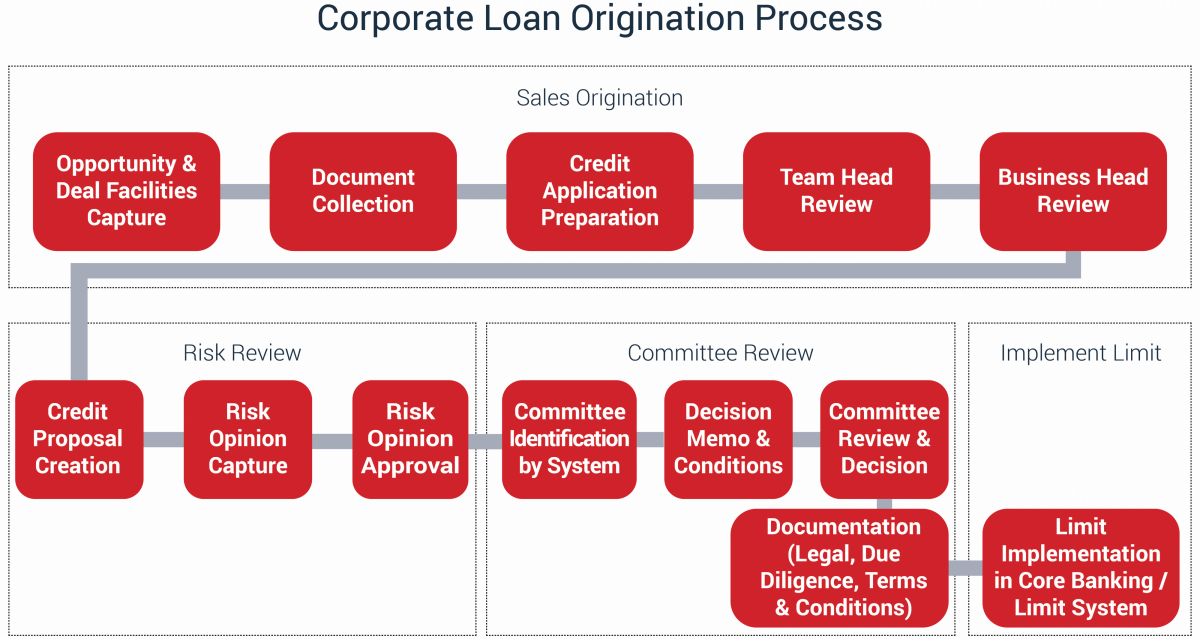

Corporate Loan Origination

End-to-end corporate loan origination process on a single platform

Financial institutions face challenges during corporate loan origination processes that revolve around complex business rules, lack of consolidated financial data and calculated risk ratings. VeriLoan, providing an end-to-end corporate loan origination process on a single platform, enables financial institutions to:

- Be future ready,

- Capture data across multiple entities,

- Optimize work flows,

- Cover all related information including shareholders, subsidiaries, parent companies,

- Increase the analysis scope,

- Ease customer onboarding processes.

VeriLoan Corporate Loan Origination covers portfolio management, risk assessment, compliance with regulatory norms, and transparent lending process to address the competitive business environment and changing regulatory requirements.

The solution covers Construction Loans, Commercial Real Estate, Asset Financing and Small Business Loans.

Corporate Loan Origination - Key Features

-

Credit Limit Request

- Initial Funded/Non Funded Limits

- Limit Increase/Decrease

- Limit Sub-allocation

- Disbursement for Limit Utilization

-

Credit Application

- Funded & Non Funded Facilities

- Collaterals & Appraisal Details

- Covenants & Deferrals

- Client’s Documents

-

External System Integrations

- Moody’s Risk Integration

- Dun & Bradstreet

- Credit Bureau

- AML/Internal/Domestic Blacklists

-

Integrated Rule Engine

- Policy Check & Exceptions

- Business Rules & Validations

- Risk Committee Approval Matrix

-

Risk Analysis

- SWOT Analysis

- Risk Opinion & Approval

- Credit Proposal Template

- PDF Proposal Generation

-

Risk Committee

- Risk Opinion & Proposal Review

- Exceptions Approval & Waivers

- Decision Memo Capture & Review

- Credit Approval

-

Documentation

- Contract, T&C Generation

- Document Collection

- Scanning & Upload

- Integrated Document Management

-

Implementation

- Integration with Core Banking

- Integration with Limit Management System

- Limit Implementation & Renewal

- Loan Origination & Disbursal

SME Digital Lending & Commercial Loans

An effective commercial loan origination system can deliver massive benefits. When banks achieve straight-through processing in their loan origination process they will see significant improvements in client experience, speed of decision making and, ultimately, profitability. VeriPark’s Digital Lending & Commercial Loan Origination Solutions enable financial institutions to attract, onboard and retain SME customers while increasing operational efficiency. The clients can easily use the online digital lending portal to apply for a loan where VeriLoan’s instant decisioning capability allows the bank to provide the decisioning outcome as quickly as possible.