VeriPark's response to COVID-19

Thriving in the New Normal

How you deal with the challenges in the “New Normal” will not only define the future of your financial institution's brand; it will significantly affect your customers, employees and the wider economy. To be digital-ready for a post-Covid-19- world, organizations will not only have to build resilience, but also reimagine and reinvent their strategies and operations.

VeriPark has the digital solutions to ensure that:

- employees can work from home, stay safe and be available to meet the needs of your retail and business customers

- financial organizations can acquire and onboard new customers without the need to meet them in a physical branch

- customers can manage their finances & insurances remotely - via internet or mobile

Let us inspire you

On this page, we gathered relevant insights and strategies to assist leaders in financial services to thrive in a post-Covid-19-world. From reimagining the workforce of the future to accelerating digital transformation in digital lending, creating branches of the future to digital customer onboarding, these insights will empower you to thrive in the New Normal and give you the keys for digital success in financial services.

Solutions to help you build resilience, reimagine and reinvent your strategy

-

-

-

VeriPark's Digital Onboarding Solution provides a single platform that allows...

-

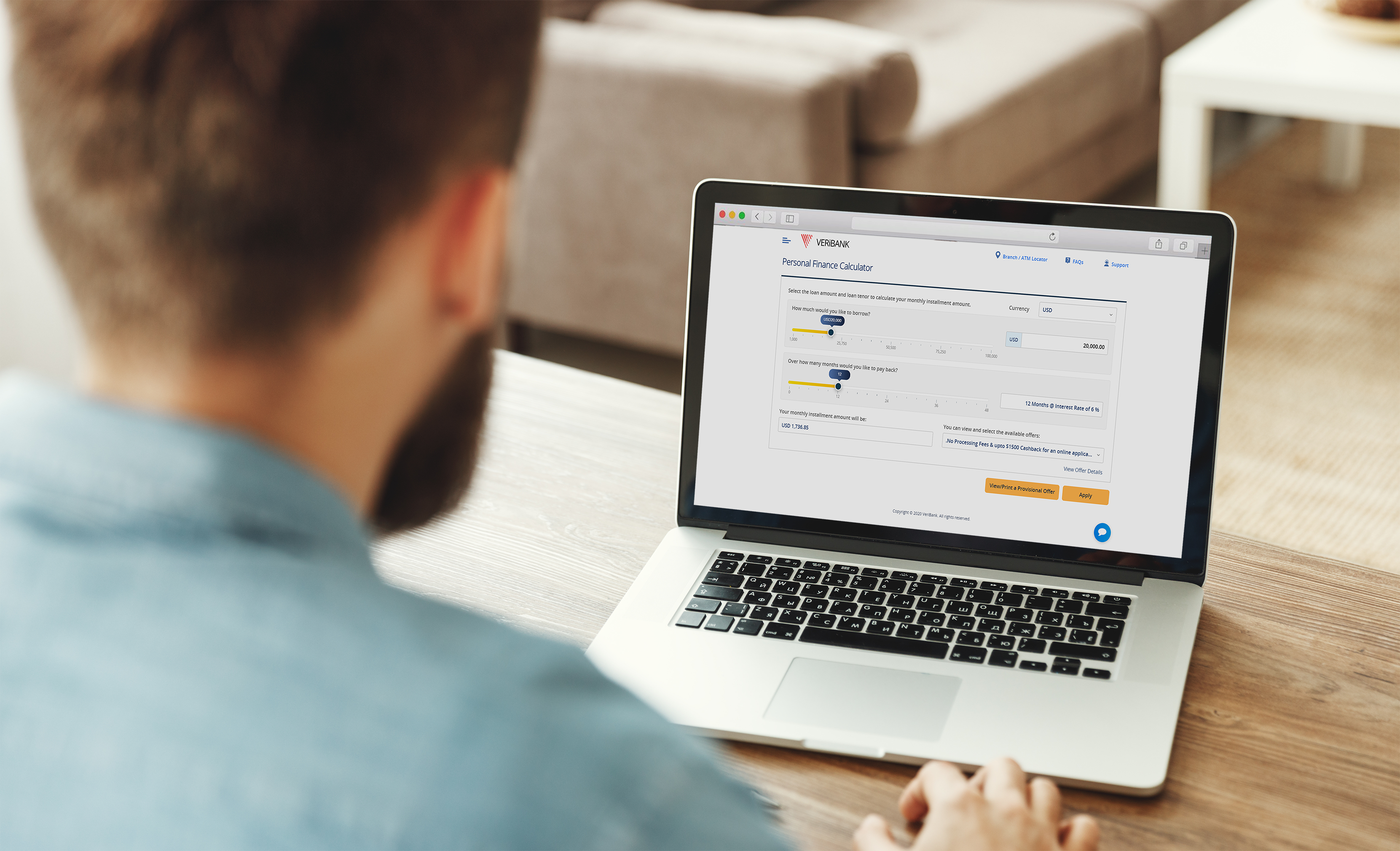

The future-ready lending platform built on Dynamics 365 empowers financial...

-

Take early actions in collections, improve loan collection management and reduce...

-

VeriPark offers a Mobile Banking Solution that enables financial institutions to...

-

-

The solution is designed to provide the best customer experience while providing...

-

Related videos

-

May 28 & June 3, 2020 - 1 hour

-

VeriPark offers you a new way of banking and helps you become the bank that your...

-

By entering into a strategic partnership with Adobe and Microsoft, VeriPark...

Related Blog Posts

-

Digital servicing, online and mobile banking are key for retail and SME...

-

Customers and businesses are adapting to the Coronavirus pandemic. Almost...

-

Banks work from home and keep staff safe during COVID-19

-

Interview with Esra Beyzadeoglu, EVP Information Technologies, Digital Banking...

-

Embracing digital lending is no longer a 'nice-to-have' future-focused project...

-

What does the future hold for bank branches as parts of the world start to...

-

Interview with Metin Demirel, Executive Vice President, AKSigorta

-

Corporate banks need to reimagine their post-crisis future. Here are 5 actions...

-

6 strategies retail banks can act on right now to support their customers and...

-

Interview with Adewale Salami, Chief Technology Officer with FirstBank Nigeria

-

Insurance companies and agents can help customers through Covid-19 with hyper...

-

An interview with Zubair Ahmed, Executive Vice President and General Manager of...

-

Interview with Connie Leung, Senior Director, Financial Services Business Lead –...

-

Interview with Patrice Amann, EMEA Regional Business Lead – Worldwide Financial...

-

Pandemic chaos forced the banking sector to work through some difficult...

-

Banks are beginning to emerge from the pandemic with new priorities and...

-

Emerging technologies are facilitating faster ways of implementing traditional...

-

To fight back against the potential rise of non-performing loans, lenders will...

-

Remember when the word ‘bank’ evoked a physical building where you’d talk to an...