VeriLoan | Loan Origination Solution

Omni-product omni-channel loan origination solution built on top of Dynamics 365 CRM

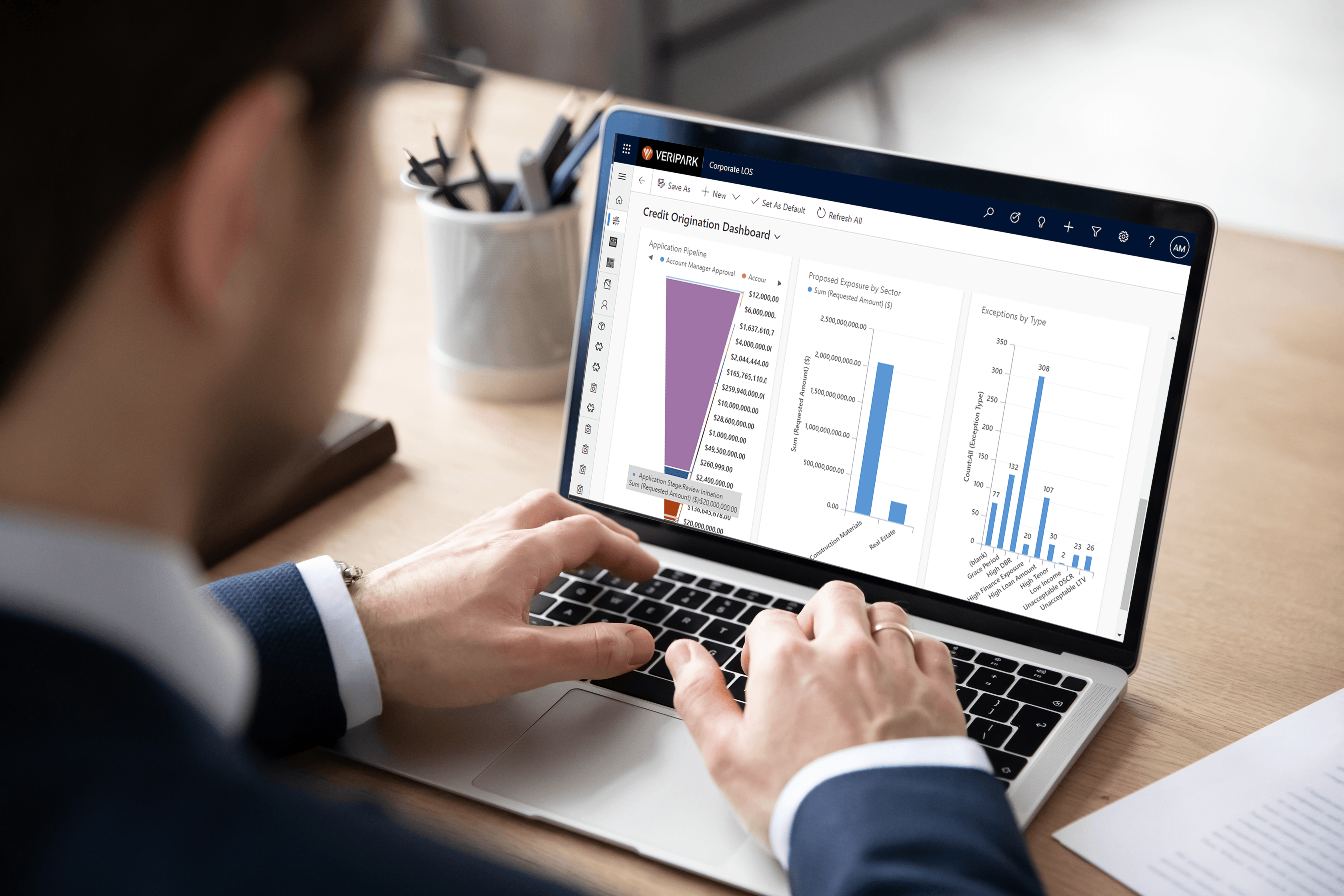

VeriLoan is a powerful end-to-end digital loan origination, servicing and collection solution built on top of Dynamics 365. It allows managing the entire customer lifecycle in one, unified CRM platform. Covering everything from pre-screening, onboarding, risk and credit review, underwriting, disbursement to collection, VeriLoan automates the entire retail, commercial and corporate loan processes from start to finish.

The solution empowers financial institutions to make fast, consistent and cost effective loan decisions within predefined risk margins. It provides straight-through processing (STP), sophisticated rule engine, simplified KYC and AML check processes and an advanced eligibility calculator. It allows different teams -relationship managers, business line managers, credit analysts, credit committee, credit admin officers, operation department - to coordinate easily.

Integration with the Rule Engine software InRule helps automating business decisions and processes. It makes it easy to complete policy checks, risk committee rules and validations seamlessly. The solution can be customized to integrate with external systems such as Credit Bureau to enable speedy risk assessments, Know Your Customer (KYC), antimoney laundering (AML) and blacklist checks.

Main Benefits

-

REDUCE

turn-around time -

ENABLE

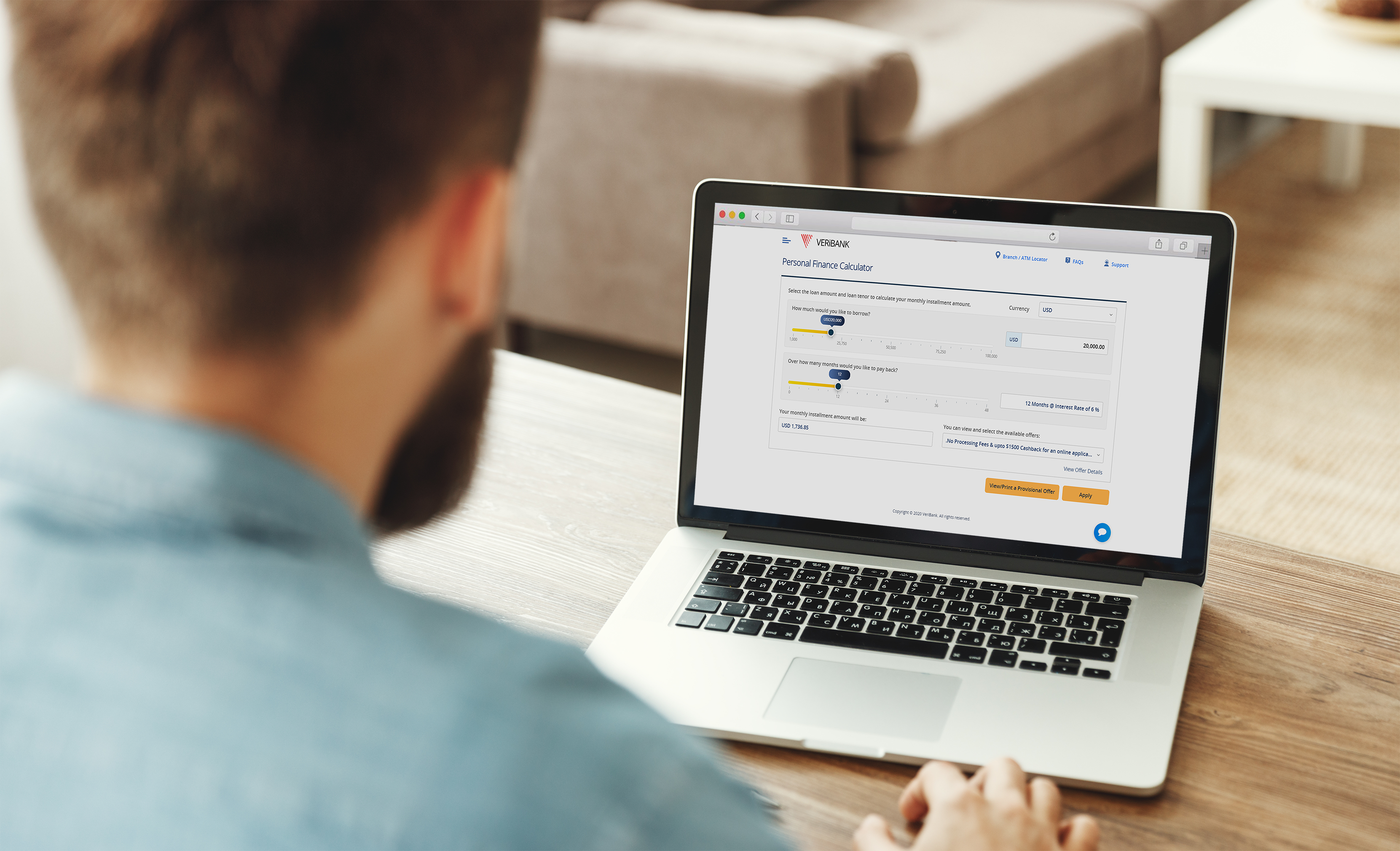

digital & self-service origination -

REDUCE

error & return rates -

ADVANCED

risk mitigation& decisioning -

IMPROVE

client experience with loan portal -

REDUCE

cost of client acquisition -

IMPROVE

employee experience -

INCREASE

workflow efficiency with OCR and PDF upload