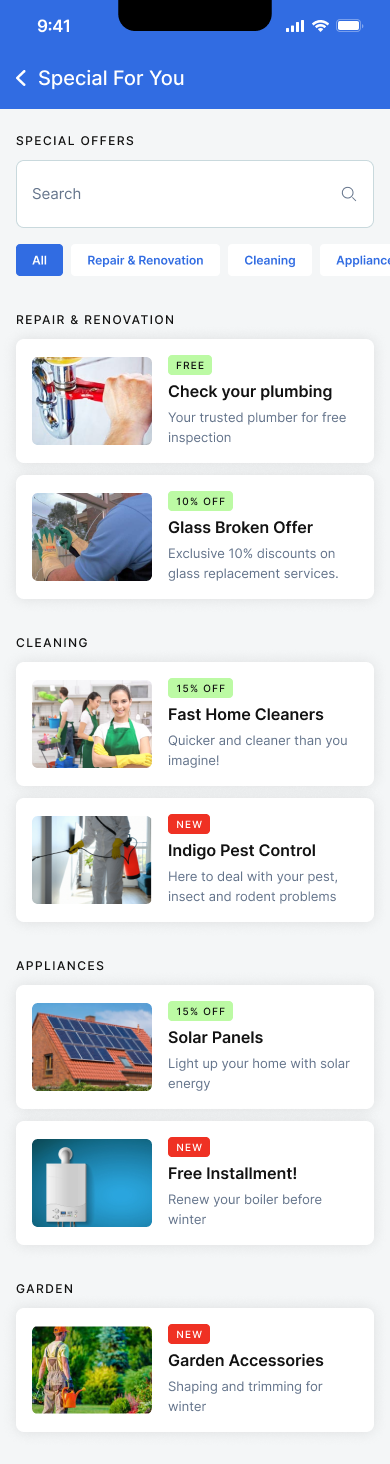

AI-Driven Offers

-

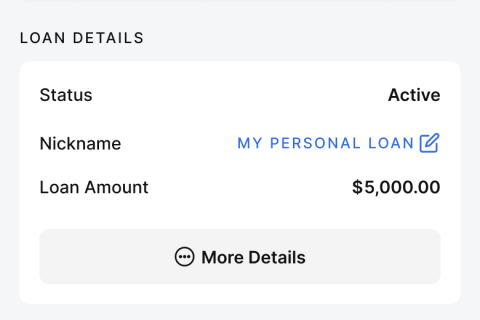

Lending & Financing

-

Retail / Commercial / Private Banking

-

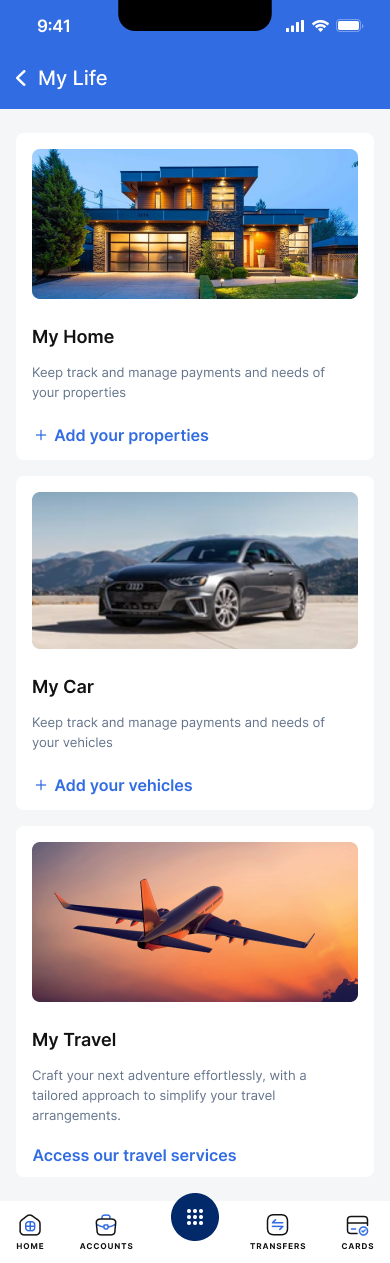

Lifestyle Services

Benefits of Choosing VeriPark for Mobile Banking

-

Seamless Integration, Easy Adoption

Once you've chosen VeriPark's Mobile Solution for your business, integration is quick and easy so you can go to market, fast. Our advanced VeriLink and VeriChannel technology means we can effortlessly unlock information in existing systems to make integration a straightforward affair.

What's more, our VeriChannel UI designer allows banks to have full control over their mobile banking application. This means you can uphold customer preferences and offer the right products and services, at the right time, in the right place.

-

Digital Innovation

Impress, delight and inspire confidence among your customer base by providing a progressive approach to mobile finance. Our offering allows you to integrate advanced customer-centric technologies that position your business as a market leader. Customer-centric capabilities include:

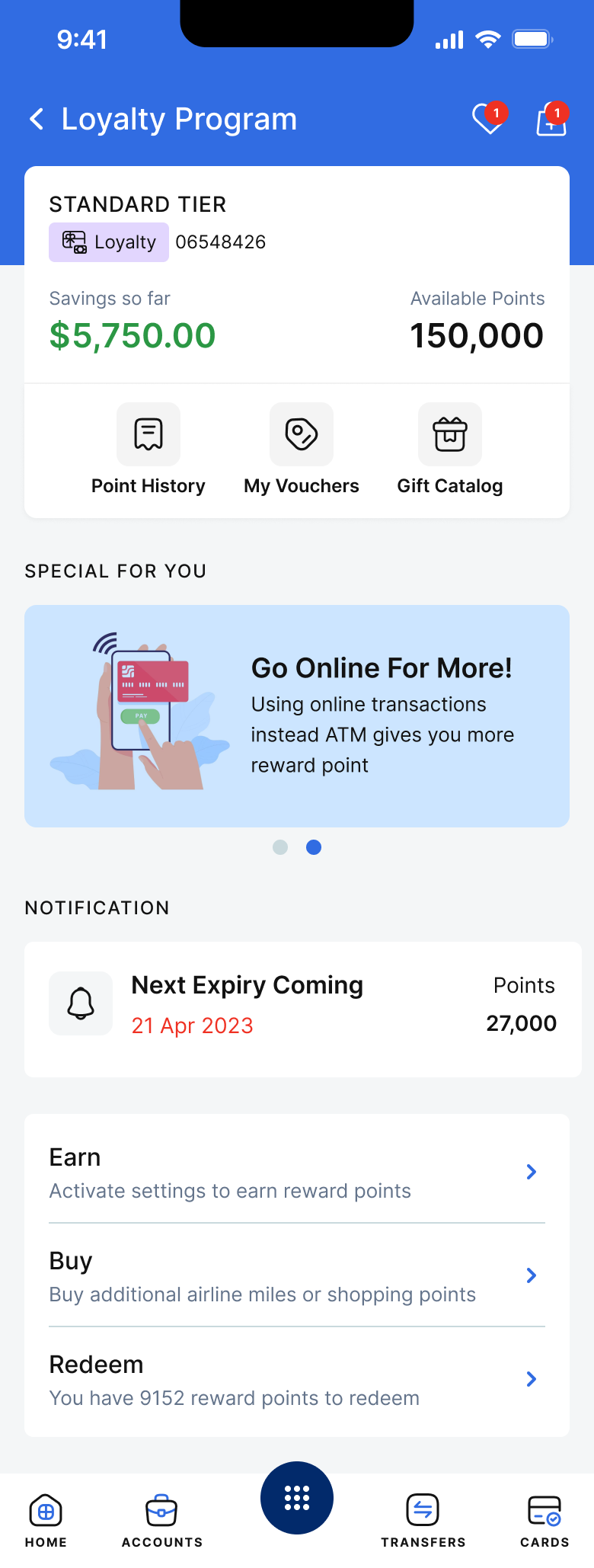

- AI-powered upsell/cross-sell

- Biometric-enabled authentication

- Personal onboarding screens

- Contactless payment through QR Code/HCE/Barcode

- Remote deposit captures

-

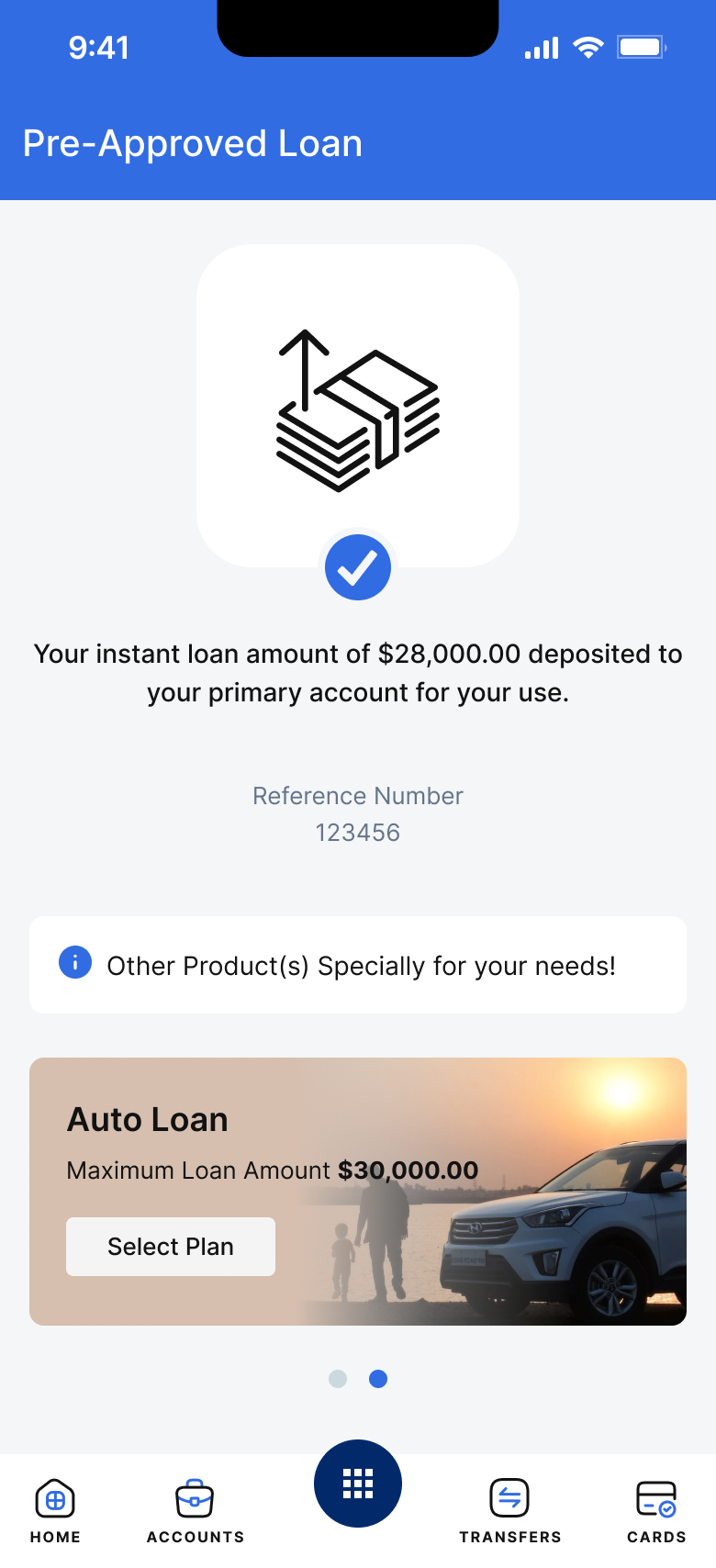

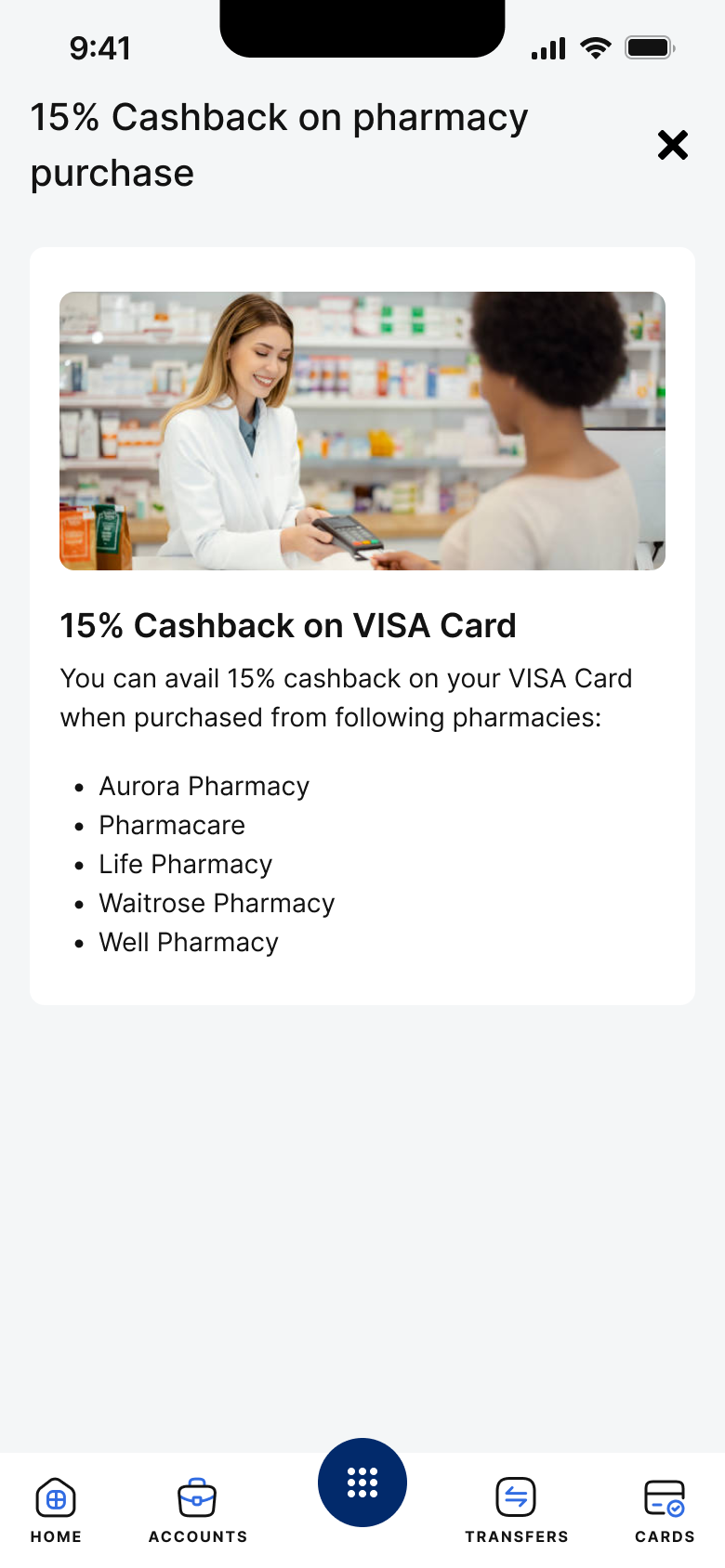

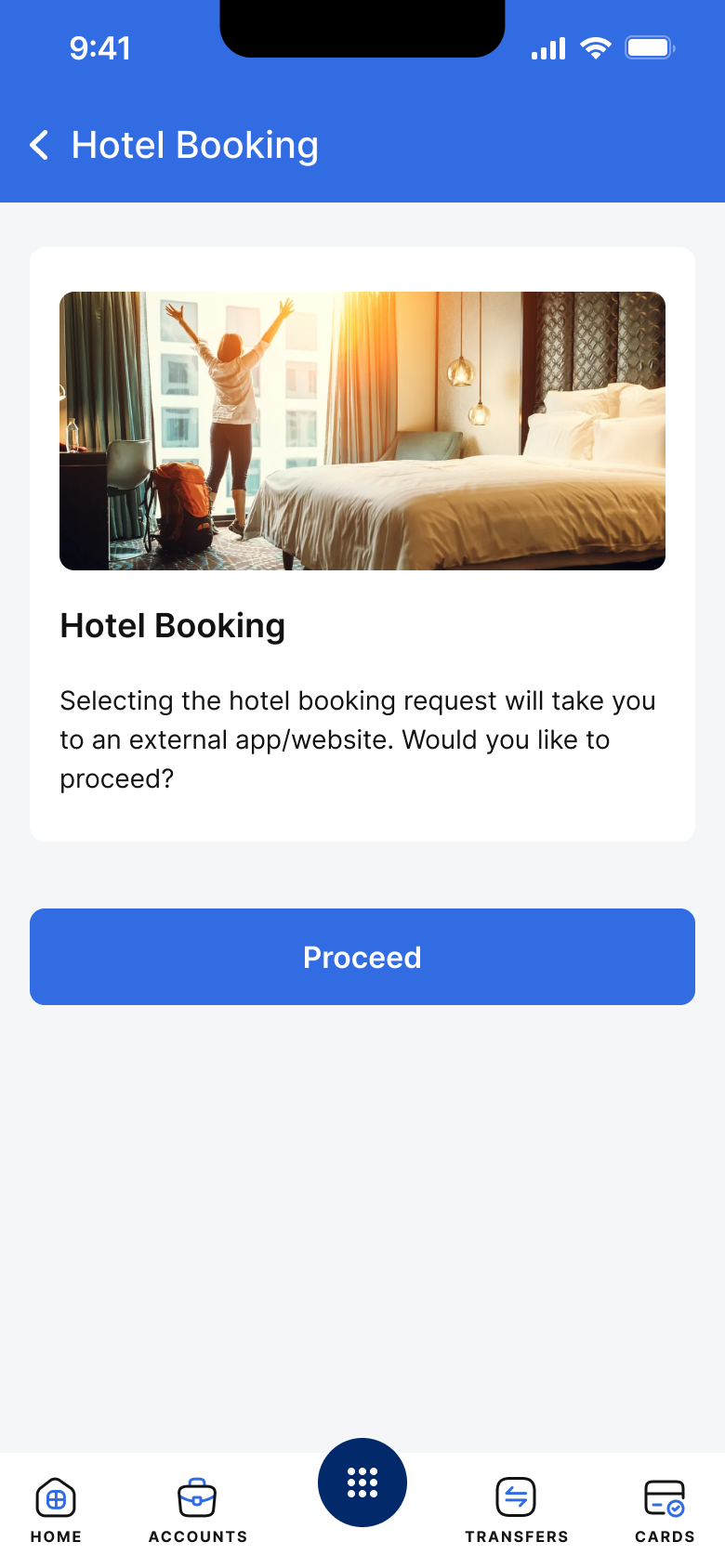

Be the Super App of Choice for Your Customers

A super app can offer multiple functionalities such as payment gateway, remittance service, bill payment service, lending platform and many others. It allows customers to use their mobile banking for accessing a variety of lifestyle services such as travel booking, entertainment, investment services, etc. Offer your customers valuable features including payments, deals, rewards and entitlements at their favorite restaurant, cinema or gym and become a key part of your customers' everyday lives. Provide a seamless user experience with all the banking, financial and transactional services merged into one powerful app. By offering personalized and easy to use services that your customers are looking for, you can create a loyal customer base.

-

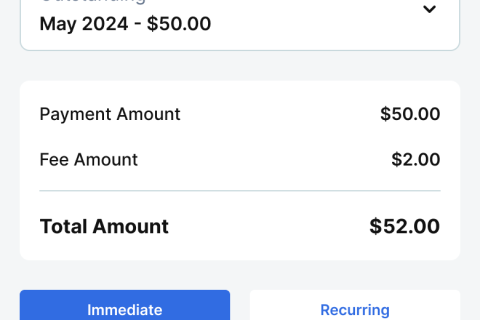

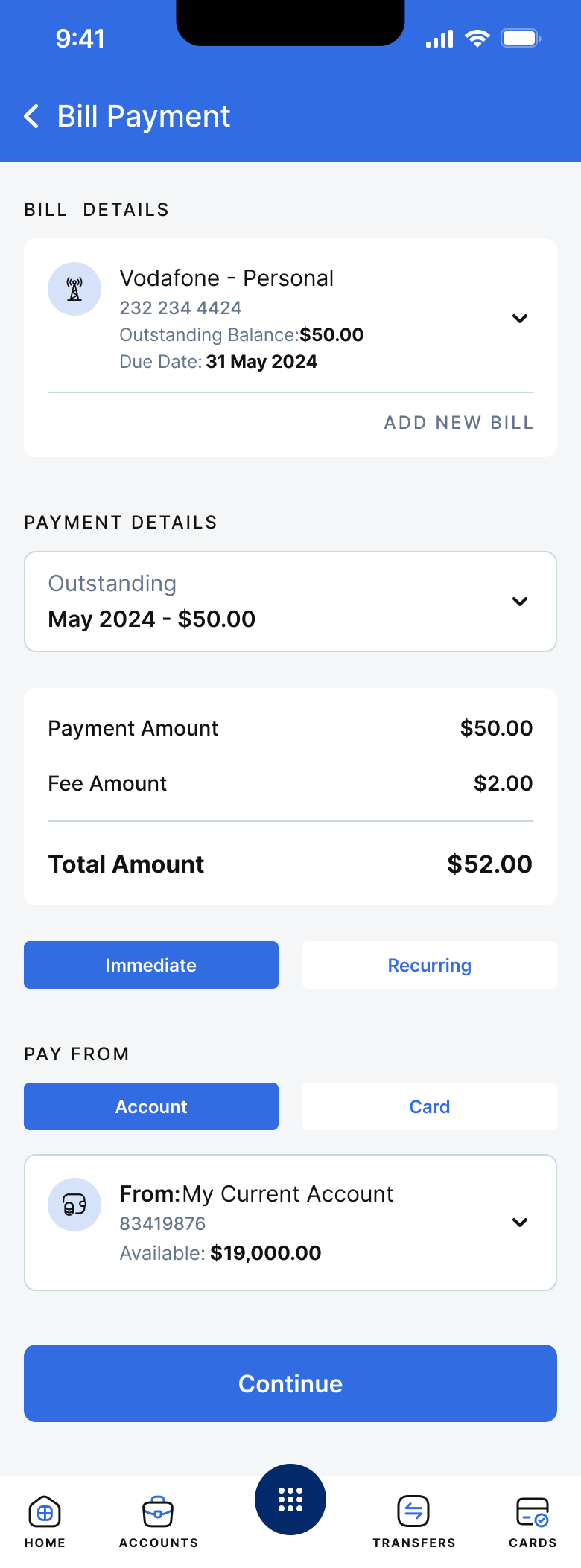

Diversify Your Customer’s Payment Methods

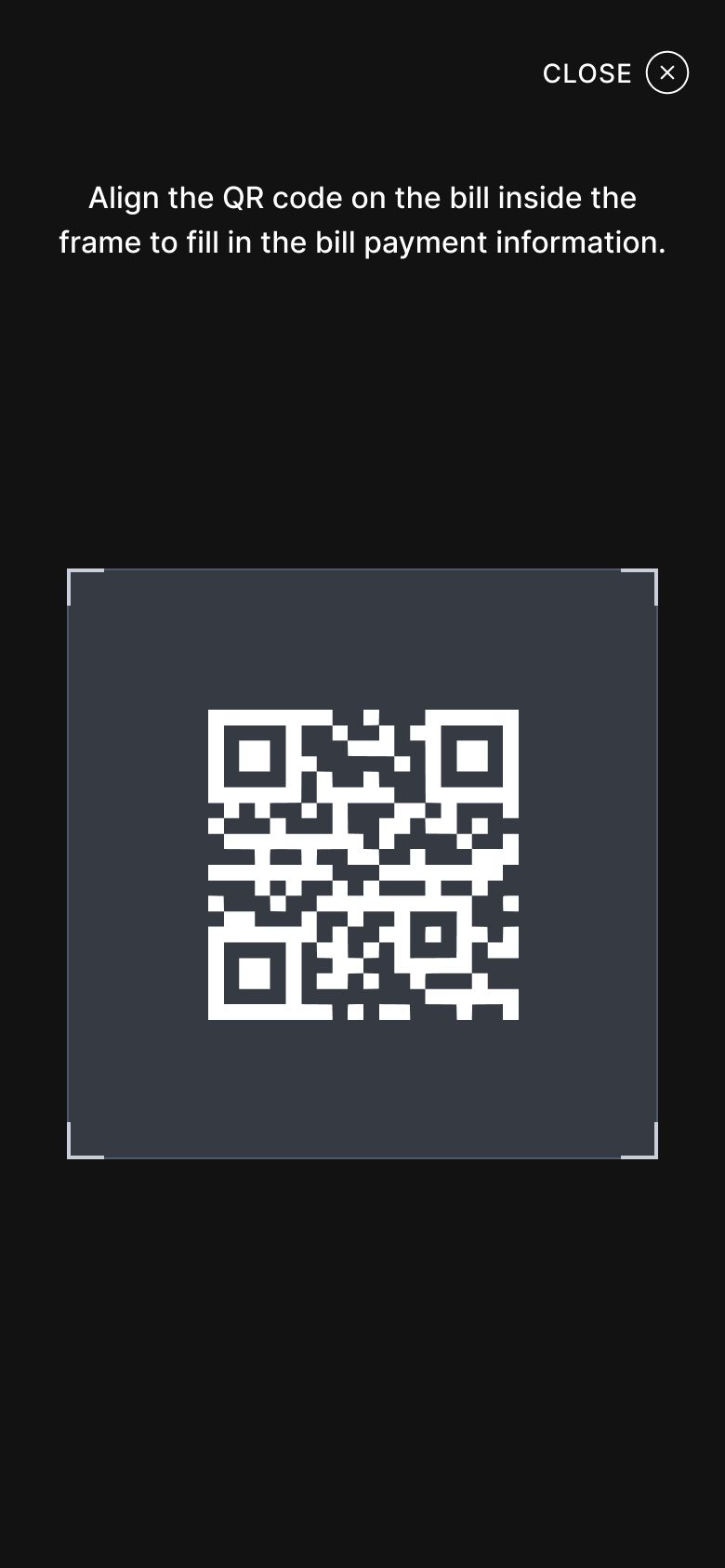

Convenience is still king, which is why we help you to provide faster and more convenient payment methods to your customers. Build the embedded finance, banking-as-a-service infrastructure and an API hub for third parties under one mobile platform. Combine payments, loyalty and offers, e-commerce and other services into one place.

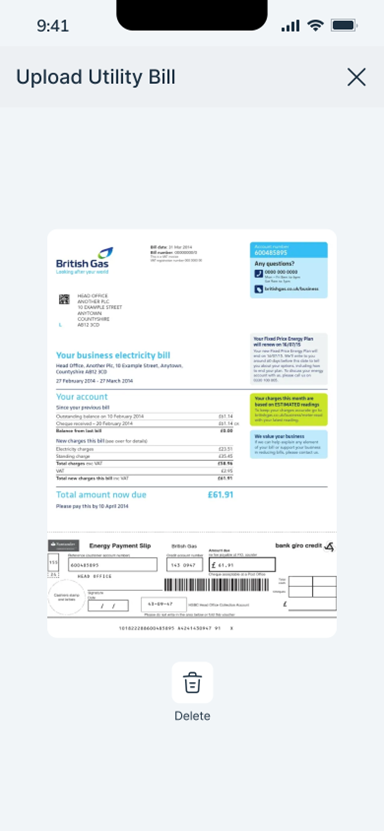

With multiple ways to pay, including Payment Holidays, Smart Instalment Plans, QR Payments, P2P Payments, Pre-Staging and e-Wallet options, your customers can choose the option that works best for them. Our comprehensive QR technology allows mobile app users to scan pictures of their bills and confirm bank transfers. Customers simply choose their bill, scan it and confirm their transaction. Job done.

-

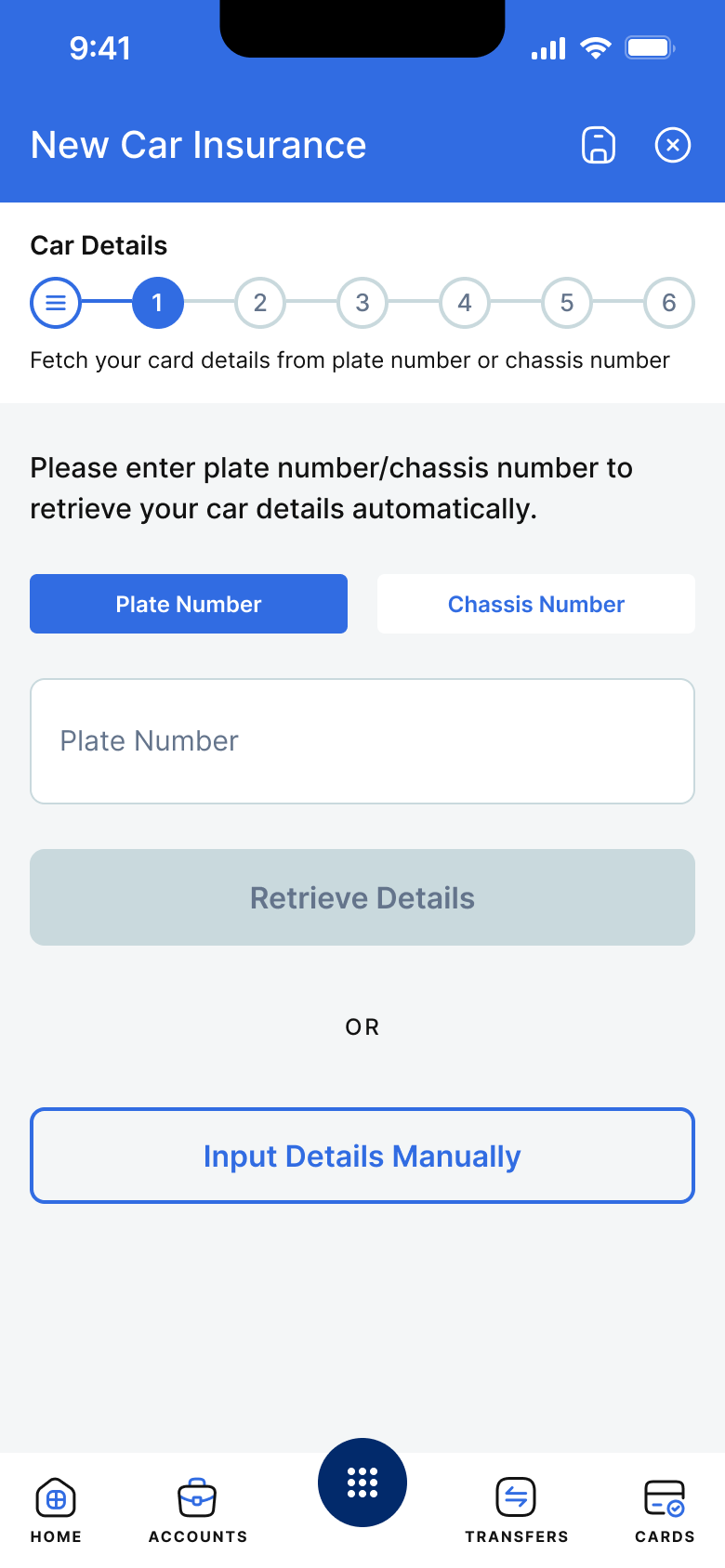

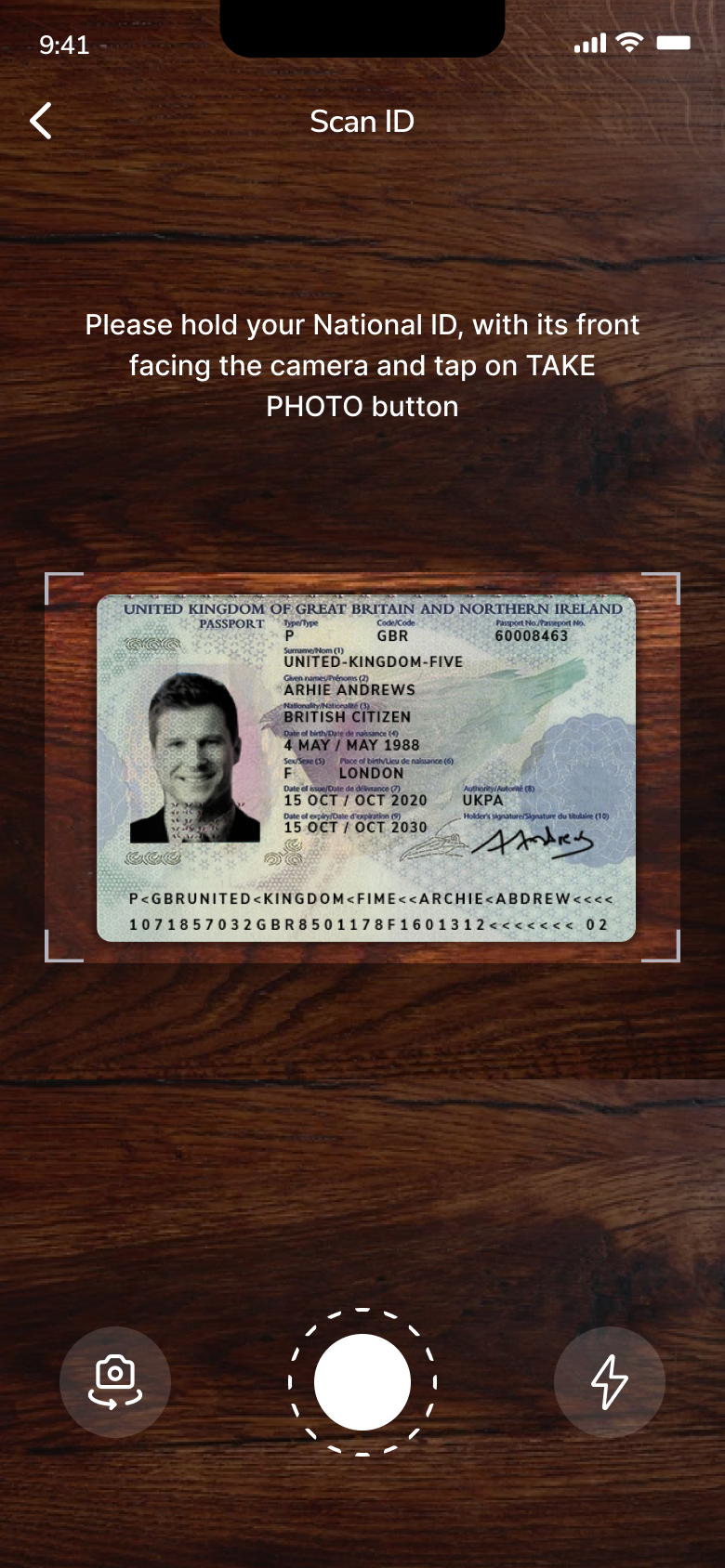

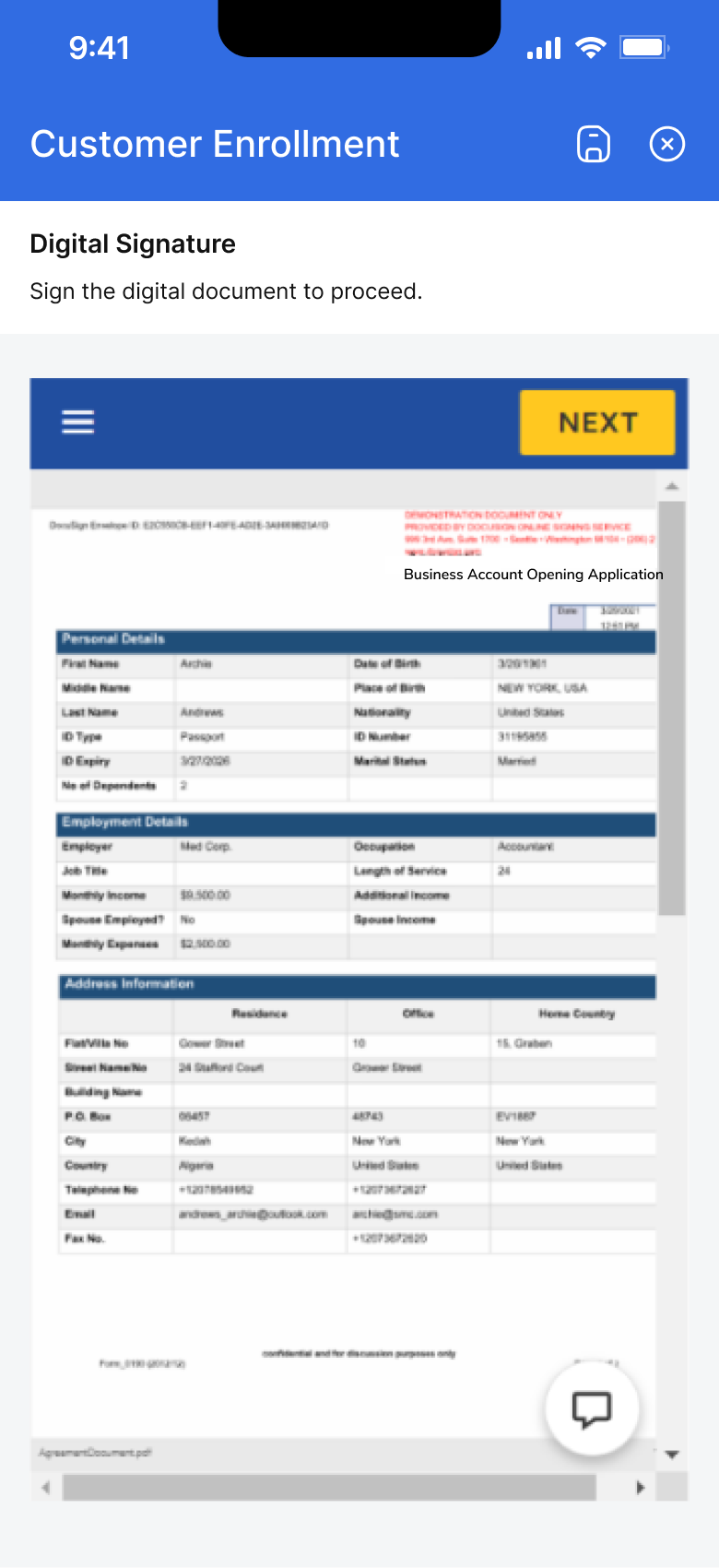

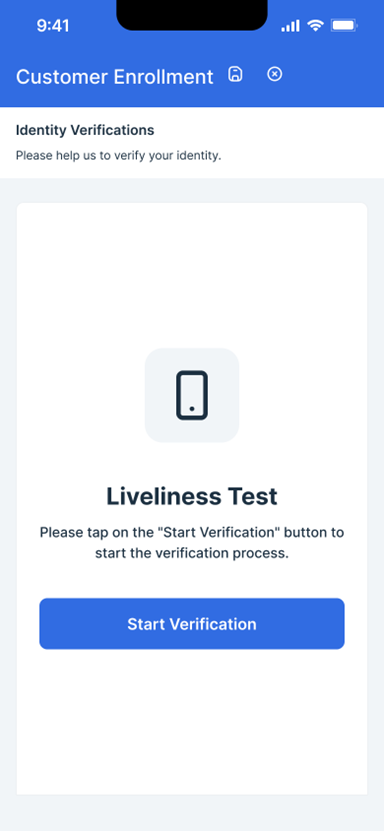

Grow Your Business with Speedy Onboarding

With VeriPark you can onboard more customers, more quickly. Our technology provides a smooth and direct onboarding experience that's over in minutes. Our Mobile Customer Onboarding system uses smartphone tech to automatically capture and validate customer documents, sending them to back end systems for rapid processing. Intuitive, automatic and efficient, with VeriPark's Mobile Solution you can reduce operational costs while increasing productivity and improving customer experience.

-

Be Where Your Customers Are

Customer satisfaction means being there whenever they need you. VeriPark Mobile Solution allows you to offer an exceptional customer experience no matter whether your client is a corporate or an individual. Our responsive solutions operate across mobile, tablet, desktop and wearable devices so you can deliver a unified and personalized service that's always in sync with the way they want to access your services.

-

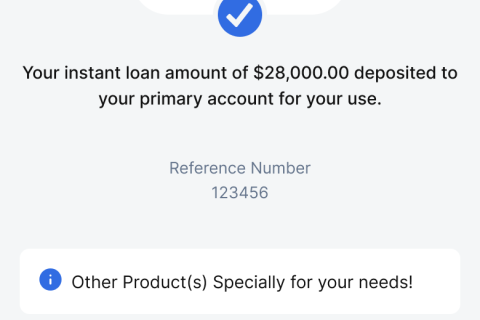

5-Minute Loans

Impress your customers and enhance your sales proposition with rapid loan approval. We offer the technology for in-mobile loan approval in no more than 5 minutes. Regardless of whether or not the applicant is a customer of your bank, app users can peruse your competitive loan products and can apply in an instant.

-

Improve Retention with Streamlined Customer Offboarding

Show how much you care about your customers and convert churn alerts into new opportunities for growth. With streamlined processes, customer offboarding can be used as an opportunity to turn customer churn into an opportunity to offer them relevant products and services based on their situation and needs.