Innovation Credit Union - Digital Transformation

ICU eyes massive digital growth and goes national with VeriPark and Microsoft

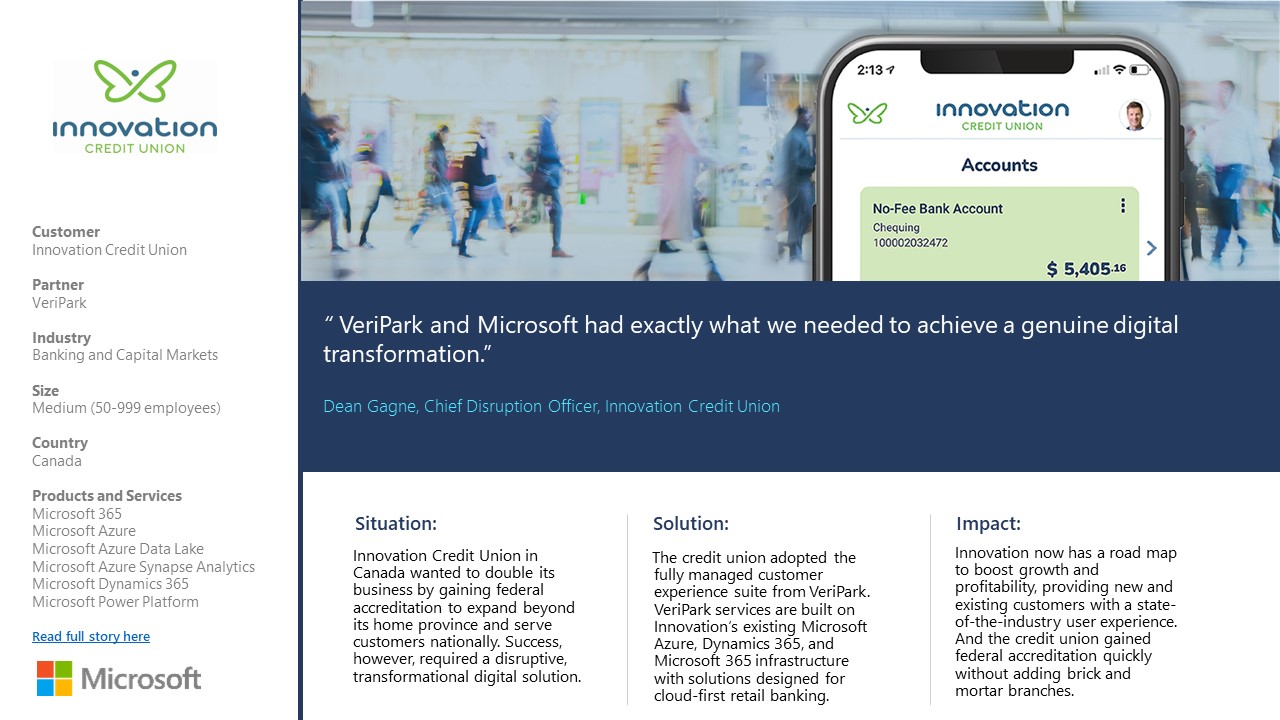

Innovation Credit Union (Canada) chose a transformational, cloud-first solution to the challenge of doubling the size of its business, simplifying members’ lives, and expanding to serve customers nationally. Innovation started by adopting the leading-edge retail banking customer experience suite from VeriPark. Building on Innovation’s existing investments in Microsoft Azure, Microsoft 365, and Microsoft Dynamics 365, VeriPark's solution provides a state-of-the-industry customer experience and a road map to the growth and scale that will drive Innovation’s success.

Strategic disruption

Sometimes it takes more than changing how you work to achieve new organizational goals. You might need to completely disrupt the status quo and transition to a new way of working. You might also need someone like Dean Gagne, a disrupter who is accomplished enough to enjoy the title of Chief Disruption Officer at Innovation Credit Union in Canada. Growth was stagnating at Innovation, and Gagne was asked to help come up with a plan to double its 58,000 membership. To make that happen, “We made a couple of strategic decisions,” he says.

Innovation’s first decision was to expand geographically beyond its home province, which meant gaining approval to become a federal credit union, making it subject to regulation across Canada. Second, the credit union decided to expand digitally. Research showed that Innovation’s target customers are digitally savvy and more likely to take their business to an organization that offers primarily digital options than to a conventional bank. And the research also showed that a fully digital experience was even more popular with existing customers. “We did not want to increase our membership with more bricks and mortar,” says Gagne.

This is where disruption came into play. “Historically, online and mobile banking, customer relationship management, and account and loan origination systems do not talk to each other,” says Gagne, noting that their only connection might be that they’re in the same building. “We wanted to fix that with software in a single integration layer, bringing together all those functions beneath a unified customer interface.” Gagne evaluated 37 different banking software vendors, but none of them fulfilled all of the credit union’s criteria.

Innovation’s current environment featuring Microsoft 365, Microsoft Dynamics 365, and Microsoft Power Platform offered an example of the sort of solution that Gagne was looking for. “It was as if we were trying to build a Microsoft Bank,” he says. “In one of our meetings with Microsoft, we told them, ‘If you had a digital bank, we would buy it!’” Microsoft doesn’t offer a banking platform, but Innovation’s Microsoft account team knew someone who does: VeriPark.

It was as if we were trying to build a Microsoft Bank. In one of our meetings with Microsoft, we told them, ‘If you had a digital bank, we would buy it!’” Microsoft doesn’t offer a banking platform, but Innovation’s Microsoft account team knew someone who does: VeriPark.

Dean Gagne

Chief Disruption Officer, Innovation Credit Union

Banking on Microsoft

VeriPark offers a complete suite of cloud-first banking applications and services built on Azure and Dynamics 365. “Microsoft provides our cloud and CRM platforms, and VeriPark enabled us to productize them,” says Gagne. VeriPark's “intelligent customer experience suite” consists of four transformational pillars. The first two pillars are VeriChannel, an omnichannel delivery platform for a unified, consistent user experience across devices and touchpoints, and VeriBranch for branch automation, and both are built on the Azure platform. The other pillars, built on Dynamics 365, are VeriTouch, the customer engagement piece optimized with industry best practices to serve, solve, and sell, and VeriLoan, which handles loan origination. The cloud-first solution can be tailored to a specific customer’s requirements and quickly deployed.

Everything runs on Azure and Dynamics 365 and is fully managed by VeriPark,” says Selim Hasan, Sales Director at VeriPark. “So, it only took us two or three days to do a proof of concept for Innovation.

The credit union adopted the entire suite, which Gagne says was an easy decision. “VeriPark and Microsoft had exactly what we needed to achieve a genuine digital transformation.” According to Gagne, not going all-in from the start with the disruptive change of transitioning from a conventional institution to a fully digital banking and financial services business would have been a mistake. This sometimes happens when businesses try to adapt rather than replace conventional operations. Gagne cites a bank CEO colleague who confirmed that his transformational journey did not bear fruit by making piecemeal changes. “His project finally took off and saw immediate gains after deploying VeriPark’s processes more or less out of the box.”

Returns on investment

A significant benefit of Innovation’s new digital architecture is separating the front-end customer experience from the supporting back-end services. On the back end, all the credit union’s data resides in Azure Data Lake and is processed in Azure Synapse Analytics, which drives internal and external regulatory reporting and feeds the CRM system to help turn data into actionable information. “We can adapt much more quickly and safely to marketing demands. (...)

Learn more