How retail banks can turn offboarding into a customer engagement opportunity

Does your bank have an offboarding strategy to retain customers, build lifetime value and create brand advocates?

Banks and other financial institutions tend to see offboarding as the final step in a customer’s journey, when they say goodbye and close the door on the relationship for good. We think there is a better way to manage the process for both the customer and their financial services provider. An approach that leaves the door open to renewing the relationship later, or even transforms it now to keep the customer engaged.

We think of this as retention-focused offboarding, treating the customer’s status as fluid rather than strictly binary (in or out). It takes a strategic, active approach to managing the process, recognizing that it costs more to acquire new customers than it does to retain them. This is not simply about retention but also about ensuring that customers leave on good terms, remaining positive about your brand and willing to consider returning in time.

In short, we think offboarding optimized for retention can deliver one of two broadly positive outcomes:

- Either, closing a relationship entirely but on good terms, if possible, with the potential for reopening it.

- Or offboarding the customer to a new relationship status, perhaps with another part of the organization.

Why is retention-focused offboarding important?

New customer acquisition is expensive.

- According to this Harvard Business Review article, acquisition can cost 5 to 25 times more than retention.

- That report also references this research from Bain & Company, which found that, in financial services, a 5% increase in customer retention can increase profits by more than a 25%.

An offboarding strategy that reduces attrition (‘churn’) rates will save you valuable time and resources that you could otherwise invest in keeping existing customers happy. You are likely to have invested a lot in onboarding each customer. It makes sense when they want to offboard, for any reason, to try to change the relationship status rather than end it completely.

What difference can offboarding optimized for retention make?

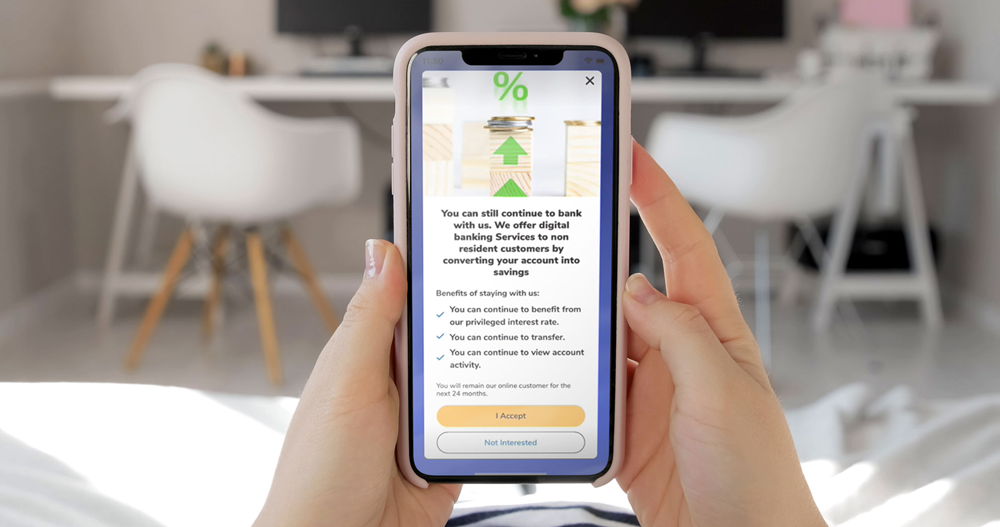

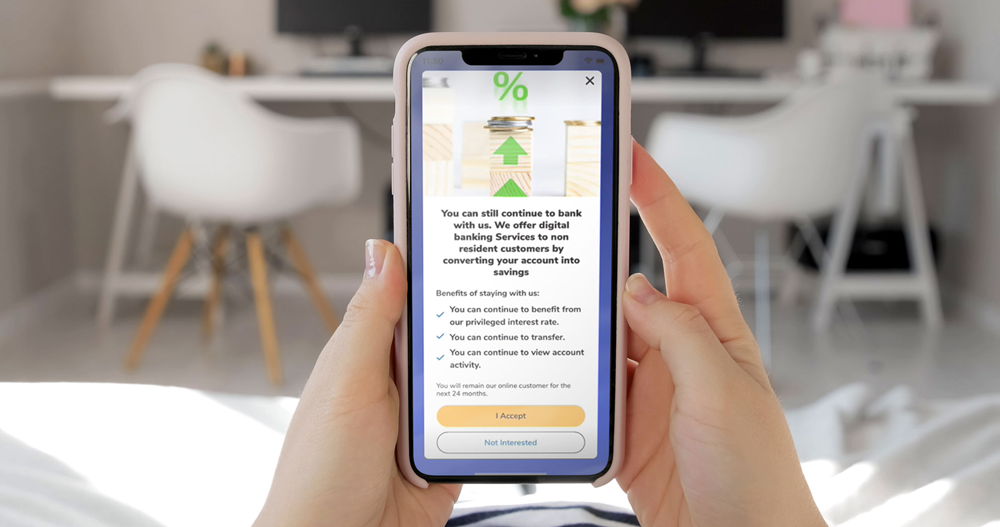

Example: Archie used to work in a Gulf Cooperation Council (GCC) country where he had a current account with a local bank. The current account was only available to GCC residents, whereas anyone with a valid passport could have a savings account with the bank. When Archie left the country, his bank lost him as a customer because they closed his current account, instead of turning it into a savings account. Effectively they missed the opportunity to reshape this customer relationship and retain some of Archie’s business.

We can summarize this new approach to offboarding as follows:

GOAL:

Retain or upgrade customers by converting ‘churn alerts’ into new opportunities.

You need to understand why customers might enter the offboarding process. Your strategy should be to shape your response according to the data you gather. For instance, VeriPark’s CRM campaign management module aims to reduce offboarding by generating dynamic retention offers (‘the right product at the right time’). This could involve a Relationship Manager calling the customer to ask if they have a specific problem (say with a loan rate) and seeing how they might help.

STRATEGY:

- Retain – if it’s in the customer’s best interest: Offboarding is not always in the customer’s best interest. Take this opportunity to re-engage them by offering the best product for them at this time.

- Liabilities (protect the business): For instance, Your offboarding system should check whether the customer has outstanding debts with other parts of your business that need clearing first.

- Provide data protection clarity and control to customers: Clients often worry about what will happen to their data and how you might use it later. Demonstrate that your offboarding complies with GDPR.

- Provide a seamless graduation experience: If the customer cannot start the process in their branch and then finish it online, your relationship will suffer. If the customer has to visit the branch again to fill in forms, they are unlikely to become a brand advocate.

- Build relationships for life: When you understand why a customer wants or needs to leave, you can address those reasons specifically. You can then close the gap between where they are now and where they want to be. The key is knowing and responding to the customer’s motivation for changing their relationship status.

BENEFITS:

- Improved retention: You can use offboarding as an opportunity to renew customer relationships. By understanding their changing situation, you can offer them products or services relevant to their needs. The primary objective should be to maintain some form of engagement, rather than losing them forever.

- Timely regulatory response: With automated offboarding processes, you can keep customers informed of next steps. This can reduce the risk of bad publicity, while ensuring a seamless and compliant transition.

- Understanding customer life events: Customers don’t always end their business relationships because of poor service. It’s often because something in their private life has forced them to act. Understanding these life events and their changing needs will improve your chance of retaining them.

- Creating brand advocates for life: Offboarding gives you a chance to demonstrate how much you really care about your customers. By addressing their concerns effectively, you can turn it into a positive experience for them. As a result, they will be more likely to recommend you to friends and colleagues.

What are your views on retention-focused offboarding?

At VeriPark, we are always keen to discuss service enhancements and new product development with our finance clients. New AI architecture is helping us develop more proactive tools for managing customer events, such as offboarding, in a way that benefits both them and your business. We’d like to understand your views and needs for streamlined, automated strategies that help improve customer retention and lifetime value.

Please contact us to share your views and to discuss your needs.