Every online banking login is an opportunity to know and serve your customers better

How banks can improve data quality and KYC by integrating their self-service channels with CRM

Banks and other financial services institutions face a challenge as they strive to adapt to changing market conditions. Understanding their market and customers is crucial to this endeavor, hence they need to rely on data to remain competitive. That’s not always easy in a heavily regulated environment. Simply having data is not enough. Banks and financial services institutions need accessible data that can be trusted in order to compete profitably while complying with the law.

Maintaining a strong focus on data quality is therefore becoming one of the important success factors not only for KYC/AML but also to improve customer engagement.

However, we see that, with regards to data, many financial services institutions only have mechanisms in place for regulatory purposes, but don’t have any built-in processes yet to update and improve actionable data to add value to their business.

What’s wrong with manual processes for data quality and KYC?

Usually, it’s a call center agent or a relationship manager, while interacting with the customer, who finds out that the customer’s ID is about to expire or that his/her work or family situation has changed and updates the information accordingly. Sometimes key customer data collection is done through outreach. Banks manually send emails or rely on outbound calls for KYC reviews.

The data quality and KYC processes often remain highly manual, which makes them expensive and prone to errors. With more and more tech-savvy customers, manual processes are getting even harder as these customers choose digital services (like online and mobile banking) over physical or assisted ones.

Given the importance of automated quality data collection, a comprehensive data-quality management approach is required for financial institutions. By allowing customers to update their own information on digital channels, banks can improve the quality of data collection and tap deep customer insights to increase their own ability to serve customers, and lower costs.

Integrated omnichannel customer engagement

To achieve this, banks need to integrate their CRM (customer relationship management) solutions with their digital banking channels. With a Business Layer API that exposes important functionalities of CRM to web services, channels and apps like VeriChannel or VeriBranch can use CRM logic easily. The business processes defined in CRM (like Dynamics 365), automatically take place on digital channels.

Without systems talking to each other natively, each tool keeps its own kind of data. Integrating them removes this limitation. All the information the customers create or change is pushed directly into the CRM system, ready for relevant business workflows to kick in.

Customer-driven data improvement

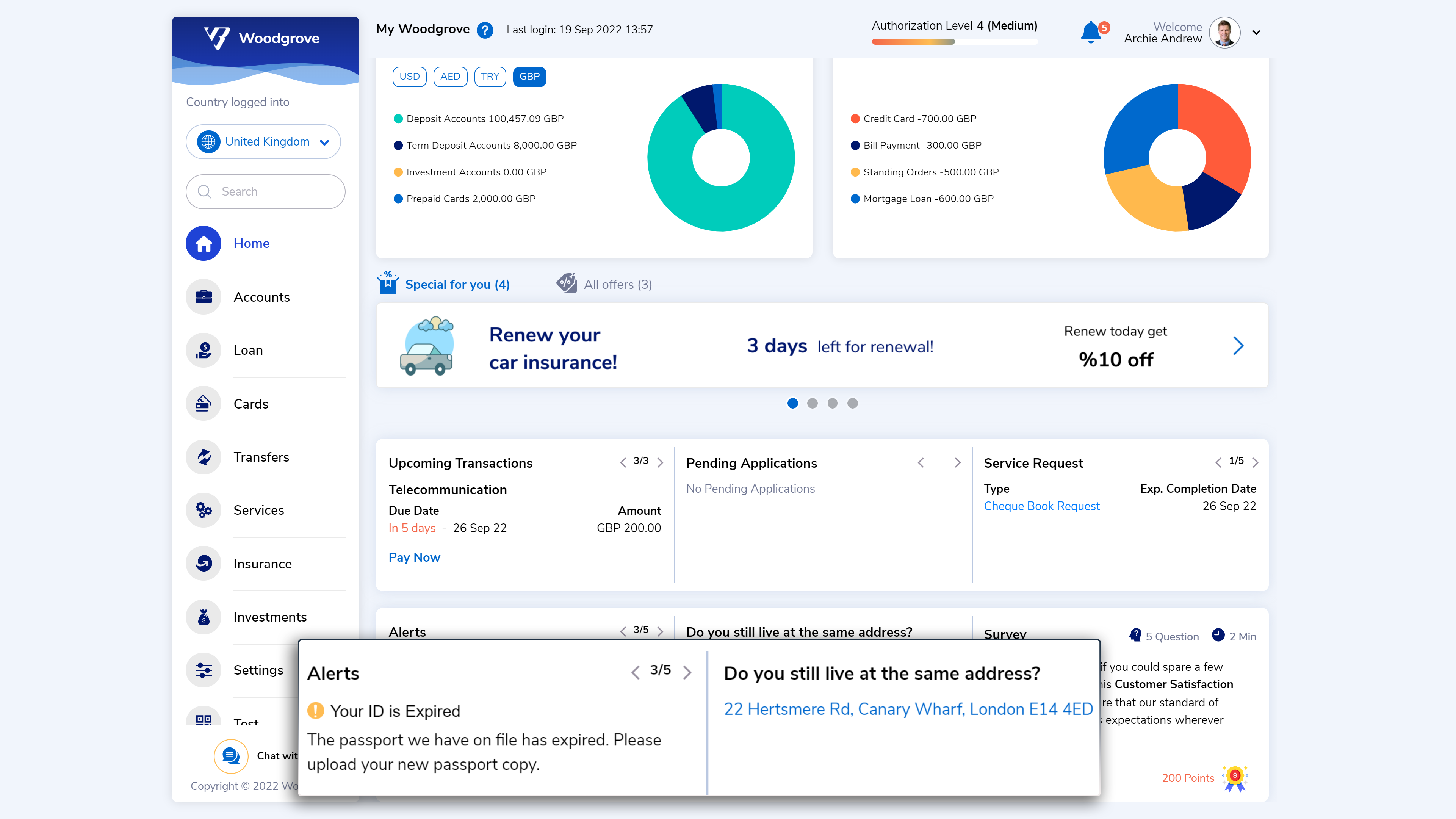

Every piece of information your customers update on your online banking can be reflected in your CRM and vice versa. Now, all you need to do is to send out the right questions and alerts to your customers when they log in on internet banking and let them do the rest. This is easily doable with a widget for online banking asking yes/no questions.

Every login is an opportunity to know more about the customer

For example, every time a customer logs in, the Data Quality Widget will ask one question at a time about critical pieces of information and accept customer selections to confirm data. It will not repeat questions that have been answered before. Similarly, alerts for the customer can pop up in the online banking interface, such as a request to update an expired ID or a missing mandatory field.

All the updates will be applied to your CRM and back-end systems in real-time so that every login is an opportunity to know more about your customer immediately and ultimately serve him better.

E-Book | Banking Reimagined