Digital SME and Corporate Client Onboarding

Digital SME and Corporate Client Onboarding

Traditionally, opening a business account meant face-to-face meetings and signing paper documents. That can no longer be the only option. As more customers are switching to digital channels to interact with their banks, digital onboarding for corporate and SME banking is becoming a critical component of their experience.

Onboarding processes for SME and corporate clients can be complex and challenging for banks due to the diversification in many aspects. However, since it’s the first impression potential clients get of their banks, it's essential to get this "first journey" right. Banks are quickly realizing that, to differentiate in such a competitive market, they must embrace digital and reimagine the SME and corporate client onboarding experience. They need to redesign the entire onboarding process, ease complexities and minimize pain points such as paperwork and manual entry of data in the application.

VeriPark’s Digital SME and Corporate Onboarding solution orchestrates a seamless and engaging end-to-end onboarding journey. It provides a single platform for banks to onboard SME and corporate customers easily, using secure mobile banking or online banking channels. With this solution, banks can meet client expectations and craft unique experiences while striving to improve digital client onboarding efficiency.

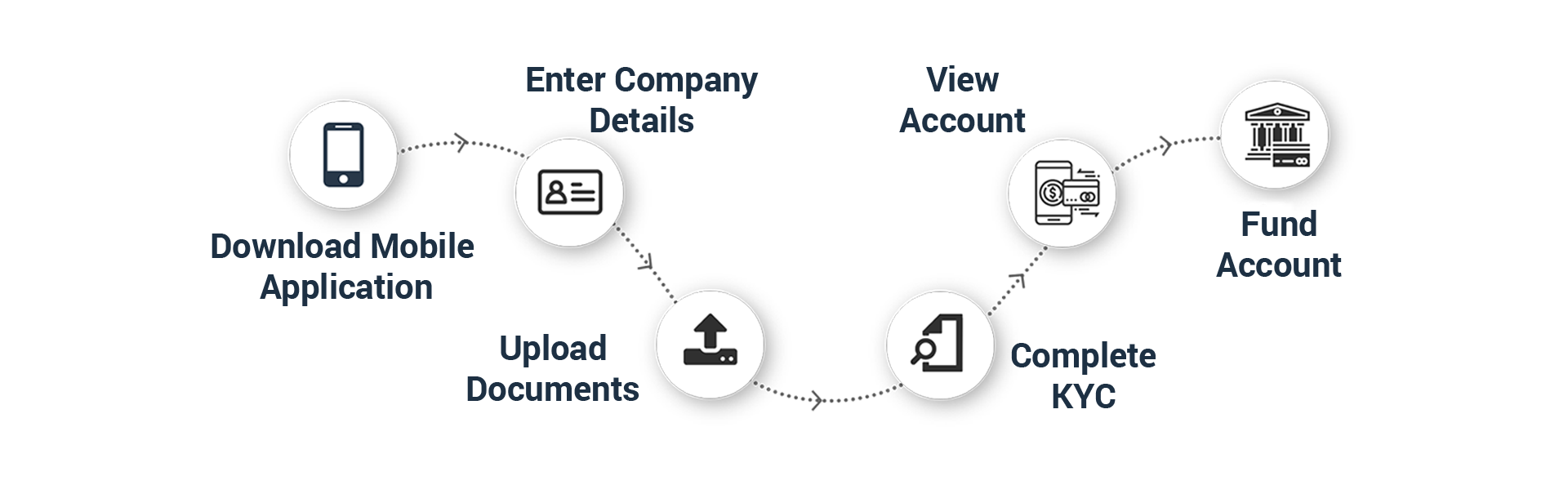

5 Key Steps to Digital SME & Corporate Client Onboarding

Step 1: Application & Data Capture

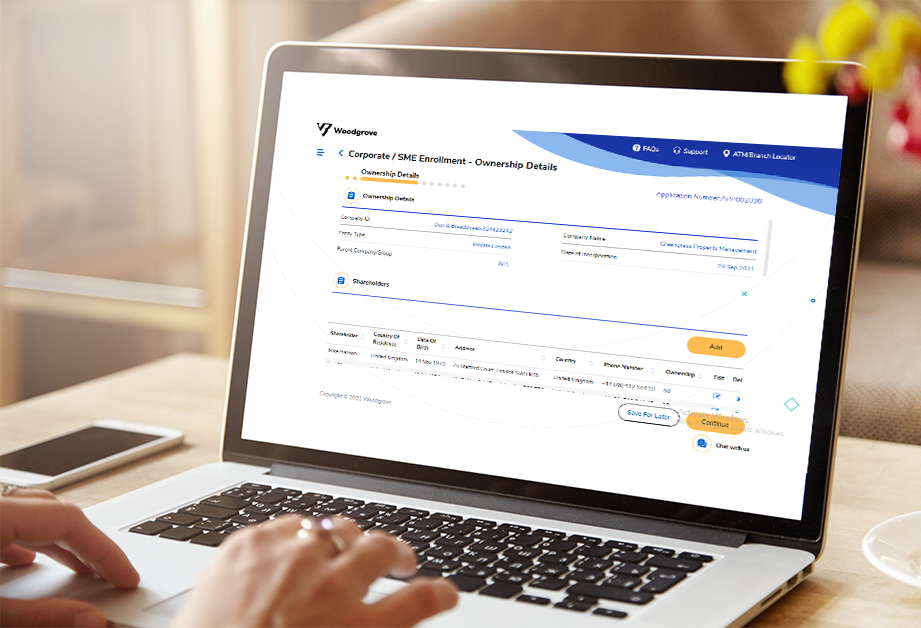

There are far more data required to onboard SME and corporate clients compared to retail customers. Whether a client chooses to start onboarding via internet or mobile banking, VeriPark's Digital SME and Corporate Client Onboarding Solution provides a simple user interface to capture and verify the client's initial request and primary information digitally. In the due diligence phase, all necessary client information is gathered either from commercial data providers such as Dun & Bradstreet or by entering all the information manually. Once the details of the owners, directors, authorized signatories and POAs are also collected, clients can easily upload their financials. Then the system uses OCR (Optical Character Recognition) technology to handle all documents swiftly and accurately.

Step 2: Needs Assessment

Following data capturing, a detailed assessment of the client's needs is made through a Business Needs Assessment Questionnaire. The dynamic process is based on the input of the client. At this stage, banks can learn more about their new client, understand and assess their needs and then develop a comprehensive baseline of their most significant journeys.

Step 3: Product recommendations

Once the assessment is made, the solution gives banks the capability to offer the best possible products to their clients. The product recommendations are tailored to meet the client's needs, catering to their specific requirements.

Step 4: Document & Signature Capture with an Omni-Channel Approach

Every client is different. Using our SME and Corporate Client Onboarding solution, banks can serve their clients in a personalized manner while providing the flexibility to switch seamlessly between channels of their choice. They can either upload all documents digitally using the mobile app or internet banking, book a branch appointment or request an onsite direct sales agent visit. The digital contract generation and the DocuSign integration enable banks to get the client's consent with an e-signature.

Step 5: Checklist for documents and signatures

In an age of one-click ordering and instant approvals, SME and corporate clients no longer tolerate frustrating lengthy banking processes. In this last step, banks give their clients an option to easily check their documents and signatures or add any additional document later on with an application number.

Key Features

-

Enrollment request

-

Capture company information

-

Capture shareholders, directors and guarantors information

-

e-KYC and system checks: government services, internal blacklist, AML, country blacklist checks

-

Ready to use required document packages

-

PDF application forms generation

-

Face recognition with Azure Cognitive Services

-

Document scanning & uploading

-

Account opening within Dynamics 365

-

Compliance approval & due diligence

-

Client ID reservation

-

Client generation in the back-end system

-

Account opening in the core banking system

-

Checklist control

-

Multiple product onboarding

Key Benefits

-

For Financial Institutions

- Lower cost of acquisition and cost-to-serve

- Enhanced regulatory compliance

- Improved decision time & complete fulfilment

- Reduced KYC due diligence time

- Higher client satisfaction with improved turnaround times

- Reduced complexities and failed client acquisitions

- Increased customer lifetime value

- Reduced operational and transactional risks

-

For SME & Corporate Clients

- Easy, secure, stress-free onboarding anytime, virtually anywhere without the need of visiting a branch

- Minimized time spent during the onboarding process

- Faster and more flexible access to banking services

- Switching seamlessly between channels of choice

- The ability to perform an e-signature using the smartphone