Consulting

VeriPark Consulting: Unlock the Full Potential of Your Banking Solutions

At VeriPark Consulting, we go beyond solving individual business challenges—we simplify complexity for financial institutions.

By seamlessly aligning advanced solutions with strategic business objectives, we empower financial institutions to realize their full potential. Rather than navigating the complexities of working with multiple software and consulting providers, you’ll benefit from partnering with a single, integrated team. We provide end-to-end solutions: from designing business processes and developing robust models to implementing cutting-edge technology. VeriPark Consulting serves as your one-stop shop for comprehensive, holistic banking solutions.

With over 25 years of experience and partnerships with 150+ financial institutions worldwide, we guide banks through transformation journeys. Our approach ensures sustainable growth, operational excellence, and long-term success. VeriPark Consulting is your trusted partner in transformation—unlocking opportunities, enhancing performance, and redefining the future of banking.

Why Choose VeriPark Consulting?

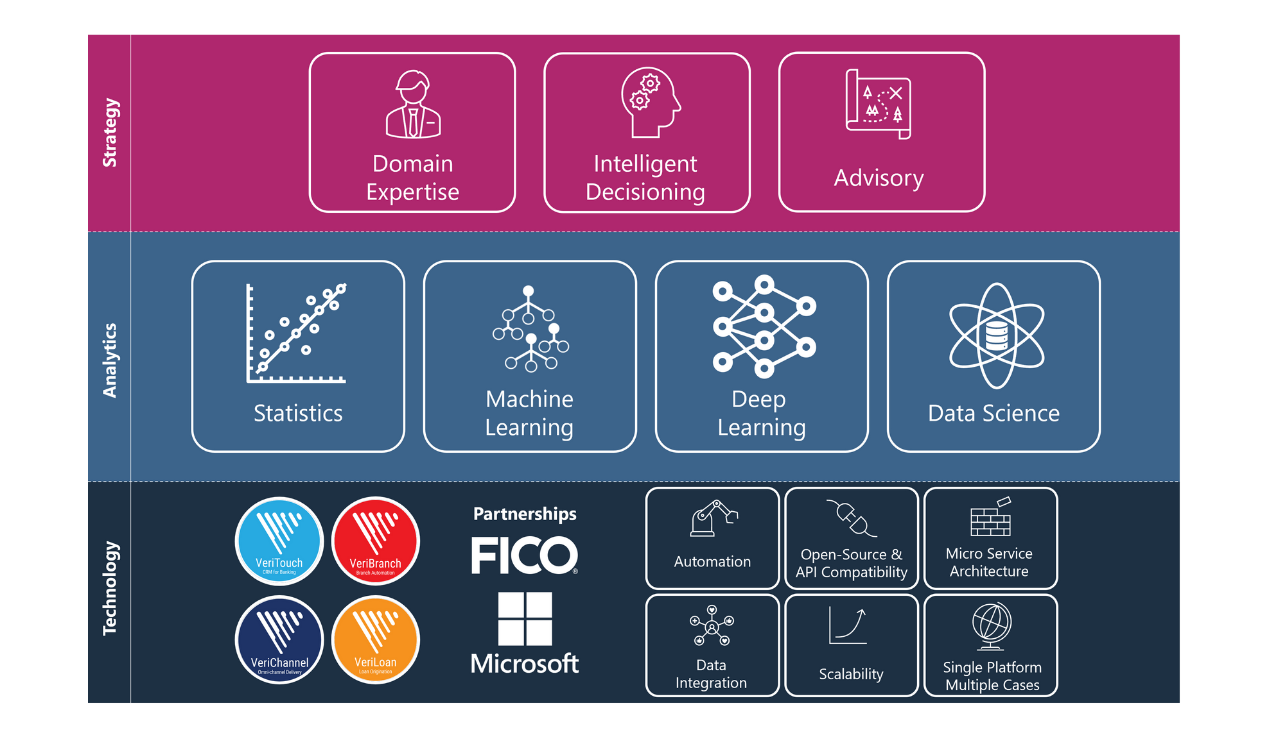

Financial institutions are under growing pressure to deliver seamless customer experiences, embrace digital transformation, and stay ahead of the competition. But technology alone isn’t enough to drive growth—true success comes from integrating technology, analytics, and strategy effectively.

By partnering with VeriPark Consulting, banks can:

- Enhance customer engagement with personalized and meaningful customer journeys. Drive profitability by identifying and unlocking new revenue streams..

- Achieve operational excellence by leveraging data-driven decision-making models.

- Adapt quickly to evolving market needs with agile, future-proof solutions.

How We Help: Our Approach and Services

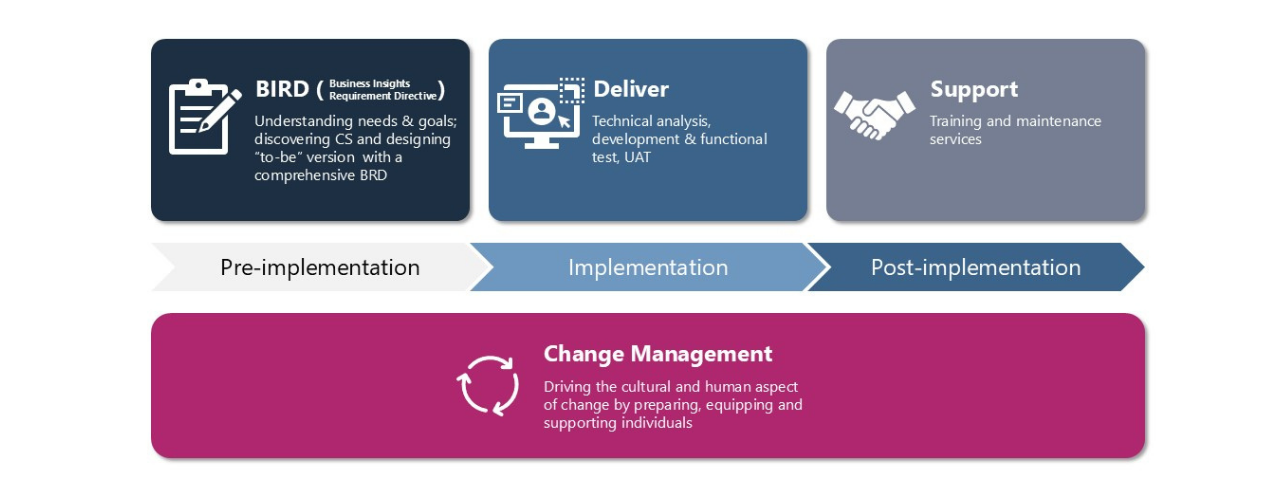

At VeriPark, transformation is more than just implementation—it’s about creating a successful, practical, and widely accepted use case. We believe this is only achievable through a holistic framework that harmonizes planning, execution, and change management from the moment a need arises until the transformation is fully integrated into the organization.

Our Consulting Success Framework simplifies the complexities of transformation by providing an integrated, end-to-end approach. This framework is built around four distinct and strategic phases.

Our Consulting Success Framework: Phases of Transformation

-

BIRD (Business Insights Requirement Directive)

We start by understanding your needs and goals, assessing the current state, and designing a "to-be" solution. This phase culminates in a comprehensive Business Requirements Directive (BRD) that serves as the foundation for your transformation.

-

DELIVER

We provide technical analysis, development, functional testing, and User Acceptance Testing (UAT) to ensure a seamless implementation that aligns with your objectives and business needs.

-

SUPPORT

Our ongoing training and maintenance services ensure sustainable success and operational continuity, keeping your systems optimized and your teams empowered.

-

CHANGE MANAGEMENT

Integrated throughout the transformation lifecycle, our change management approach addresses the cultural and human aspects of change. By preparing, equipping, and supporting individuals, we ensure that the change is not just implemented but fully embraced by your organization.

With this comprehensive approach, VeriPark ensures that every transformation journey leads to meaningful and sustainable results for your organization.

Who We Are: The Expertise Behind VeriPark Consulting

At VeriPark Consulting, our team comprises seasoned industry experts—many of whom are former bankers with extensive, hands-on experience in transforming financial institutions across the globe. This unique blend of technical expertise and industry insight enables us to design practical solutions that solve complex challenges.

With a proven track record across regions, our consulting team brings:

- Strategic banking domain expertise to align technology seamlessly with business objectives.

- In-depth market knowledge to address region-specific challenges effectively.

- Advanced Analytics Expertise to deliver data-driven insights and enhance decision-making capabilities.

- Collaborative problem-solving to foster innovation and drive sustainable growth.

We also capitalize on strategic partnerships with industry leaders like Microsoft and FICO, ensuring access to cutting-edge tools, industry best practices, and advanced decision management solutions.

At VeriPark, we go beyond being a technology provider—we are your strategic consultancy partner in redefining the future of banking. By combining deep industry expertise with practical solutions, we help financial institutions tackle complex challenges and seize new opportunities.

Whether it’s transforming CRM applications, optimizing risk strategies, or enhancing analytical models, our approach ensures tailored strategies that deliver measurable value. With VeriPark Consultancy, you gain a partner focused on driving innovation, maximizing growth, and empowering your organization to thrive in a rapidly evolving market.

Comprehensive Consulting Services

-

Risk Management & Credit Analytics

We help banks effectively manage risk and optimize credit strategies through:

- Advanced Fraud Detection Models to identify and mitigate risks in real time.

- Development of PD, LGD, EAD, and Expected Loss Models for robust credit assessment.

- Early Warning Systems to proactively manage potential credit risks.

- Collection Analytics to streamline recovery efforts and improve cash flow.

- Holistic Portfolio Quality Management to ensure sustainable growth.

- Underwriting Decision Strategy Management to enhance approval efficiency.

- Limit Estimation and Income Estimation/Affordability tools to refine credit offerings.

- Streamlined Pre-approved Loan frameworks to enhance customer satisfaction.

-

Customer Engagement & Personalization

We enable deeper customer connections and personalized experiences with:

- Channel Propensity models to identify customer behavior across touchpoints.

- Next Best Offer strategies for delivering timely, relevant recommendations.

- Customer Segmentation to tailor offerings to specific groups.

- Customer-Based Pricing for dynamic and competitive pricing strategies.

- Insights on Propensity, Churn, and Retention to optimize customer relationships.

- Customer Lifetime Value (CLV) analysis to prioritize high-value customers.

- Comprehensive Marketing Strategy Management to drive engagement and ROI.

-

Operational Efficiency & Process Automation

Our solutions streamline operations, improve efficiency, and reduce costs:

- Fraud Process Optimization to enhance detection and response times.

- Optimization of Channel, Branch, and Credit Processes for seamless operations.

- Branch Screen Design & Automation for faster service delivery.

- CRM Process Optimization to enhance relationship management.

- Loan Application Screen Design & Automation to simplify credit applications.

-

Sales & Portfolio Analytics

We empower sales teams and portfolio managers with data-driven insights:

- Retail Portfolio Insights Dashboards for a comprehensive view of performance.

- Holistic Portfolio Quality Management to maintain balanced and profitable portfolios.

Can't see the contact form?

If you can't see our contact form above, it might be blocked by an adblocker in your browser. Please click on the button below to open our form as a separate page.