Retail Internet Banking

VeriChannel’s Internet Banking module is designed to offer personalized and fulfilling internet banking services to retail banks and their customers.

With our comprehensive suite of features, your customers can manage their accounts, pay bills, transfer funds, and more, all from the convenience of their computer or mobile device.

If you're a retail bank looking to provide top-notch online banking services to your customers, VeriChannel's Retail Internet Banking module is the perfect solution. Our advanced security measures ensure the protection of your customers` sensitive financial information, while our intuitive interface makes it easy for them to access and manage their accounts with ease.

Key Features

-

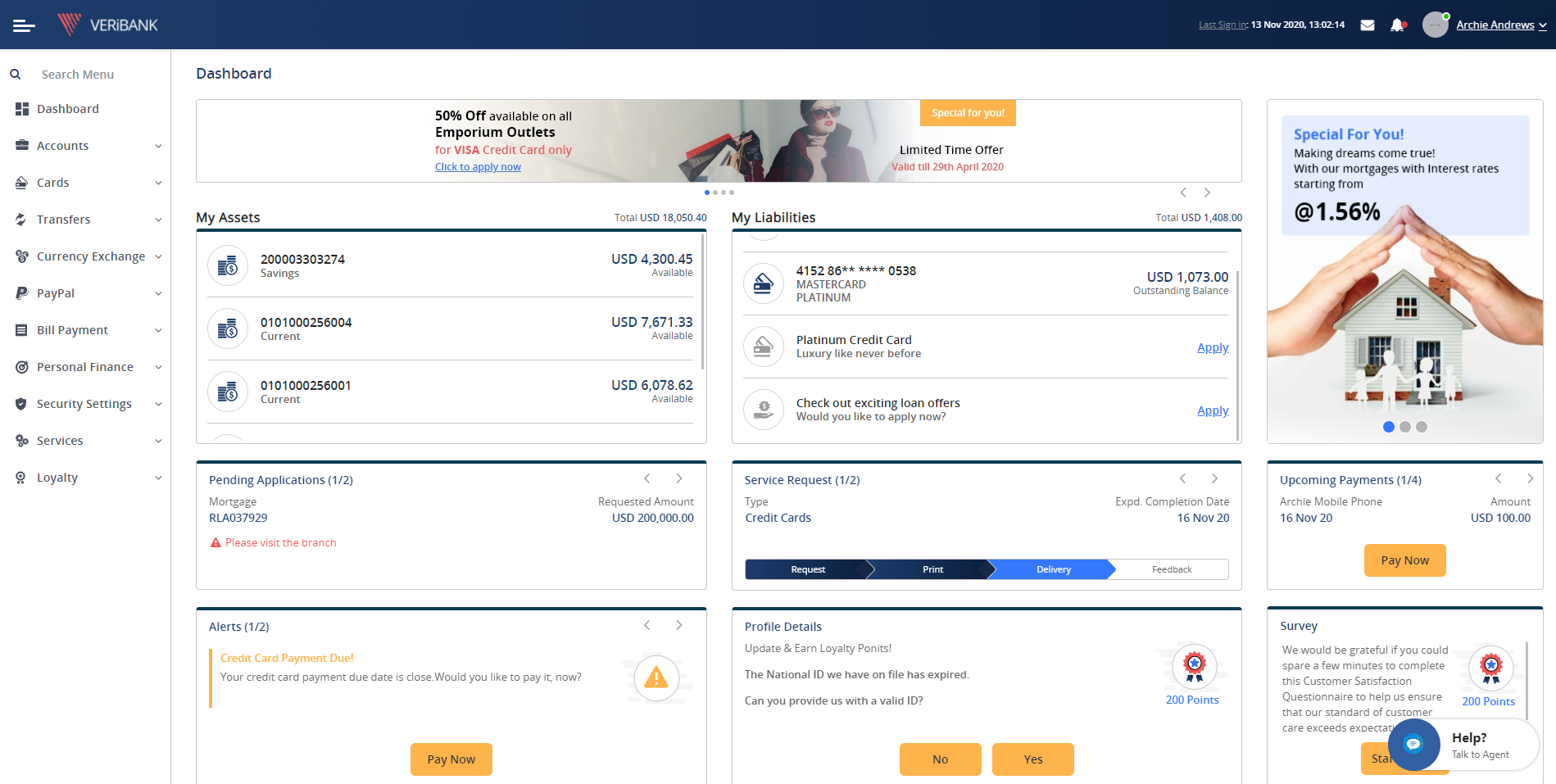

Account Management

- Customer enrolment and account opening capabilities

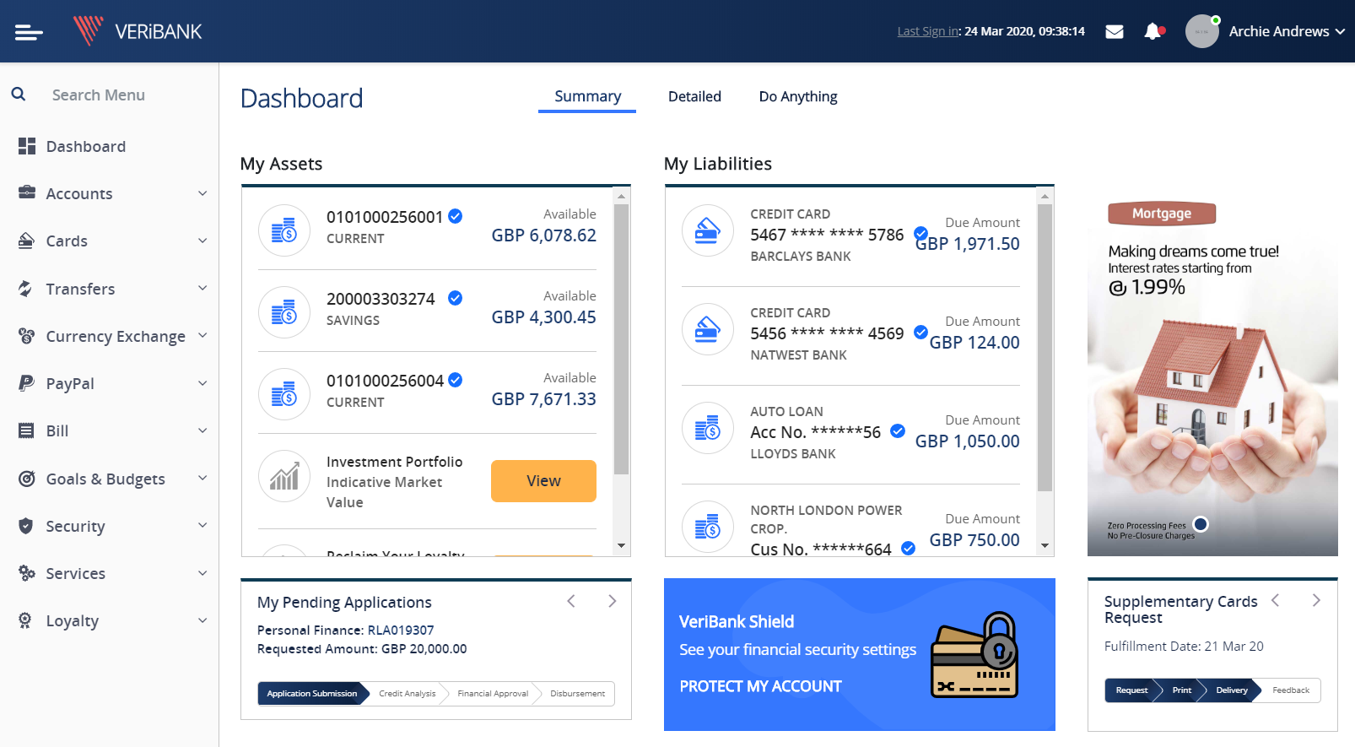

- Ability to show detailed customer account information such as Current Account, Saving Account, Investment Account, Loan Accounts etc.

- Ability to show details of customers’ accounts including status, available balance, blocked amount and other account details.

- Ability to operate detailed account transaction’s which can be searched by different filtering options.

- Enriched customer portfolio single screen that shows net worth of a customer by displaying all assets and liabilities.

-

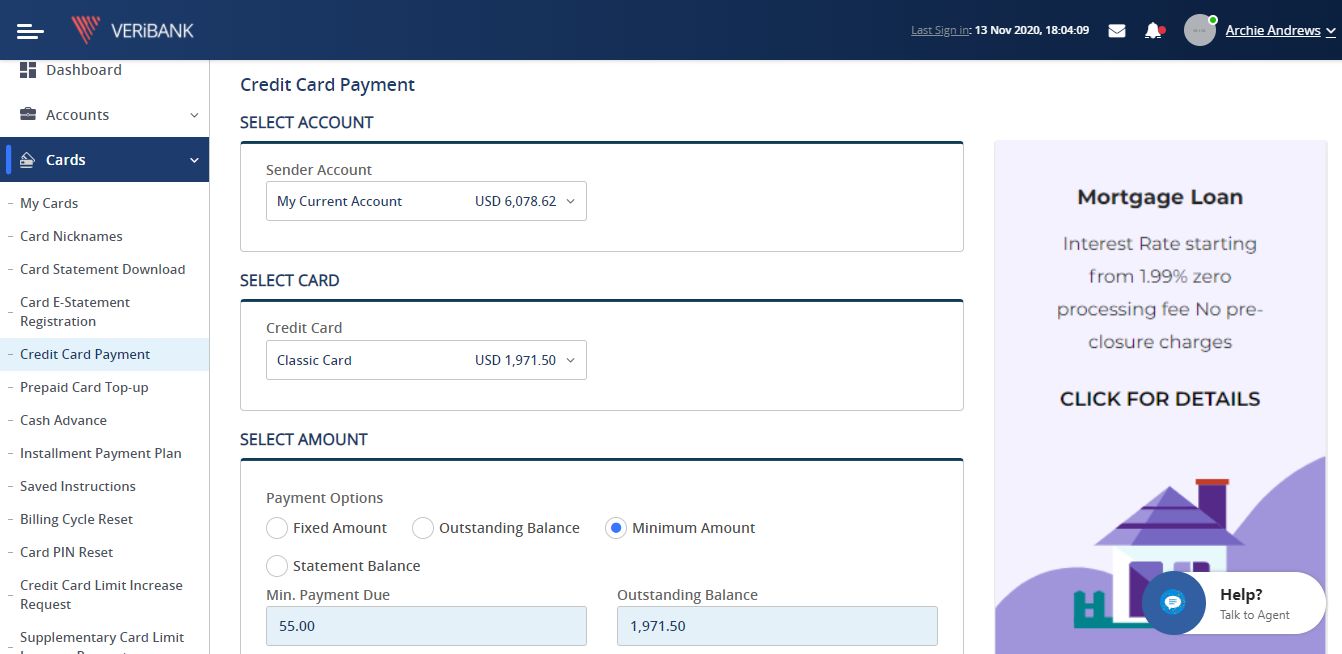

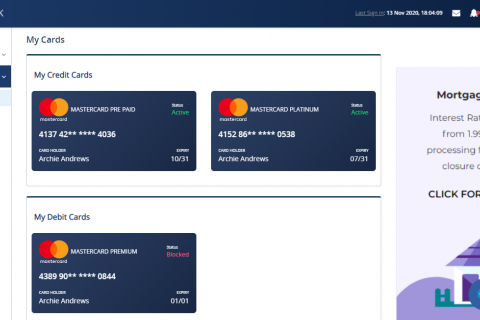

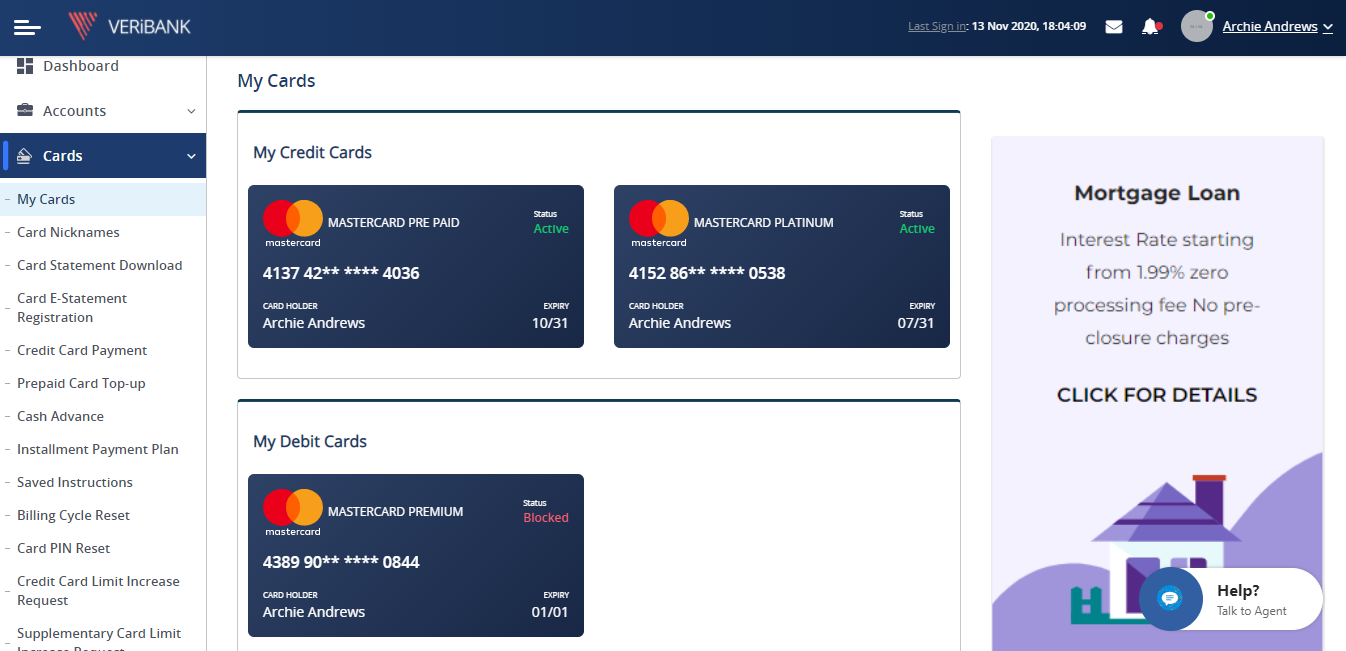

Cards Management

- Ability to show list of cards such as credit and debit along with the status of each card.

- Ability to show the details of the cards including card status, card limit, available balance and other details.

- Card transactions can be searched by different filtered options.

- Ability to view transactions that are still pending.

- Ability to make a search on card transactions for a specific period of time and export to a desired format including Excel, CSV, and PDF.

-

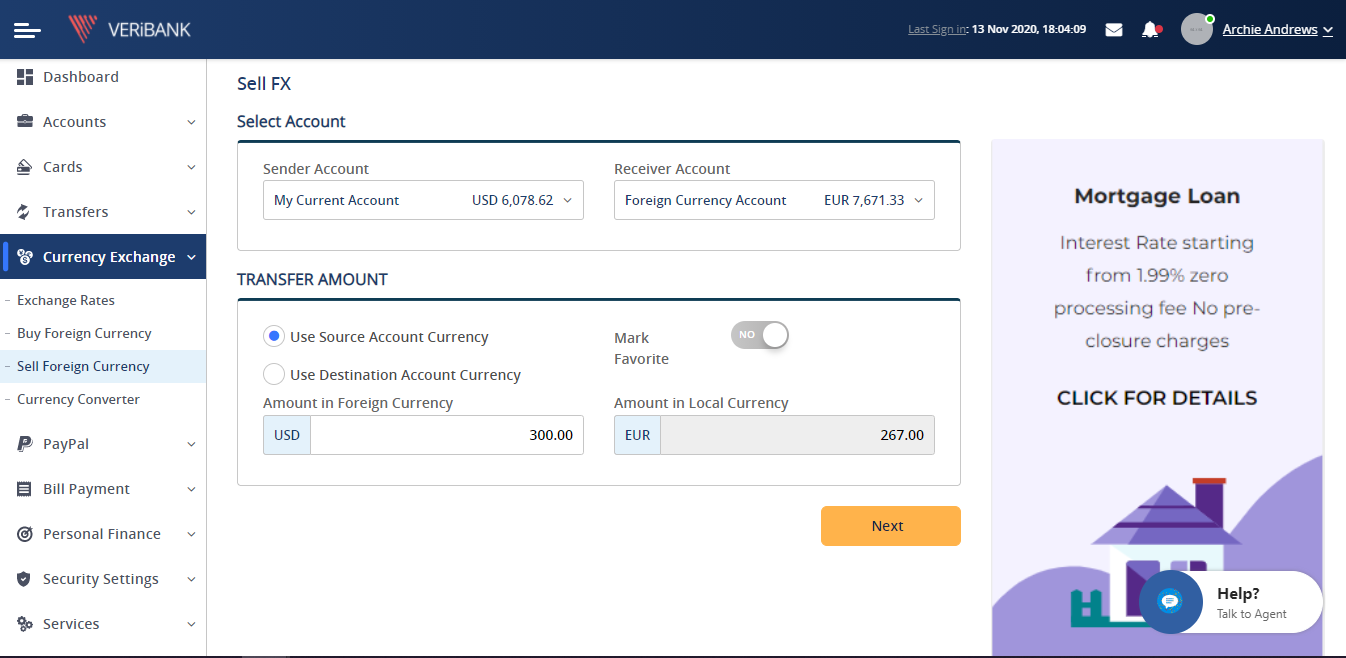

Transfers & Payments

- Ability to make fund transfers between a customer's own accounts in the bank.

- Ability to make fund transfers between different customers' accounts within the bank.

- Ability to make fund transfers to an account at another bank in the same or different country.

- Ability to set up standing order instructions for automatic transfers.

- Ability to notify customers with SMS and E-mail notifications.

-

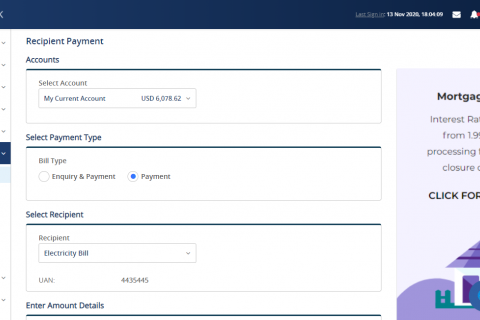

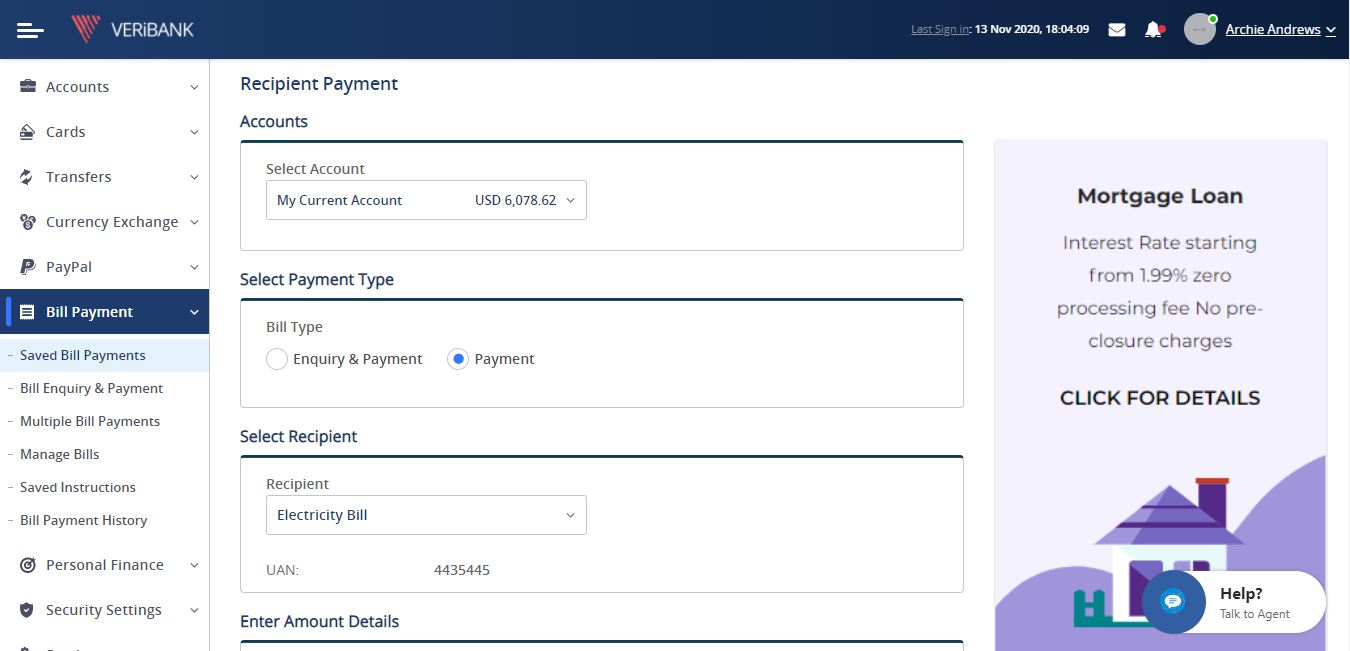

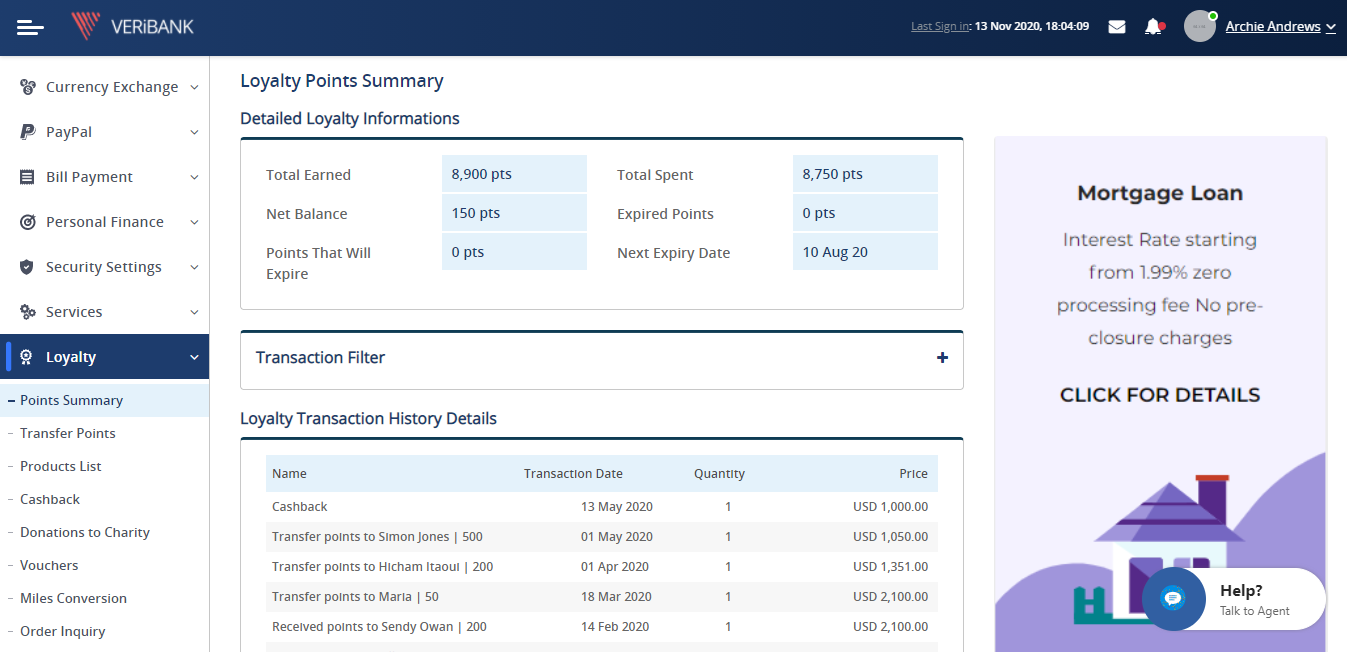

Payment Management

- Ability to check and validate bills with service providers.

- Ability to make bill payments for different service providers.

- Ability to check history of bill payments.

- Ability to set up automatic bill payments and repeated transactions.

- Ability to make payments to governmental authorities.

-

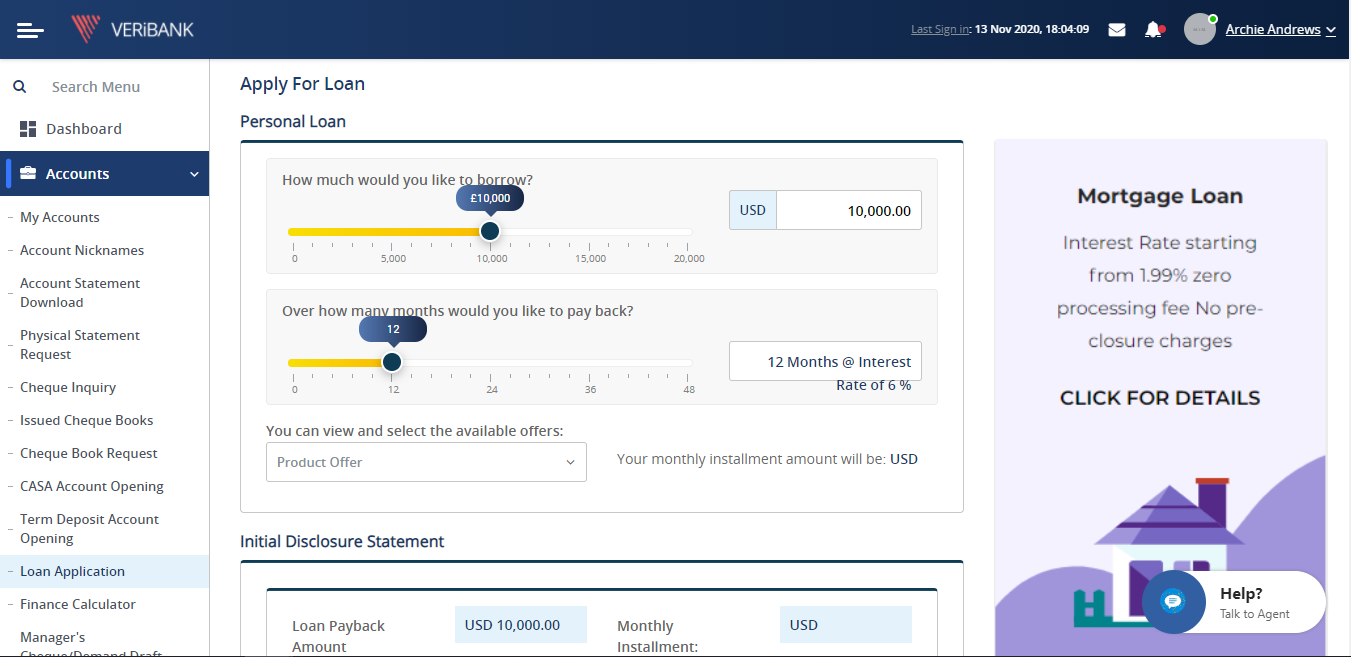

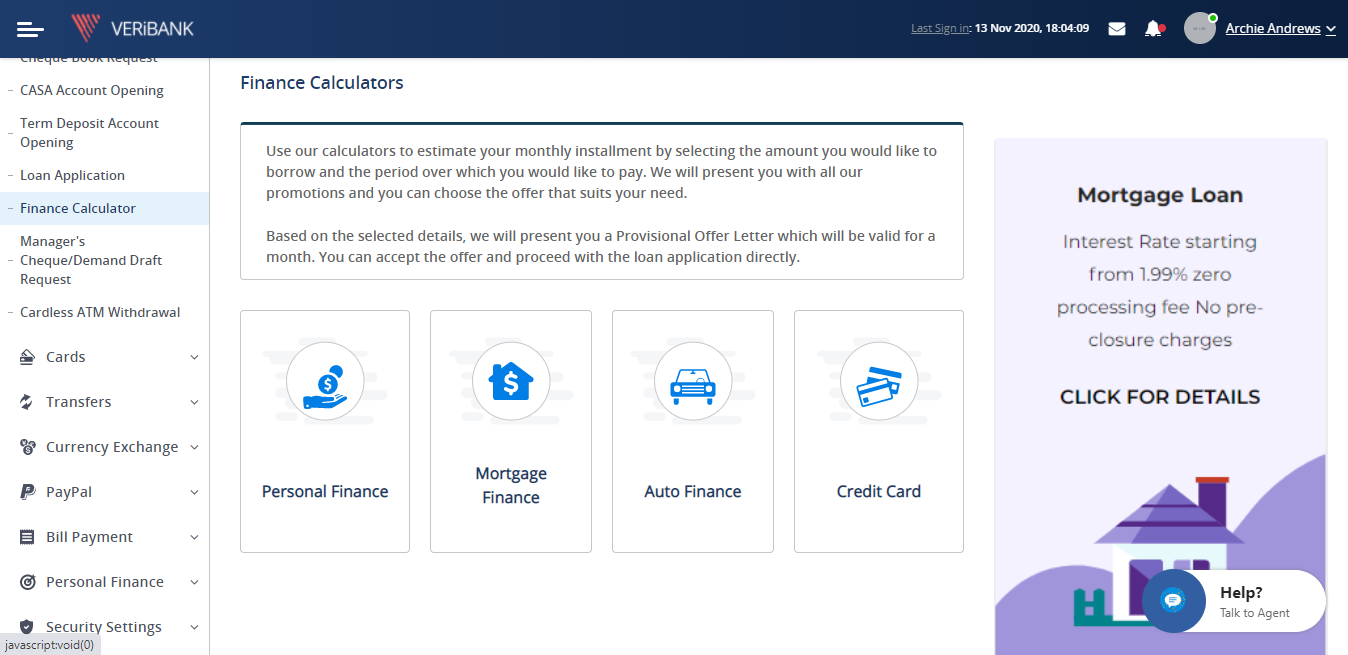

Personal Loans

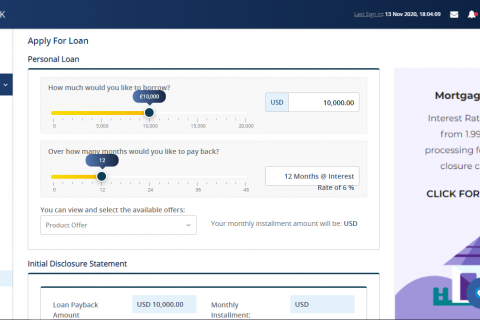

- Ability to view details of loan agreements.

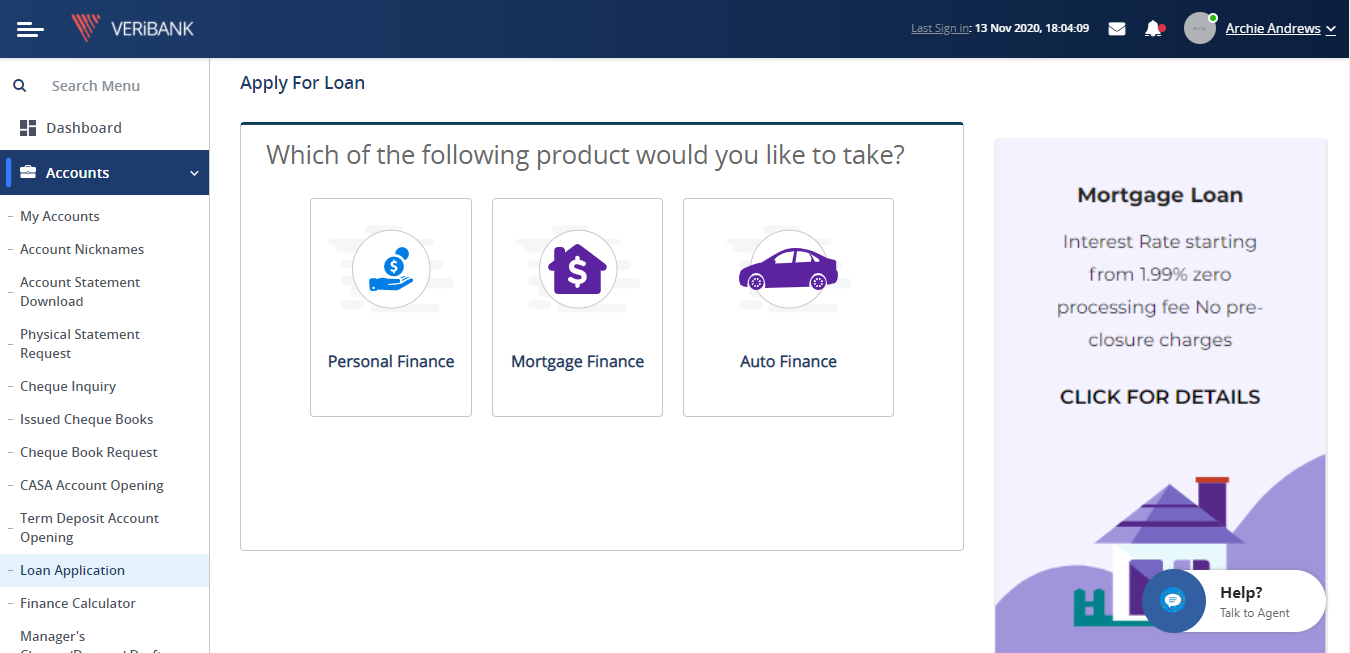

- Ability to apply for new customer loans with simplified application process.

- Ability to make loan payments with simple payment processes.

- Ability to offer pre-calculated and approved customer loans.

- Ability to manage loan payment schedule.

-

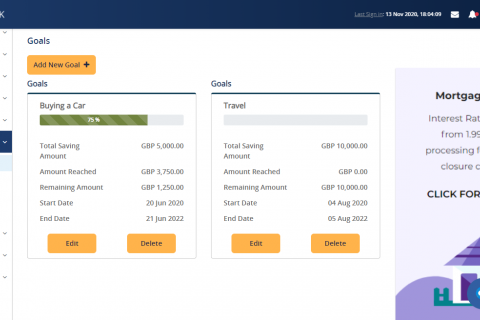

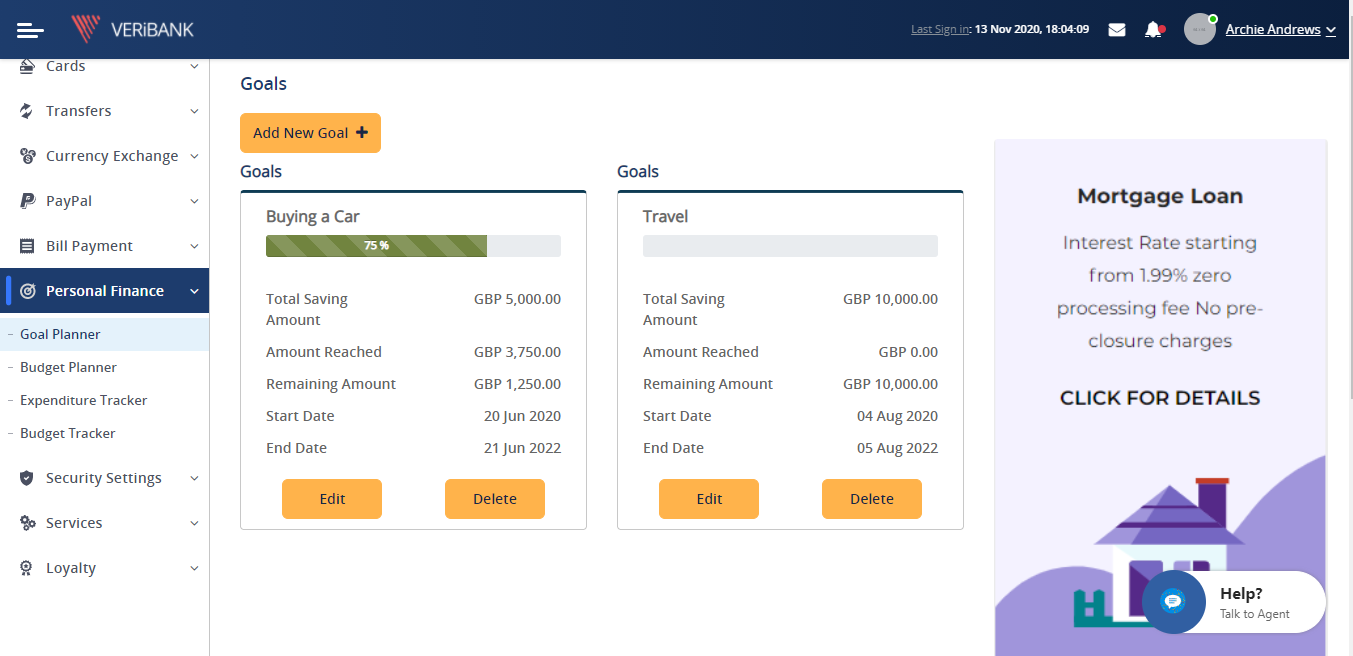

Personal Finance Management

- Define personal budget areas and specify thresholds,

- Set goals for savings and manage the goals,

- Perform financial health checks,

- Categorize spending based on different filters,

- Categorize payments and transactions.

-

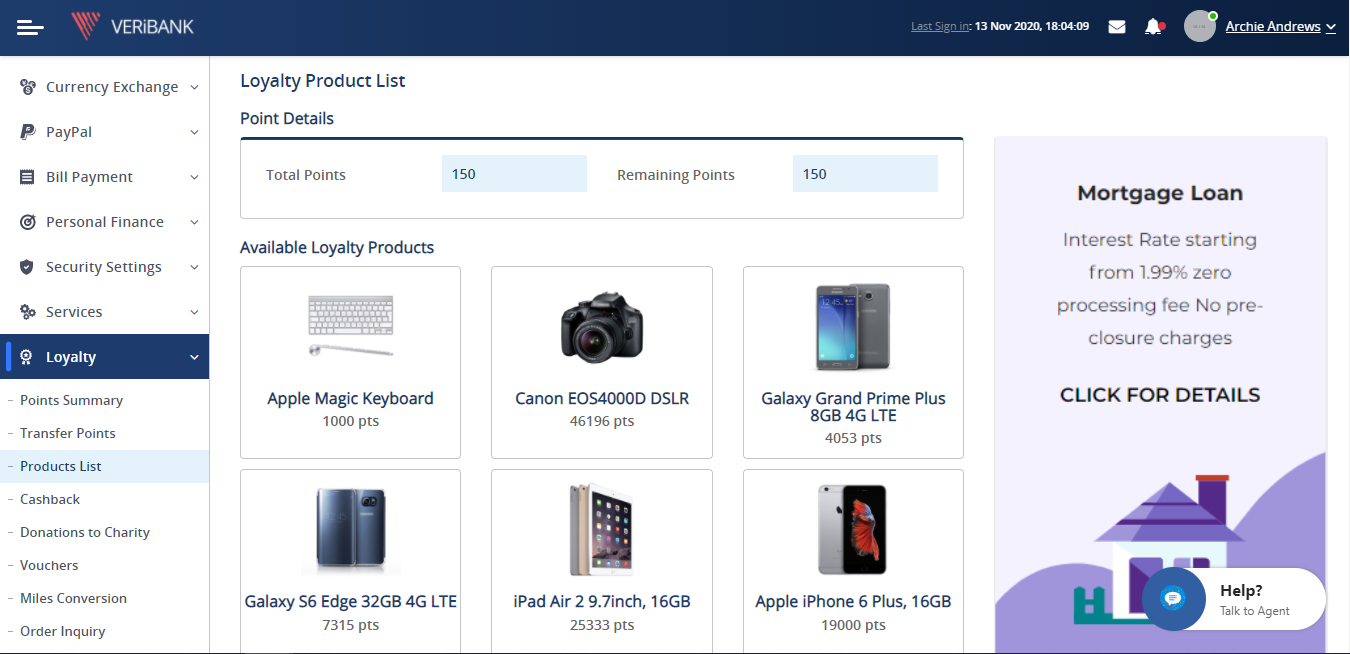

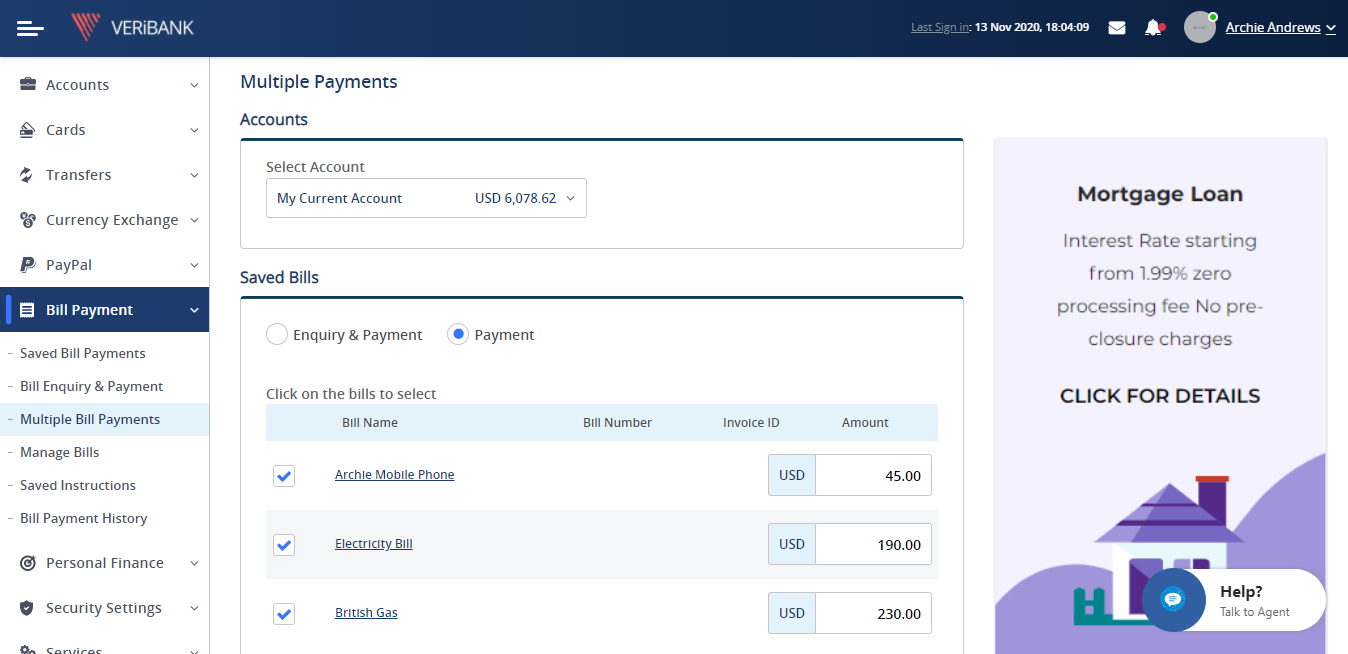

Lifestyle Services

- Timely offers and products to increase customer engagement and loyalty.

- Lifestyle rewards, deals, perks and entitlements for a “digital-first” customer.

- Valuable lifestyle services including family, home, car/travel, leisure, and household services, investments and online shopping.

- Ability to offer extras, such as donations and gifts for friends.

- Ability to respond to changes in customer lifestyle and deliver new banking services quickly.

-

Customer Offboarding

- Convert ‘churn alerts’ into new opportunities.

- Ensure outstanding debts are cleared before offboarding.

- Provide data protection clarity and control to customers.

- Provide a seamless graduation experience.

- Create brand advocates for life.