JS Bank - CRM

JS Bank drives customer engagement excellence with Dynamics 365 and VeriTouch

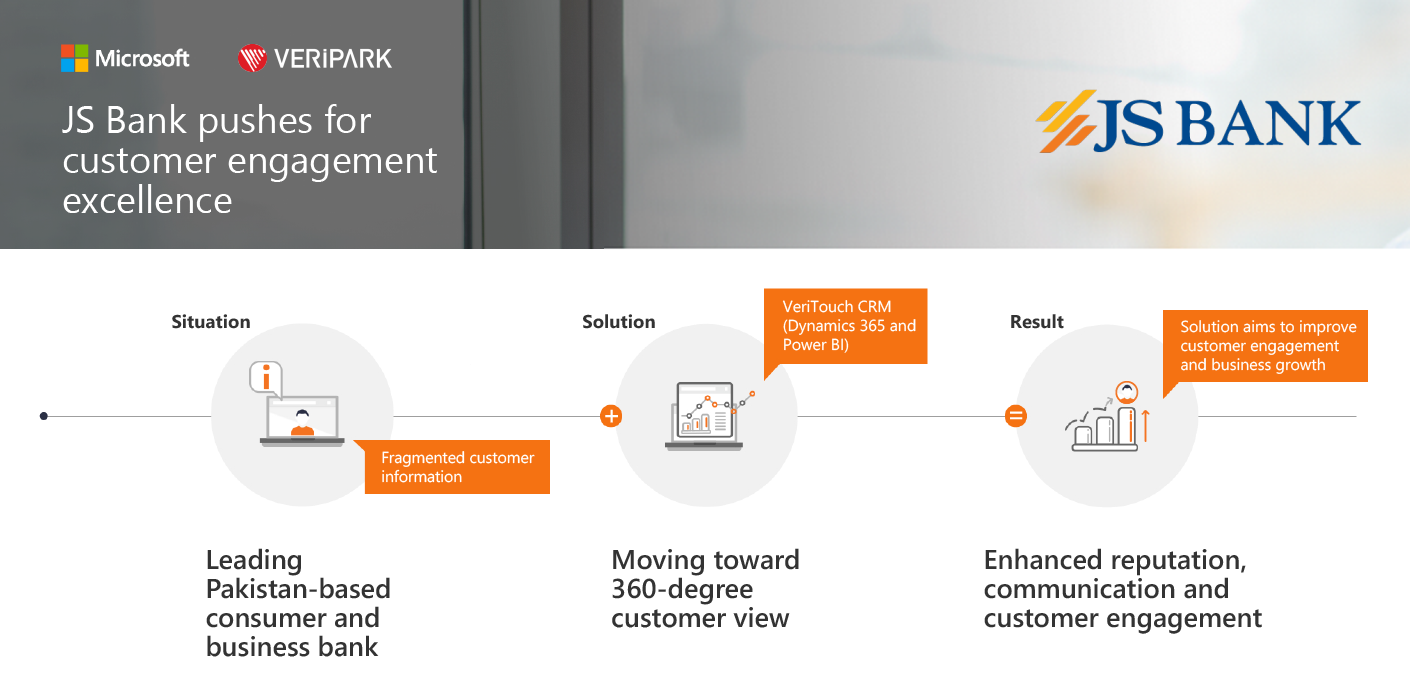

In order to shape the next stage of its development -becoming a deeply engaged and trusted advisor to every client- JS Bank needed greater insight into customer activities, pain points, and key metrics. To help it achieve its mission, JS Bank turned to VeriPark.

Founded in 2007 and operating more than 300 branches in 172 cities, JS Bank is one of Pakistan’s fastest growing and most respected financial institutions. As the country’s leading distributor of mutual funds and the second-largest partner to the Prime Minister’s Youth Business Loans program, JS Bank is now consolidating its credentials with an even stronger focus on building meaningful customer connections—becoming a deeply engaged and trusted advisor to every client. Helping bring about that change is VeriPark, a member of the Microsoft Partner Network.

Better connection, deeper engagement

“For us, digital transformation is very important,” begins Imran Soomro, CIO of JS Bank. “As one of the most highly thriving banks in the country, we plan to extend that journey, to feature among the top-ten banks. Digital transformation is just a part of that process.”

Recognizing that JS Bank lacked an effective end-to-end CRM system, Soomro started searching for solutions. “While we did have a complaint and case management system for phone banking—we also leveraged some of that data for outbound sales—we didn’t have an end-to-end CRM solution giving us a 360-view of the customer.”

JS Bank needed a solution that would bring together all customer data. “Things are changing,” echoes Farooq Asghar, Country Manager of VeriPark in Pakistan. “More and more banks are realizing the importance of having an effective enterprise CRM. Without one sales, service, branches, and every other customer touch point end up working in silos. You can imagine the effects of this kind of disconnect on the quality of communication and collaboration. It becomes frustrating for the customer whose customer journey is more complex and lengthened, and it can even stop a bank from being able to onboard new customers as it impacts brand image.”

To improve its service offering, JS Bank needed a platform where everyone—from call center staff to relationship managers—would all see the same data about customer wants, needs, pain points, current products, feedback, branch visits, and more.

This is of course where Microsoft Dynamics 365 comes into the picture,” says Asghar. “It has a number of major success stories across the globe and VeriPark's internet protocol is built on top of it. Better yet, Dynamics 365 comes with pre-developed solutions to common problems faced by financial services companies.

We want to know our customers and we want to bring them the ‘wow-factor’.

Imran Soomro

CIO, JS Bank

The foundation for a connected future

“We want to know our customers and we want to bring them the ‘wow-factor’,” explains Soomro. “So, whether a customer comes into a branch, or uses a phone-banking service, or engages with us at any other touch point, we want them to walk away from that interaction and say, ‘You know, JS Bank really knows me and knows exactly what my requirements are and what my pain points are.’ To feel that JS Bank was able to help them immediately, and without any tedious processes.”

VeriPark stepped in to provide JS Bank with a solution to improve the bank’s customer experience. “I think everything just clicked with JS Bank in the first meeting,” explains Asghar. “We were able to quickly understand the problem and offer a solution.”

VeriPark’s vertical customer engagement (CRM) solution—VeriTouch—is built on Dynamics 365. Designed to empower financial institutions with rich, data-driven customer insights, the solution also provides propensity models for next best action or service. Also, poised to be part of the solution is Microsoft Power BI, which will underpin insights on role-based dashboards developed for different functions within JS Bank.

“After we presented the solution to JS Bank’s executive management, there were a number of follow up-meetings with the technical team,” explains Asghar. “Because Dynamics 365 is a platform where so many things can be done, we chose what to focus on at each stage carefully and guided the bank with the help of Microsoft. That helped us fully explore the capabilities of the first few modules so the bank could begin the implementation. A lot of discussion revolved around solutioning. After discussing all the details, the deal was signed. Now we are in the design phase.”

Ready to connect with and engage customers

With a sharp focus on customer satisfaction scores—especially among the feedback-savvy youth of Pakistan, many of whom talk openly about their banking experiences on social platforms—JS Bank is looking to improve turnaround time, customer service, and elevate its overall service standards. Asghar emphasizes how VeriPark’s single customer view, sales management module, as well as its call center module will be key for enabling the bank to attain its goals.

“It was important for us to use a bank-specific CRM,” explains Soomro. “You can buy many CRMs off-the-shelf, but I would advise everyone to consider the ultimate value for money. In the end, the ROI of finding the right solution will more than justify the initial investment.”

To remain focused on the customer, JS Bank uses a single customer view option. “Single customer view gives a very elaborate vision of every customer,” Asghar explains. “All the cases reported by a customer, all the products that the customer is availing, and all the channels that the customer is using—they are all there. It’s a solution that allows everyone, from call center agents to branch managers, to respond to customers in the right way. But there are additional benefits too. For example, there are several alerts available if the customer has an upcoming birthday. Not only to wish them a happy birthday, but because the day may also coincide with certain documents expiring, which is important from a compliance perspective.”

Asghar understands that JS Bank’s transformation is about its customers. “Overall, what has really inspired me about working with JS Bank was the message that it wants to give customers world-class service. It’s quite inspiring, I think, for a bank to have that kind of direction at the highest level, and for that to drive the bank’s vision and its selection of an enterprise solution like Microsoft Dynamics 365.”

“We definitely envision a very successful implementation of Dynamics 365 with VeriPark,” concludes Soomro.

It was important for us to use a bank-specific CRM. You can buy many CRMs off-the-shelf, but I would advise everyone to consider the ultimate value for money. In the end, the ROI of finding the right solution will more than justify the initial investment.

Imran Soomro

CIO, JS Bank