VeriTouch CRM solution for Private Banking & Wealth Management

Provide exceptional customer experiences to your high-net-worth clients and increase retention and cross-sell

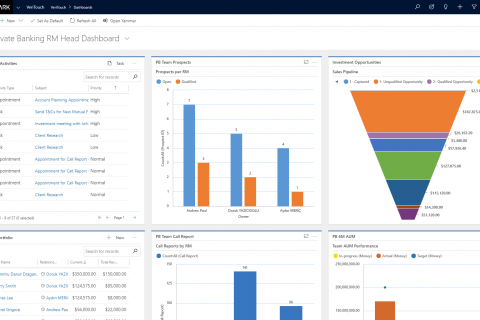

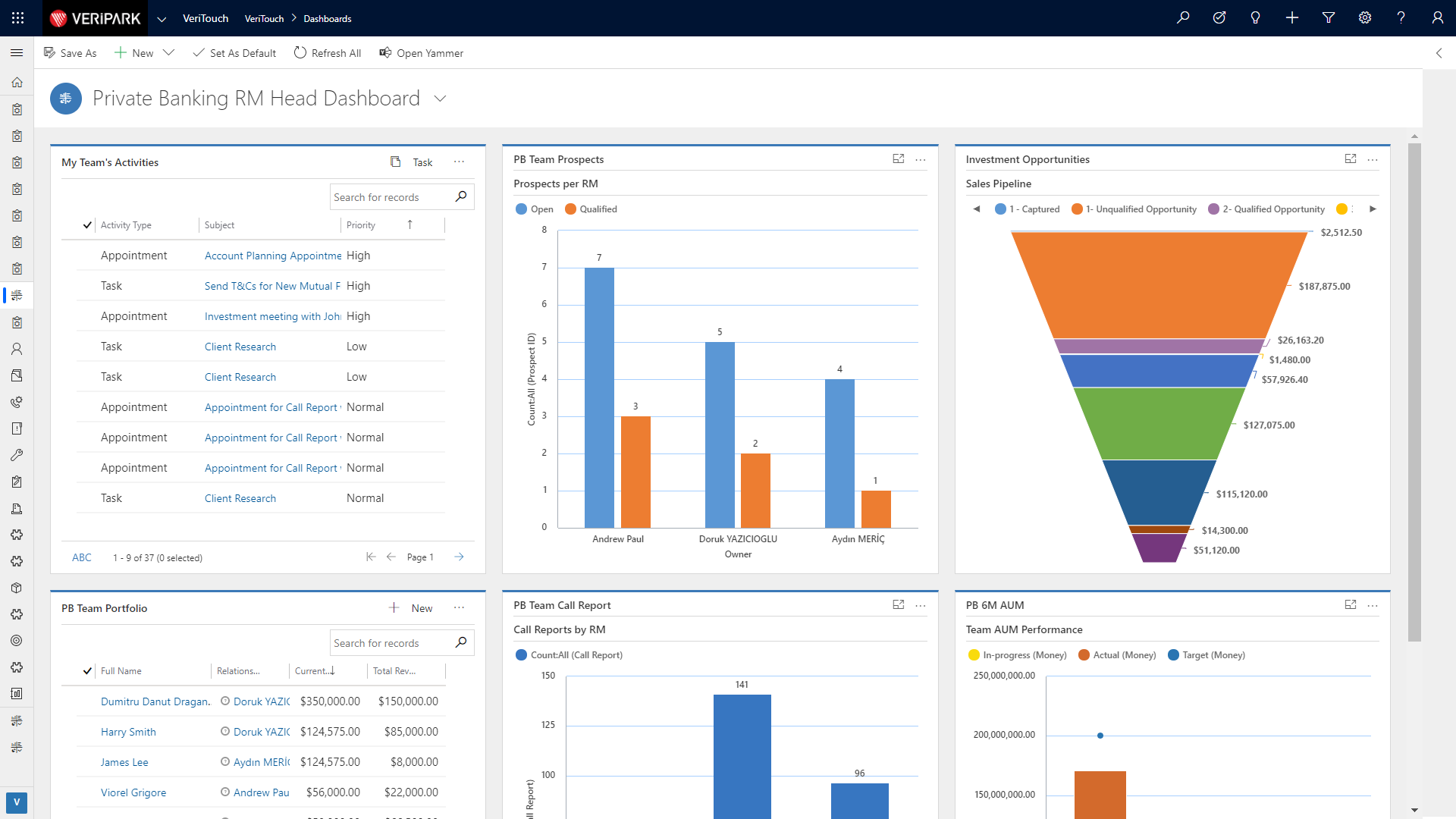

VeriPark offers a fully integrated and automated Private Banking and Wealth Management CRM solution based on Dynamics 365. The high-touch client engagement solution allows banks to retrieve client data from multiple sources, making it easy for Relationship Managers and advisors to get a 360-degree view of their clients on a single platform. It provides an opportunity to increase retention and cross-sell and improve client experience through personalized offers driven by Next Best Action analytics.

With VeriPark’s Private Banking and Wealth Management solution, you will understand your clients, their circumstances, life requirements and ambitions, and match up the right set of financial solutions and strategies to help them achieve their objectives. With this feature-rich sophisticated solution, your Relationship Managers have access to a private banking platform from which they can connect with and provide exceptional services to your high-net-worth clients.

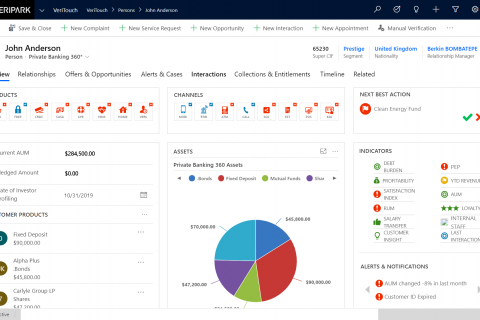

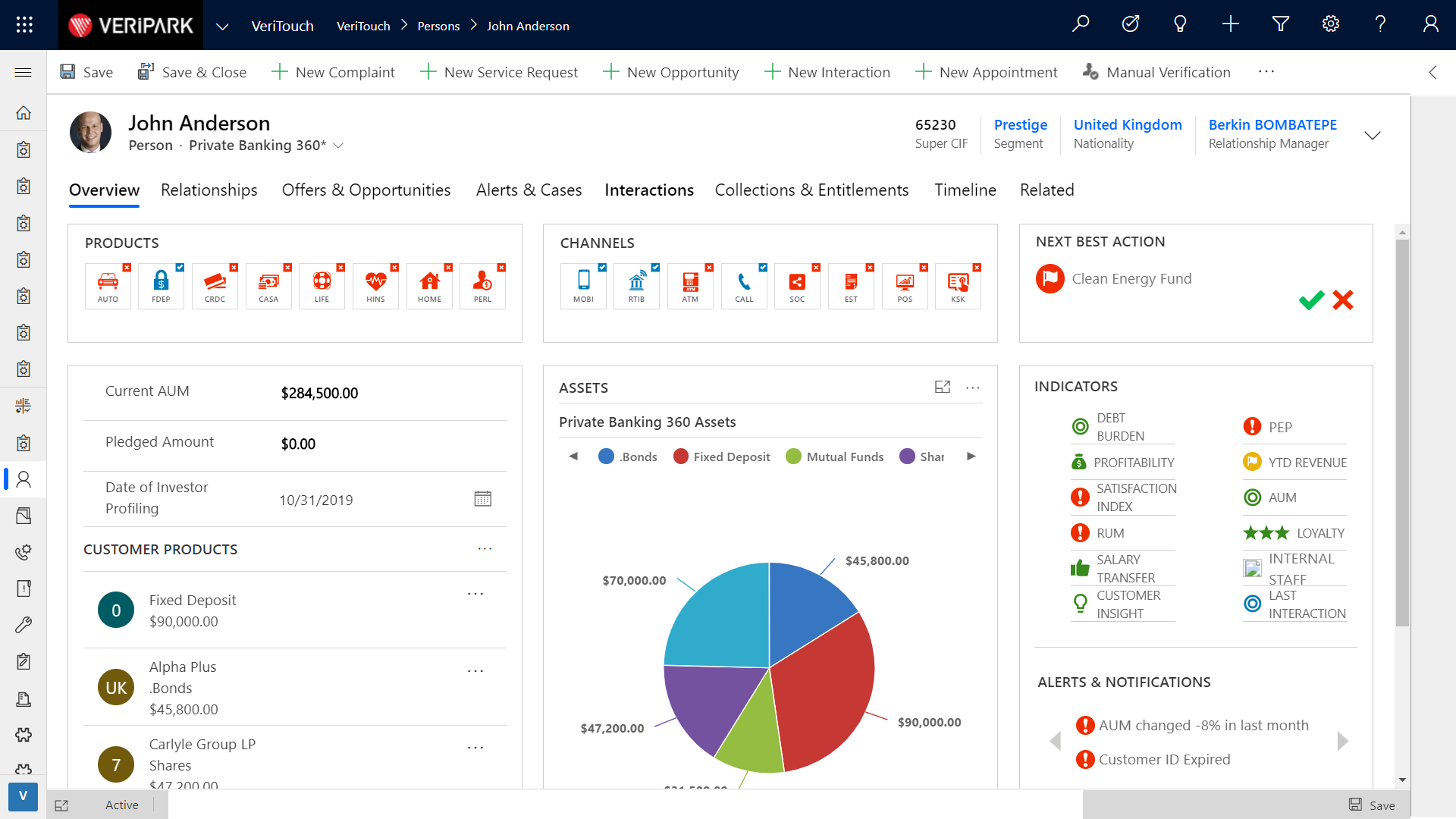

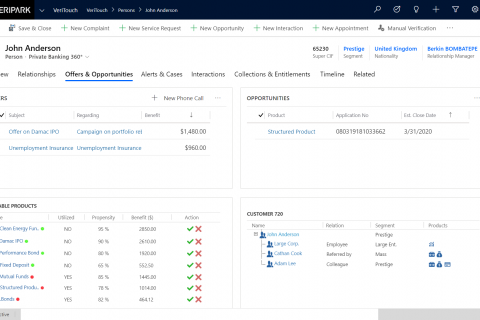

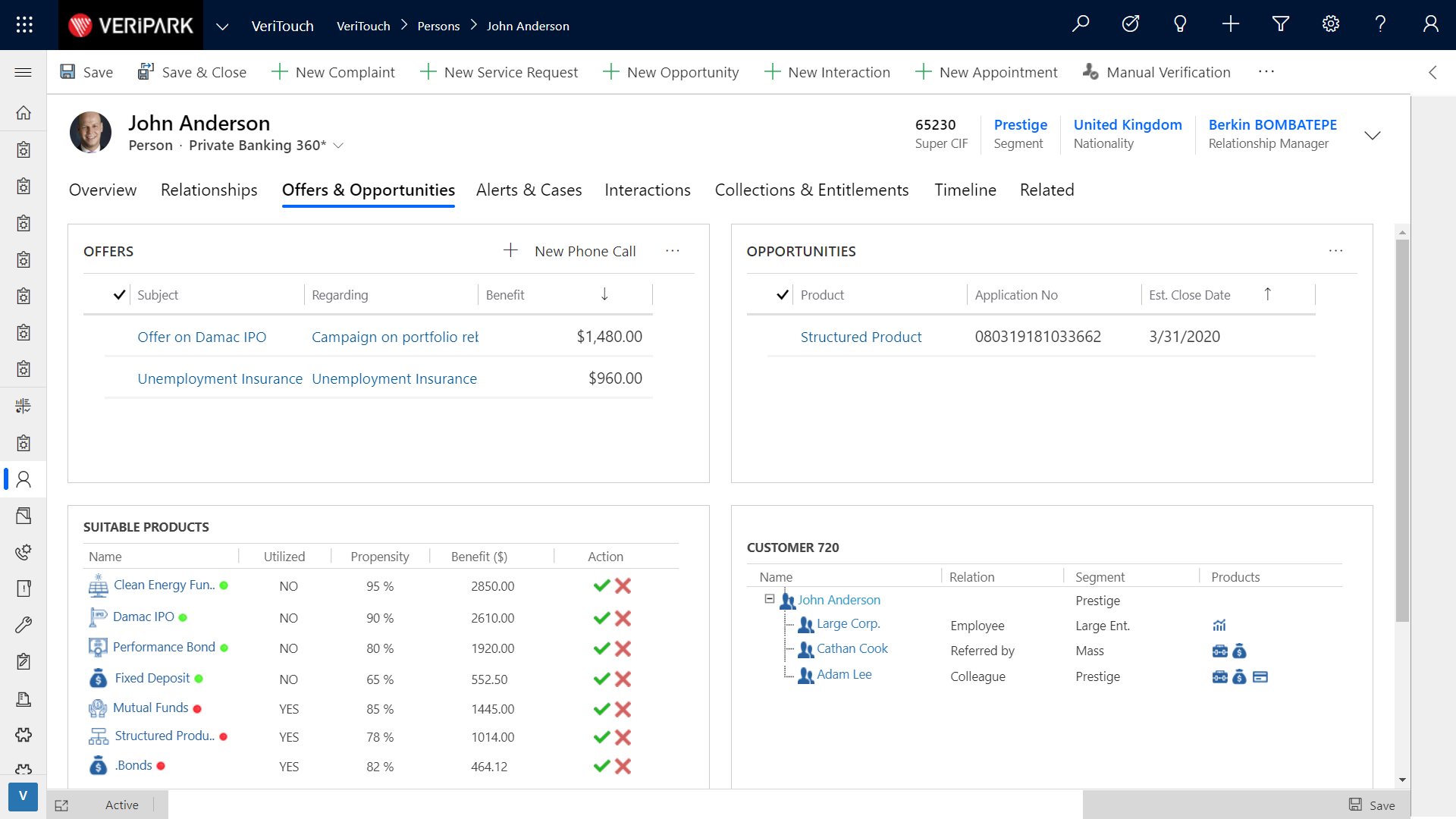

Private Banking 360 View

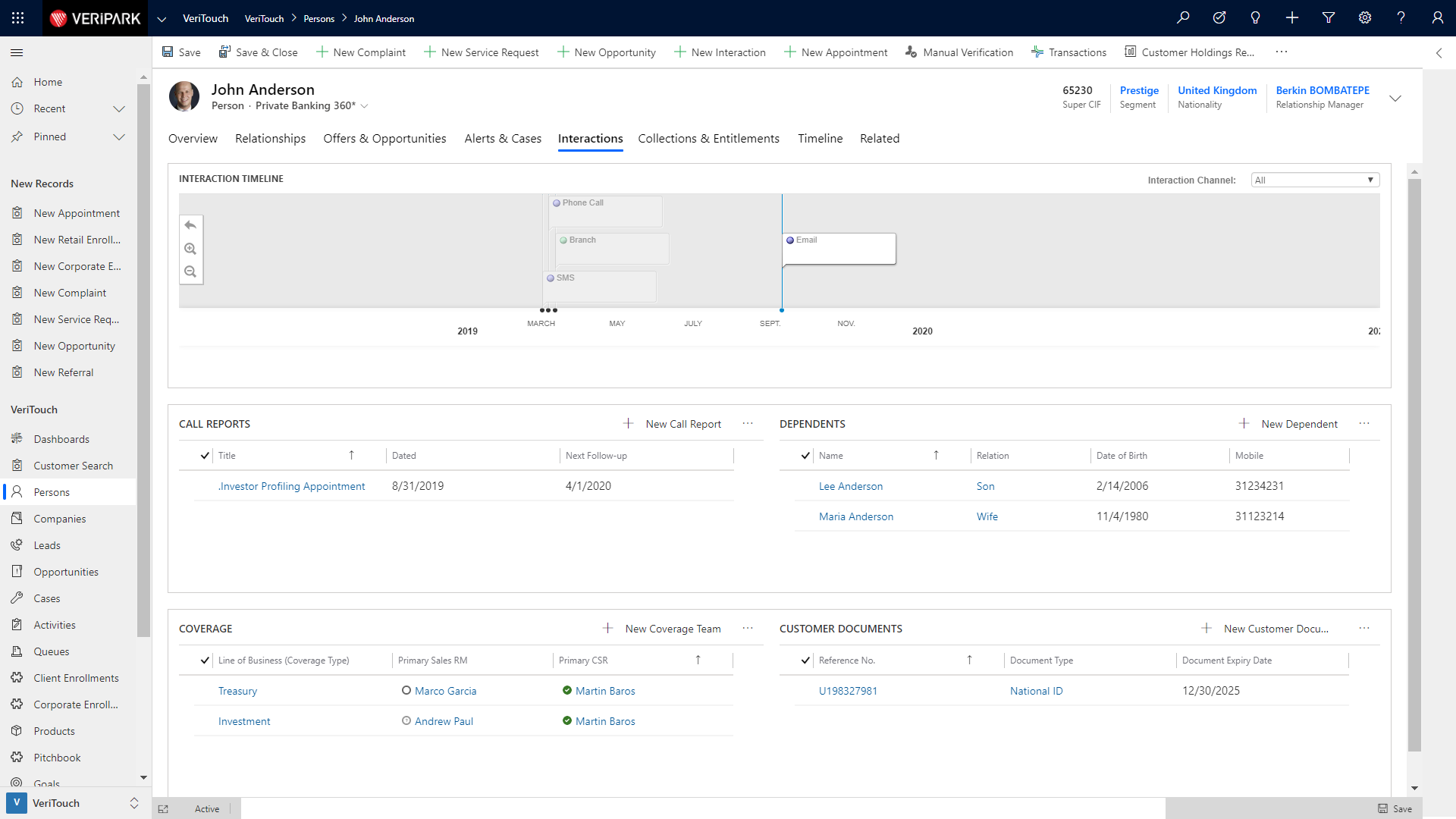

Creating strong relationships requires access to a single view of all information and services for a client. VeriPark’s Private Banking 360 View consolidates data from backend systems and digital channels, making it easy for Relationship Managers and Wealth Managers to get a complete view of their clients’ relationship with the bank on a single platform.

The 360 client view includes the client’s banking and investment products, current offers and opportunities and also suitable products that the client is eligible for. It enables successful relationship monitoring and management. With rich client profiles at their fingertips, advisors can take their client engagements to the next level — by not just understanding what data they have, but also how they can apply this data to personalize relationships at scale.

Next Best Action | Visual Indicators (Year to date return - Month to date return - Profitability - Client - Satisfaction Index) | Utilized Products / Channels | Assets Under Management | Portfolio Overview | Customer 720 View | Interaction Timeline | Alerts for Client | Entitlements | Call Reports

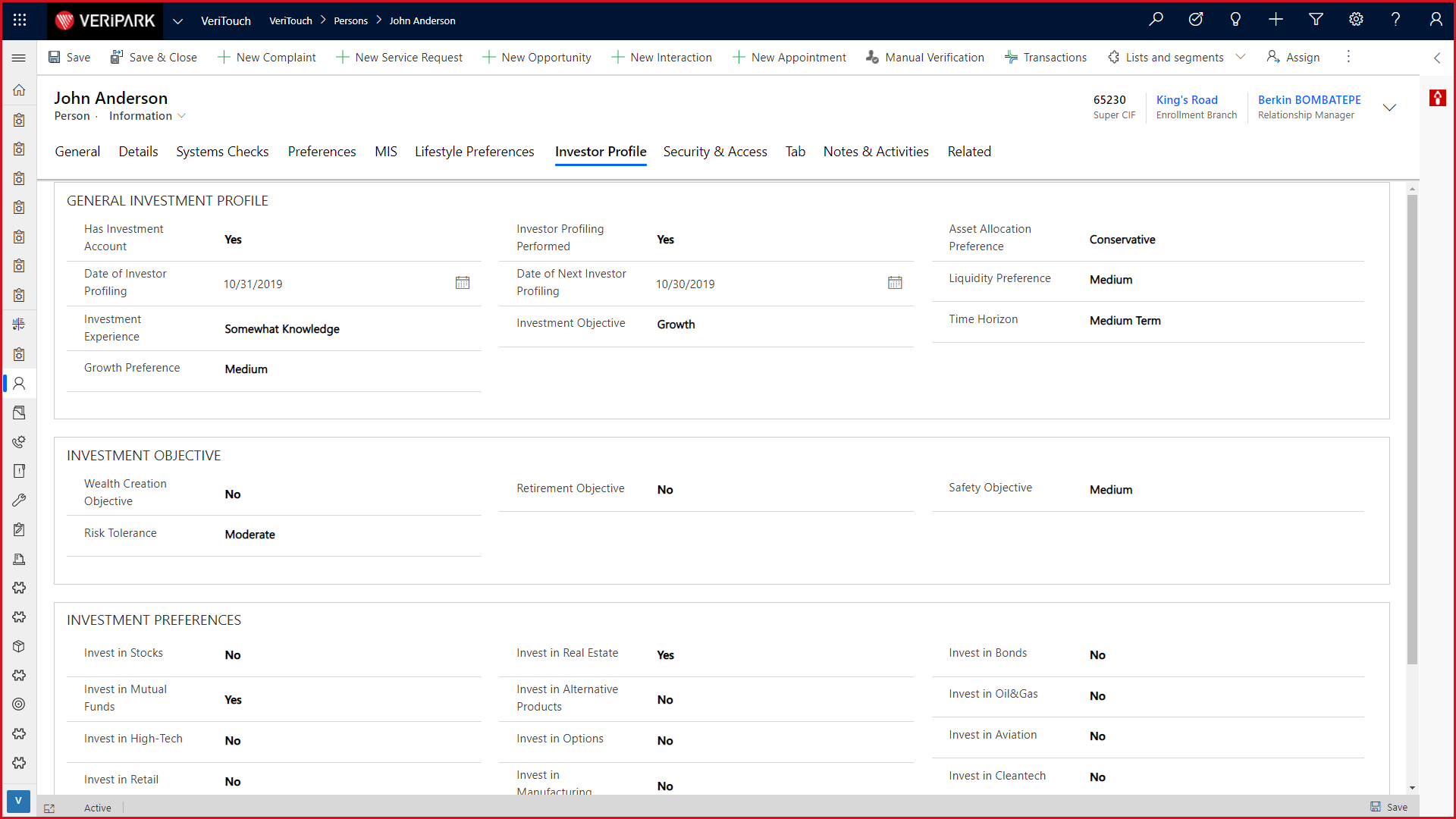

Investor Profiling, Sales & Prospect Management

Understanding your clients’ investment objectives, financial goals investment risk appetite, household structure and investment experience is the starting point of a well-conceived investment plan. It’s also critical to ensuring that your Relationship Managers can provide them with highly personalized advice. VeriPark’s advanced investor profiling surveys provide your Relationship Managers with the ability to carry out questionnaires to assess the client’s overall situation including specific financial needs, household structure, other assets and risk tolerance. This way you can offer the best suitable products to them, create cross-sell opportunities and advise on the best-fit investment strategy.

The Household Management feature of VeriPark’s Private Banking Solution extends the client’s relationship with the bank to his household and enables you to reach out to other members of the household. It helps to provide competitive services, increase revenue while satisfying the needs of a diverse group of family members.

Investment Objectives | Household & Investor 720 | Prospect Management | Opportunity Management | Regulatory Checks & KYC Capturing

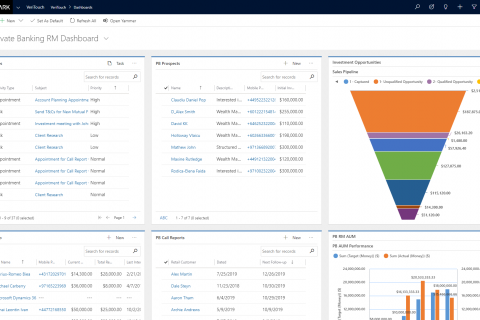

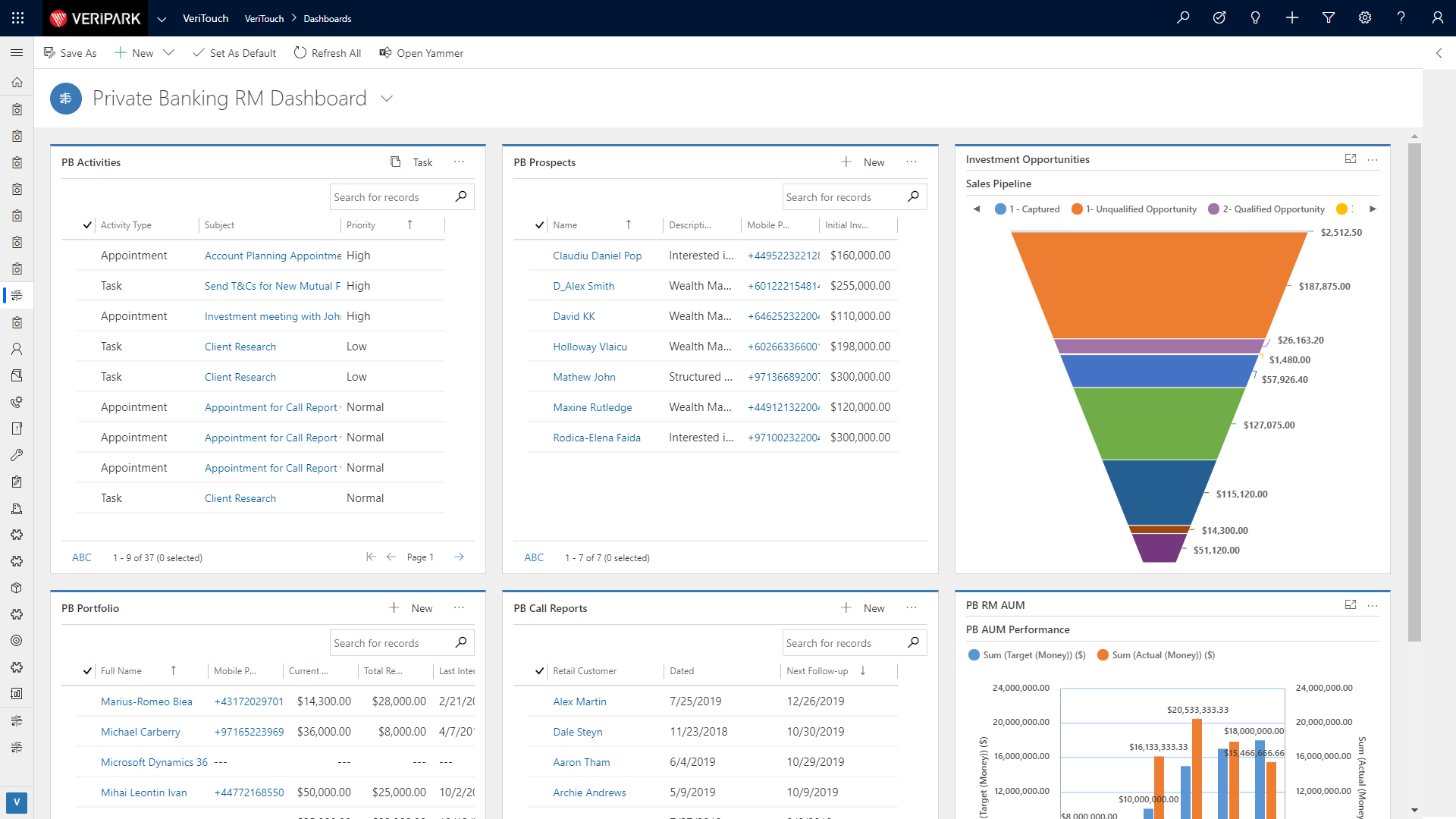

Contact Plans & Call Reporting

Every private banking sales call - from contacting the customer over meeting preparation, meeting follow-up to sales planning - should follow a pre-planned structure to increase the likelihood of the desired client engagement. With the Contact Plans & Call Reporting module, your relationship managers and advisors get access to smart digital tools that help meet your client in the right way and create rich engagements while improving client contact frequency with structured call plans.

Enhanced by appointment distribution, meeting note entity, lead capturing form and sales processing capabilities, the module empowers your relationship managers in many ways. They can create follow up tasks, list the opportunities for products that the client is interested in, see the complaints or requests raised and referrals made by the client in a single view. With the Call List Management functionality, CRM can automate client callings for margin calls, notifications and response capture for corporate actions. You can provide one application to your advisors to call your client, sell on their behalf and make the right offers.

Call plans, frequencies and call reports | Minutes of meeting | Account planning | Lead distribution to branches | Follow-up and to-do tasks

-

Segmentation & Value Proposition

The Client Segmentation & Value Proposition module provides the foundation to manage a trustworthy relationship with existing customers and for client relationship development. It is designed to help you understand your clients to serve them better and increase retention. With this module, you can easily define segmentation criteria (Annual Income, Salary, AUM, Products etc.), do automatic segment identification, promote or demote segments and see the entire segmentation history in a single screen.

Build strong client segments, empower your advisors to gain actionable insights and unlock opportunities to increase the effectiveness in cross-sell and up-sell.

Alerts & Notifications | Event invitations | Research dissemination

-

Service Requests & Complaints

“A private banking customer should only tell the story once”. With this vision in mind, the Service Request & Complaints Management module empowers you to resolve your clients' complaints in a timely fashion and reduces the frictions and barriers your clients face. It offers operational excellence with automated processes for the resolution of all complaints and service requests.

The module optimizes the service points to efficiently capture all the information required for the resolution of a client’s request. Once a complaint or a request is captured, it is automatically routed to relevant back-office queues for fulfilment. With appropriate SLAs and monitoring capabilities in place, Service Request & Complaints Management ensures timely resolution, increases client satisfaction and promotes trust and confidence.

STP / Non-STP service requests | Complaint capture | Auto assignment to back-office queues | SLAs and escalations

Front office & back office collaboration

Microsoft Teams can help to deliver a distinctive private banking client experience for banks – and add real value for your employees. Thanks to front-office and back-office collaboration, you can directly connect to Dynamics 365 from Microsoft Teams.

The Teams integration allows your Relationship Managers to create a client team, access client information directly from Teams, add notes, contacts and opportunities easily.