Using CRM-based loan origination to personalize lending

Engage early with borrowers to maximize your lending opportunities

It is wrong to assume that borrower engagement only begins with the customer’s loan application. Financial institutions that wait until then risk missing multiple selling opportunities. That’s because most borrowers consider more than one lender before deciding where to apply for a loan.

As competition intensifies, it becomes more important for lenders and other financial institutions to engage with borrowers at the very beginning of their search. That’s when you should start giving your potential customers good reasons to choose you over other lenders for the loan they're seeking.

Know who your potential customers are and what they want

Loans aren’t the kind of product you can sell anytime to anyone. Before offering a solution, you must understand which potential customers are starting their information search, who is interested in or actively seeking a loan, and who is most likely to take out a loan. A sales funnel can help you understand what potential customers are thinking and doing at each stage of this buying journey. The better your understanding of potential customers, the more you can meet their individual needs and expectations.

The new way to connect with customers in the loan market

It used to be that sales teams had to manually track every step of lead generation using electronic spreadsheets, emails, or standalone applications. This was a painful and expensive process not least because compiling all this information to meet customers’ needs was very time-consuming.

Now there's a better way: a fully integrated CRM-based loan origination system. This introduces CRM-related ideas, such as prospect management, sales funnel, lead capture, lead nurturing, cross-sell/upsell, and loyalty, directly into the loan origination process.

Faster loan processing increases customer satisfaction

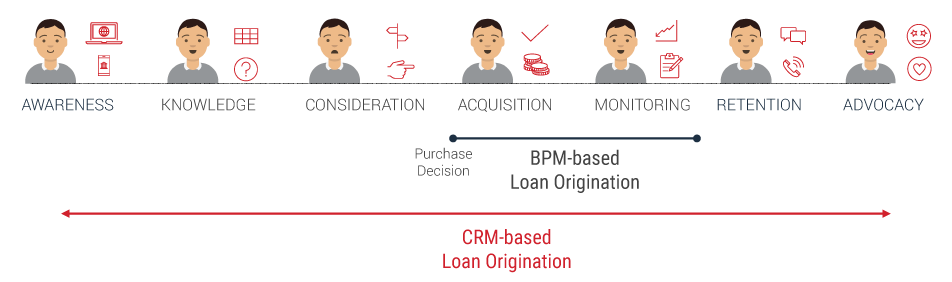

Most loan origination solutions are based on Business Process Management (BPM) systems. They tend to only enter the picture after the customer has chosen their loan provider. However, with a CRM-based solution, you can start interacting with customers as early as the awareness stage and influence their decisions from the start.

Your customers who are trying to understand the process in more detail will always ask a lot of questions when getting a personal or business loan: “How much can I borrow?” “What is the best interest rate I can get?”, “How do I know what my current credit score is?” and so on.

That’s why VeriPark offers a solution encompassing both your prospecting and loan origination needs. Combined with your CRM, VeriLoan gives you a 360-degree view of your customer as well as sight of your entire lending pipeline across channels and lines of business. This helps you to manage new borrower opportunities from any lead source alongside loans in progress.

Currently, many Loan Officers still have to use up to 10 disparate applications to answer customer queries. This is not a pleasant journey for customers or an easy job for lending teams. Now, however, lenders can process loans and close business faster with greater customer satisfaction because they have access to all the data they need within one CRM system.

Easy customer history tracking

Integrating loan origination with a CRM system helps deliver a better service by automating communications with borrowers. This can include customized emails, call scripts, and many more contact points, where all actions and interactions are automatically logged.

This information can be useful for building customer engagement. For example, if a borrower has previously asked about a particular type of loan, you can send them any additional information they need to move the process forward.

Because the CRM records all customer interactions, customers don’t have to repeat themselves.

Do not underestimate a CRM based technology stack. This is a huge reason why Innovation Credit Union partnered with VeriPark and Microsoft. Now our next technology platforms like LOA, AOS, mobile banking, online, NBA etc. are all built on the Dynamics CRM platform and CRM is the best way to ensure we will always be focused on our members.

Daniel Johnson, CEO, Innovation Credit Union.

Tasks and reminders increase conversion rates

CRM-based loan origination not only boosts conversions but also reduces customer acquisition costs. This is because it enables you to set reminders and tasks to ensure your team follows-up on enquiries, if they don’t hear from a customer after, say, a few days.

A loan origination system linked directly to your CRM can provide your team with accurate, real-time account analysis and suggest relevant offers based on existing relationship data. For instance, they can not only remind a customer who has started the loan application process to complete it, but also incentivize them to do so.

Personalization and data-driven insights

CRM-based loan origination can enable better risk management with risk-based pricing models. Instead of charging all borrowers the same loan interest rate, lenders can offer borrowers loan terms based on credit profile characteristics, such as customer history, scorecard, or products. For example, a bank can accept a customer’s fixed deposit as a security for a loan and charge a lower interest rate.

This empowers loan officers and lending teams to personalize their offers with better interest rates for favored customers. Being able to tailor products and services to meet specific needs means businesses can treat each customer who applies for a mortgage or loan as an individual. They can develop more relevant offers, so improving the customer experience and building loyalty.

Leveraging CRM data for new business opportunities

People who are ready to apply for a loan tend to ask, “How can I improve my chances of getting a loan?”. That’s your opportunity to upsell other products or use ‘product bundling’ to increase sales by providing the customer with perceived added value. For example, when your customer is set to buy a new home, you can offer them the option of selecting house and contents insurance.

CRM integration makes your company's entire product catalog, including all applicable information for every item, available in your loan origination system. That makes it much easier to use product bundling and cross-selling strategically to differentiate your offer from rivals and so increase sales.

E-Book | CRM-based Loan Origination to Optimize Lending